Bitcoin ETF race begins: Has institutional trust returned to crypto?

Source: CoinMarketCapWhile numerous institutional giants have actually submitted area Bitcoin ETF applications with the United States Securities and Exchange Commission (SEC) in the past, all have actually either withdrawn their applications or faced straight-out rejections from the regulator.The SEC authorized the first Bitcoin futures ETF in October 2021– the ProShares Bitcoin Strategy ETF– which debuted on the New York Stock Exchange on Oct. 19, 2021. The area Bitcoin ETF filing by the possession management huge BlackRock has actually increased the opportunities of the SEC approving the first area Bitcoin ETF. In overall, 7 institutional giants have actually now submitted for a spot Bitcoin ETF to date.Some industry observers think 2023 to 2024 will be crucial for authorizing a spot Bitcoin ETF.”The recent new applications for Bitcoin spot market ETFs by some of the worlds most important possession managers demonstrates that there is investor, as well as company need for Bitcoin, and that will just magnify.”Magazine: How wise individuals invest in dumb memecoins: 3-point plan for success”I anticipate this bull market to be Asia driven as soon as again, maybe with Hong Kong at the helm for the area, but based on my personal observations on the ground, I likewise anticipate a significant push to come from the Middle East, particularly from the United Arab Emirates, Saudia Arabia and other oil-rich jurisdictions,” he added.With the next Bitcoin halving set up for April 2024, the rising interest of institutional investors is seen as a bullish sign for Bitcoins price and the more comprehensive crypto market.

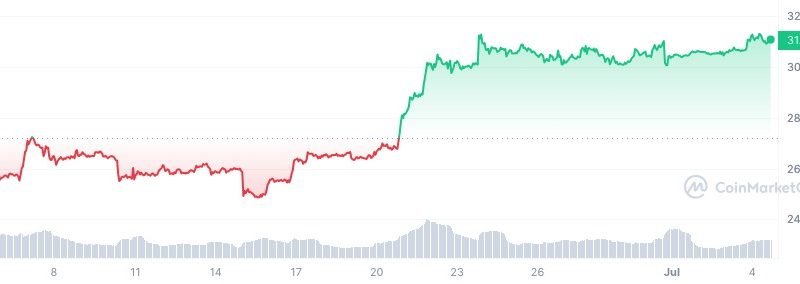

With the Bitcoin (BTC) halving occasion less than a year away, numerous monetary giants have submitted applications for a spot Bitcoin exchange-traded fund (ETF)– a scenario last seen prior to the 2020 to 2021 bull run. Institutional interest in the sector dried up after significant crypto giants such as FTX collapsed in the middle of a prolonged crypto winter in 2022. Bitcoin and lots of other cryptocurrencies traded mainly sideways as several crypto exchanges fell under regulatory scrutiny. On news that significant monetary organizations such as BlackRock, Fidelity, Valkyrie and others were submitting applications to note an area Bitcoin ETF, the rate of BTC recovered to over $30,000, stimulating investment into the crypto market again.Bitcoin one-month cost chart. Source: CoinMarketCapWhile numerous institutional giants have actually filed spot Bitcoin ETF applications with the United States Securities and Exchange Commission (SEC) in the past, all have either withdrawn their applications or faced straight-out rejections from the regulator.The SEC approved the first Bitcoin futures ETF in October 2021– the ProShares Bitcoin Strategy ETF– which debuted on the New York Stock Exchange on Oct. 19, 2021. Nevertheless, the area Bitcoin ETF filing by the asset management giant BlackRock has increased the chances of the SEC approving the first spot Bitcoin ETF. Thats according to Bloomberg senior ETF analyst Eric Balchunas, who offers BlackRock a 50% opportunity of getting its spot Bitcoin ETF authorized. The most recent wave of ETF filings started with BlackRocks filing with the SEC on June 16. WisdomTree, Invesco and Valkyrie likewise filed in the days and weeks that followed. Current: Chibi Finance $1M alleged rug pull: How it happenedOn June 28, ARK Invest, which formerly declared a spot Bitcoin ETF in June 2021, modified its filing to make it comparable to that of BlackRock. The next day, possession supervisor Fidelity Investments likewise applied for a spot Bitcoin ETF. In overall, seven institutional giants have actually now applied for an area Bitcoin ETF to date.Some market observers think 2023 to 2024 will be essential for authorizing an area Bitcoin ETF. Robert Quartly-Janeiro, primary strategy officer of the cryptocurrency exchange Bitrue, told Cointelegraph that the timing is right, as “inflation is rampant and the cash supply is a blended photo, interest rates are high, and businesses are seeing good profits, which suggests crypto will need to perform in a financial environment where rates and inflation are key considerations.”Institutional trust in BitcoinBitcoin has weathered the consequences of 2022 incredibly well and recovered more than half of its rate decline throughout the bear market, largely thanks to the ongoing interest of institutional investors in the possession. Undoubtedly, there are substantially more institutional financiers in the crypto market now compared to just one year back. Up until 2022, organizations kept a safe distance from the market, with even MicroStrategy stopping its routine BTC purchases.Many large funds and companies have actually ended up being thinking about cryptocurrencies and are exploring their possible to invest in them. Regardless of market volatility, worldwide organizations reveal a consistent interest in cryptocurrencies. Bitfinex chief innovation officer Paolo Ardoino told Cointelegraph that Bitcoin represents significant worth in terms of its utility and special nature as a completely scarce asset that can not ever be debased. He said, “The most standard banks recognize that,” adding, “Its barely unexpected that at a time of record inflation in both major industrialized economies, as well as emerging markets, that the value of Bitcoin is being much better comprehended by markets.””The recent new applications for Bitcoin spot market ETFs by a few of the worlds essential asset managers demonstrates that there is investor, as well as issuer demand for Bitcoin, which will only heighten. Apart from showing increased institutional demand for Bitcoin, it will likewise bring in new retail investors and encourage more comprehensive participation,” Ardoino said.While many institutions distanced themselves from crypto over the past year, much of that was because of the public relations disaster induced by FTX, with bank failures even more worsening it. Richard Gardner, CEO of Modulus, informed Cointelegraph that institutions anticipated the simmering of the crypto industry, and decided to lay low and avoid the public and political reaction in the aftermath of FTX, believing they d have the ability to revisit their choice prior to crypto rose. “Were at the point where theyre starting to weigh the danger versus benefit of stepping back into the fray. A lot of organizations will likely be far more cautious, given the FTX catastrophe. Theyre going to largely be moved based upon the regulative environment. As federal governments patch together a complete regulative routine, and as bureaucrats decide how they plan to interpret the law, institutions will assess their response and move forward appropriately,” Gardner said.MicroStrategy– the leading financier in Bitcoin and one of the driving forces behind institutional adoption of BTC in 2020– has actually continued its Bitcoin purchasing spree in 2023. When the firm dealt with significant losses as the BTC rate plunged listed below $16,500, CEO Michael Saylor preserved it had no objective of selling and would continue to add more BTC to its treasury. MicroStrategy currently hodls 152,333 BTC gotten for roughly $4.52 billion at an average price of $29,668 per Bitcoin.Institutional inflow restores bull run optimismWhile the 2017 bull run was sparked by retail interest, the 2020 to 2021 bull run was sparked by institutional inflows, with the likes of MicroStrategy and Tesla, and multiple other publicly-listed companies adding Bitcoin to their balance sheet.Gracy Chen, managing director at crypto exchange Bitget, informed Cointelegraph that organizations would act promptly once they observe “stable and foreseeable retail interest.” Chen stated, “The cumulative effect of institutions outweighs that of private financiers, and, therefore, they will continue to be a driving force for the growth of cryptocurrency market capitalization.” She also stressed that growing interest from organizations could even more crypto adoption, assisting to stimulate the next bull run:”Analysts anticipate that in the event of the approval of BlackRocks ETF application alone, there might be a twofold increase in the price of Bitcoin. Thinking about BlackRocks possible institutional financier base and impact, the approval of their area BTC ETF would have a greater effect on the crypto market growth. With their BTC area ETF application, they will likely motivate competitors amongst appropriate financial companies. This will direct more funds from standard markets to Web3.”Apart from the institutional push, there have been major developments in the retail market, with Hong Kong opening the doors for crypto exchanges to use services to retail consumers. Ben Caselin, vice president at crypto exchange MaskEX, told Cointelegraph that throughout the previous bull run, “U.S. institutions were the main motorists of the rise, however they were perhaps not ready to engage deeply and acted no various than retail, basically chasing gains and acting on buzz.”Magazine: How wise people invest in dumb memecoins: 3-point plan for success”I expect this bull market to be Asia driven when again, possibly with Hong Kong at the helm for the region, but based on my personal observations on the ground, I also expect a significant push to come from the Middle East, particularly from the United Arab Emirates, Saudia Arabia and other oil-rich jurisdictions,” he added.With the next Bitcoin cutting in half set up for April 2024, the rising interest of institutional investors is viewed as a bullish sign for Bitcoins price and the broader crypto market. Bull runs have actually traditionally begun in the run-up to the Bitcoin cutting in half occasion, where the quantity of BTC benefit per block gets minimized by half every 4 years. The deficiency factor drives the price rise as institutional giants and retail traders hurry to contribute to their Bitcoin portfolios.