Bitcoin futures premium hits 18-month high — Time to flip bullish?

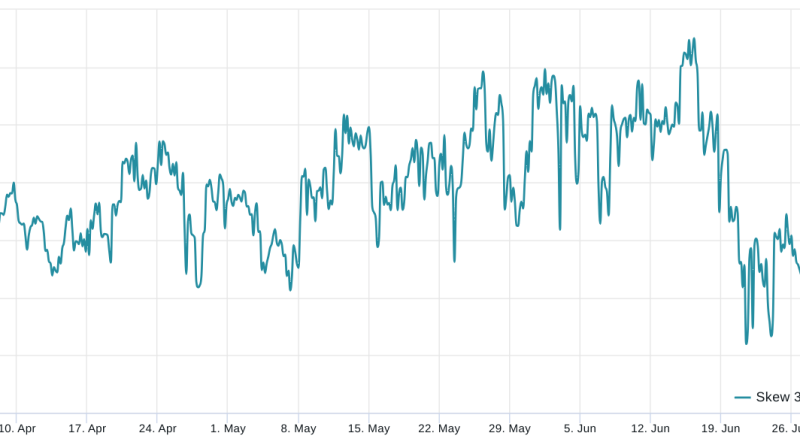

These fixed-month contracts usually trade at a slight premium to spot markets, showing that sellers are asking for more money to delay settlement.As an outcome, BTC futures agreements in healthy markets should trade at a 5% to 10% annualized premium– a circumstance known as contango, which is not unique to crypto markets.Bitcoin 3-month futures annualized premium. It exposes when arbitrage desks and market makers charge higher prices for security versus benefit or downside movements.In short, if traders anticipate a drop in Bitcoins price, the alter metric will increase above 7%, while durations of enjoyment normally have a negative 7% skew.Bitcoin 30-day alternatives 25% delta alter. Moderate optimism “healthy” for Bitcoin marketTypically, a 6.4% futures basis and an unfavorable 13% delta alter would be considered reasonably bullish. Hence, todays 6.3% futures premium represents a healthy market as opposed to 10% or greater indicating excessive optimism or euphoria.

These fixed-month contracts normally trade at a minor premium to spot markets, suggesting that sellers are asking for more money to delay settlement.As an outcome, BTC futures contracts in healthy markets should trade at a 5% to 10% annualized premium– a scenario known as contango, which is not special to crypto markets.Bitcoin 3-month futures annualized premium. It exposes when arbitrage desks and market makers charge higher prices for security versus benefit or disadvantage movements.In short, if traders expect a drop in Bitcoins rate, the skew metric will rise above 7%, while durations of enjoyment normally have an unfavorable 7% skew.Bitcoin 30-day alternatives 25% delta skew. Moderate optimism “healthy” for Bitcoin marketTypically, a 6.4% futures basis and an unfavorable 13% delta alter would be considered reasonably bullish.