4 reasons why Ethereum price can’t break $1,970

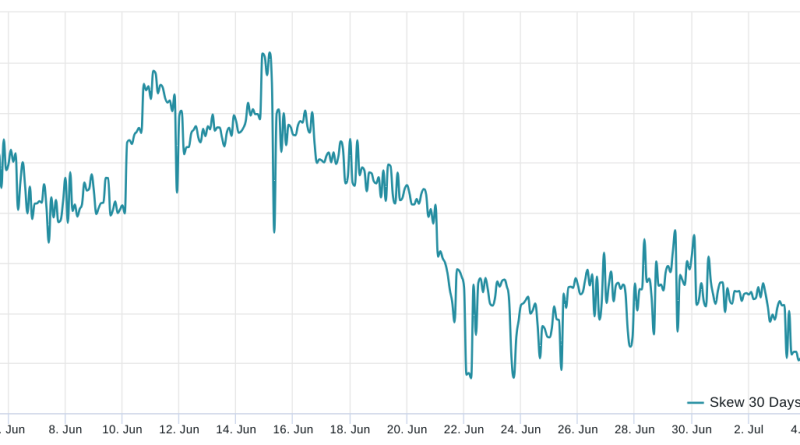

The indication decreased by 3.1% to 13.7 million ETH in the 30 days leading to July 4, according to DefiLlama.A lower TVL indicates either financiers are losing interest in the networks smart agreement usage or have moved to layer-2 alternatives in search of lower transaction fees. The 25% delta alter indicator compares comparable call (buy) and put (sell) alternatives and will turn favorable when worry is prevalent since the protective put option premium is greater than the call options.Ether 30-day 25% alter. Presently, the negative 2% metric displays a balanced demand for call and put options.Related: The Supreme Court could stop the SECs war on cryptoETH at $1,700 might be far-off, however so is $2,000 Considering these four factors, particularly increased take advantage of long-to-short ratio, decreasing TVL, prospective interest rate boosts, and tighter cryptocurrency regulation, ETH bears are in a much better position to hold back the favorable cost effect coming from the Bitcoin ETF saga.Although these factors may not be sufficient to drive ETH cost down to $1,700, they provide substantial barriers for ETH bulls.

The sign decreased by 3.1% to 13.7 million ETH in the 30 days leading to July 4, according to DefiLlama.A lower TVL implies either investors are losing interest in the networks wise agreement usage or have actually moved to layer-2 alternatives in search of lower deal costs. The 25% delta skew indication compares similar call (buy) and put (sell) choices and will turn positive when worry is prevalent since the protective put option premium is higher than the call options.Ether 30-day 25% skew. Currently, the negative 2% metric display screens a well balanced need for call and put options.Related: The Supreme Court could stop the SECs war on cryptoETH at $1,700 may be far-off, but so is $2,000 Considering these four reasons, specifically increased take advantage of long-to-short ratio, decreasing TVL, possible interest rate increases, and tighter cryptocurrency policy, ETH bears are in a better position to hold back the positive rate impact coming from the Bitcoin ETF saga.Although these elements might not be sufficient to drive ETH price down to $1,700, they present significant obstacles for ETH bulls.