Bitcoin exchanges now hold the same BTC supply share as in late 2017

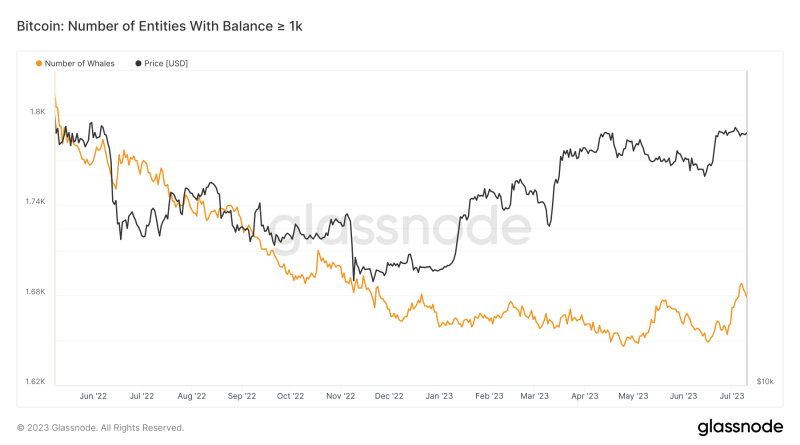

Bitcoin (BTC) held on exchanges is down to where it was at the 2017 BTC price all-time high, data confirms.Tracked by on-chain analytics firm Glassnode, the latest figures show less than 12% of the BTC supply now resides in exchange wallets.Analyst: BTC cost “on the cusp of real cost discovery”Bitcoin returned to exchanges during the 2023 BTC cost upside, during which BTC/USD more than doubled from cycle lows.The period given that late April has actually seen a reversion to the long-lasting pattern of coins leaving exchanges, nevertheless, and this month, it struck a milestone.As of July 10, 11.59% of the readily available BTC supply currently lies in recognized exchange wallets labeled by Glassnode. Source: Glassnode”Only 11.5% of Bitcoin supply left on exchanges, least expensive in over 5 years,” William Clemente, co-founder of crypto analysis firm Reflexivity Research, commented.In BTC terms, exchange balances are back to where they were in March 2018, with known wallets holding a total of 2.252 million BTC as of July 10. Related: Bitcoin supply shock will send BTC price to $120K– Standard CharteredOther developments, notably synthetic intelligence (AI), must produce a comparable impact over time, some argue.Decreasing exchange balances meanwhile continue as the number of Bitcoin whale entities– those with the largest wallet balances outside exchanges– see an uptick.