Cosmos-based Osmosis launches concentrated liquidity, lets LPs choose price

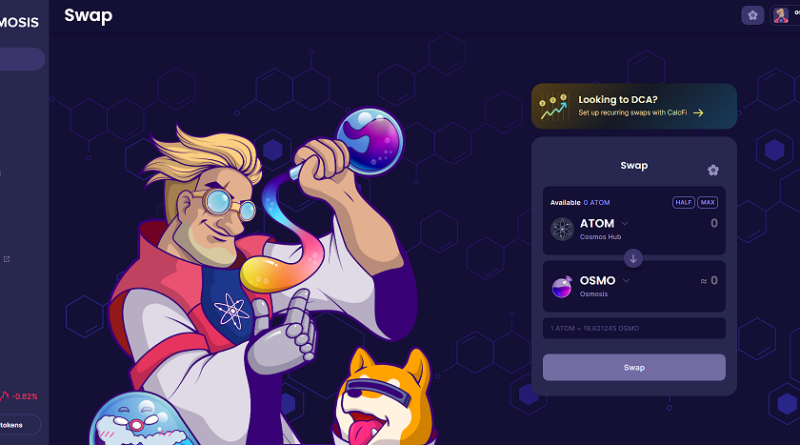

The Cosmos-based decentralized exchange Osmosis (OSMO) has introduced a new “concentrated liquidity” function, according to a July 12 statement from the apps designer, Osmosis Labs. The new feature enables liquidity providers (LPs) to pick a minimum and optimum rate to use to offer or purchase crypto.Osmosis interface. Source: OsmosisThe Cosmos community is a web of blockchain networks that use the Cosmos software advancement set and are linked through the Inter-Blockchain Communication (IBC) procedure. Osmosis is among the largest decentralized exchanges (DEXs) in the ecosystem, doing around $120 million in volume every day, according to information from DefiLlama.The brand-new function allows Osmosis LPs to provide liquidity at a minimum and optimum cost. They will no longer get costs if the rate falls listed below their minimum or above their optimum. On the other hand, they will receive greater fees when the cost is within range than they would if they had actually chosen not to mention an optimum or minimum. According to the announcement, concentrated liquidity will offer a 100x to 300x increase in capital performance, indicating that a pool can have substantially less liquidity for the exact same amount of volume and yet still not cause slippage for traders.The function was initially introduced to DEXs in Uniswap v3 and has actually become typical throughout the Web3 world. The Osmosis team told Cointelegraph that it has actually been relatively unusual in the Cosmos environment before now.Related: New Cosmos chain will utilize liquid staking tokens for securityIn a conversation with Cointelegraph, Osmosis Labs protocol engineer Alpin Yukseloglu specified that the exchanges new feature goes further than Uniswaps original version. The initial version of concentrated liquidity just allowed LPs to set minimums and maximums at particular rate periods, called “ticks.” When users couldnt place rate points exactly where they desired them to be, this better scalability however also created user experience concerns. The variation used by Osmosis includes more ticks within each cost range, allowing for the setting of more carefully tuned optimums and minimums and possibly lowering user aggravation, as Yukseloglu explained: “Were keeping that scaling, but were including more ticks into each pail to make it so that you can have those more granularly put preferences.”Yukseloglu said Osmosis plans to implement a full-fledged on-chain order book at some point in the future. The function is “basically at implementation-level specification today,” however the group is not yet prepared to announce a timeline for its conclusion. The Osmosis Labs engineer claimed that both concentrated liquidity and the order book are part of a more comprehensive Osmosis goal of giving liquidity service providers more options.Crypto futures exchange dYdX is likewise establishing an on-chain order book as part of its relocation to the Cosmos ecosystem.In August, Osmosis co-founder Sunny Aggarwal revealed his view that Cosmos IBC is an exceptional methods of securing cross-chain bridges when compared to other alternatives, calling it “the safest bridging procedure in existence.” A crucial vulnerability was found in IBC in October, which was covered the following day.