Aave Protocol launches stablecoin GHO on Ethereum mainnet, $2M minted

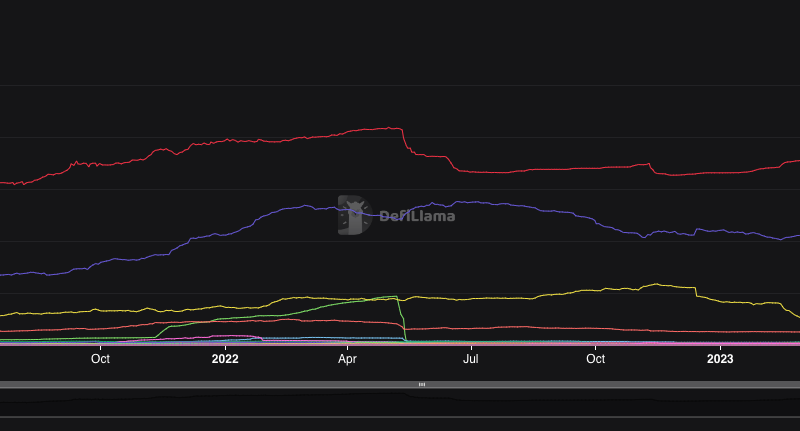

Decentralized finance (DeFi) procedure Aave has actually introduced its algorithmic United States-dollar pegged stablecoin GHO on the Ethereum mainnet, with $2.19 million worth of GHO minted so far.Aave announced the launch of the brand-new stablecoin in a July 16 blog post, describing the brand-new stablecoin GHO as a “decentralized, over-collateralized” asset.” All deals are carried out through self-executing wise contracts, and all data regarding GHO transactions is offered and auditable straight from the blockchain or by means of numerous user interfaces,” Aave wrote.Additionally, Aave said GHOs income would even more boost its DAO treasury, with governance being entrusted to AAVE and stkAAVE token holders.Total distributing supply of GHO since creation. Source: DeFiLlamaThe GHO stablecoin is presently available to the public:” Anyone can mint GHO using the assets they provide into the Aave Protocol V3 Ethereum market as collateral, making sure that GHO is overcollateralized by a wide variety of properties.

Decentralized finance (DeFi) procedure Aave has actually introduced its algorithmic United States-dollar pegged stablecoin GHO on the Ethereum mainnet, with $2.19 million worth of GHO minted so far.Aave announced the launch of the brand-new stablecoin in a July 16 blog post, explaining the brand-new stablecoin GHO as a “decentralized, over-collateralized” asset. Lets GHO!

Unlike central stablecoins such as Tethers USDT (USDT), which have actually drawn some criticism for an apparent absence of transparency around its reserves– the assets backing GHO are transparent and proven and can be confirmed by on-chain data, according to Aave.” All transactions are carried out through self-executing wise agreements, and all information relating to GHO transactions is readily available and auditable directly from the blockchain or through numerous user interfaces,” Aave wrote.Additionally, Aave stated GHOs earnings would even more reinforce its DAO treasury, with governance being turned over to AAVE and stkAAVE token holders.Total flowing supply of GHO considering that creation. Source: DeFiLlamaThe GHO stablecoin is presently available to the public:” Anyone can mint GHO utilizing the properties they supply into the Aave Protocol V3 Ethereum market as collateral, guaranteeing that GHO is overcollateralized by a wide variety of possessions.