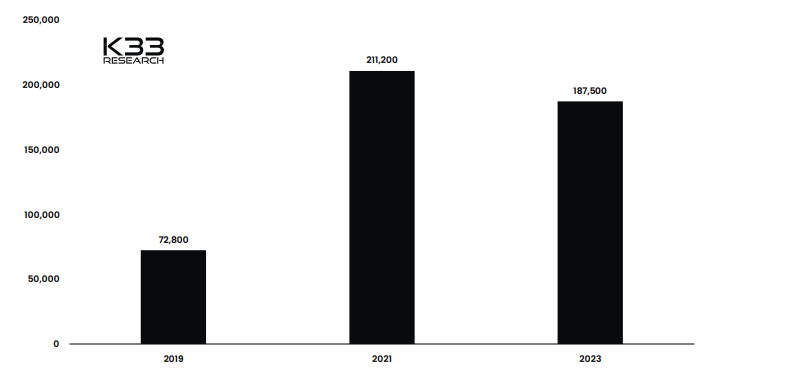

Crypto headcount surges over 100% since 2019 despite implosions

Despite several high-profile cryptocurrency implosions, the number of people working in the industry has skyrocketed over the past 4 years.According to findings by the crypto research study startup K33, the number of crypto-related staff members has actually risen nearly 160% considering that 2019. In a report entitled “The Emerging Crypto Industry,” K33 approximated that the total headcount of individuals working in crypto as of 2023 amounted to nearly 190,000 persons. According to the information, the crypto industry peaked in terms of overall staff numbers in 2021 at more than 211,000 specialists. The alleged layoffs came after the firm announced a 20% reduction in staff in May.Related: Searches for AI jobs in 2023 are 4x greater than crypto tasks when BTC hit $69KWhile some significant companies have actually been laying off thousands of people, some crypto giants have actually apparently never ever utilized more than 100 people.

Regardless of numerous high-profile cryptocurrency implosions, the number of people operating in the market has actually skyrocketed over the previous four years.According to findings by the crypto research study startup K33, the number of crypto-related employees has risen almost 160% since 2019. In a report entitled “The Emerging Crypto Industry,” K33 estimated that the overall headcount of people operating in crypto as of 2023 totaled up to nearly 190,000 persons. The estimates likewise suggested that the number of such professionals stood at just around 73,000 individuals in 2019. According to the data, the crypto market peaked in regards to total staff numbers in 2021 at more than 211,000 experts. The development came together with Bitcoins (BTC) all-time high rate of $68,000 that was recorded in November 2021. Cryptocurrency employment by years. Source: K33Although crypto-focused staff members have actually decreased by around 11% because 2021, the variety of crypto specialists is still considerably higher than four years back. This boost appears to track the characteristics of Bitcoins price, which surged more than 300% from its average annual cost of around $7,200 in 2019, according to CoinGecko.Data from some major industry companies shows K33s findings, though others seem tracking. One of those contributing to its global headcount is significant cryptocurrency exchange Kraken, which has actually seen staff numbers rise more than 150% since 2019, the companys chief people officer Pranesh Anthapur informed Cointelegraph.” Bear markets enhance the value of protecting the ideal talent to scale your operation. Interfering with the structures of conventional finance isnt easy,” Anthapur noted. He included that Krakens technique to personnel retention remains “consistent in between bear and bull cycles.” Trezor, a major hardware wallet firm, has actually also increased the companys headcount by 120% considering that 2019, CEO Matej Zak told Cointelegraph.” More significantly, we are concentrated on building and keeping skill for the long term,” Zak noted. He added that Trezor has been relocating to maintain and improve skill even in bear markets, rather than cyclical hiring and firing based upon “short-term market crazes.” He mentioned:” Weve remained in the market for 10 years, so were aware of how hard bear markets can be, and we plan accordingly. This suggests we didnt have to cut staff during the recent bearishness, instead, we continued to employ.” On the other hand, the cryptocurrency industry has likewise seen numerous rounds of layoffs over the past year, including at companies like Coinbase, Binance, Crypto.com, Dapper Labs in addition to Kraken.According to online reports, Binance has actually reportedly laid off more than 1,000 staff members in its recent headcount cut over the past couple of weeks. The alleged layoffs came after the firm announced a 20% decrease in staff in May.Related: Searches for AI jobs in 2023 are 4x higher than crypto tasks when BTC hit $69KWhile some significant firms have been laying off thousands of people, some crypto giants have actually apparently never utilized more than 100 individuals. Tether, the company of the worlds biggest stablecoin and the most-traded cryptocurrency, USDT (USDT), only has about 60 people operating at the business, a spokesperson for the firm told Cointelegraph.” We have constantly preserved a cautious method to working with. We focus on the wellness and future potential customers of our staff members, as evidenced by our track record of not downsizing our staff even throughout previous declines in the crypto market,” the representative added.Magazine: NFT Collector: Interactive NFTs the future for sport, Vegas Sphere thrills