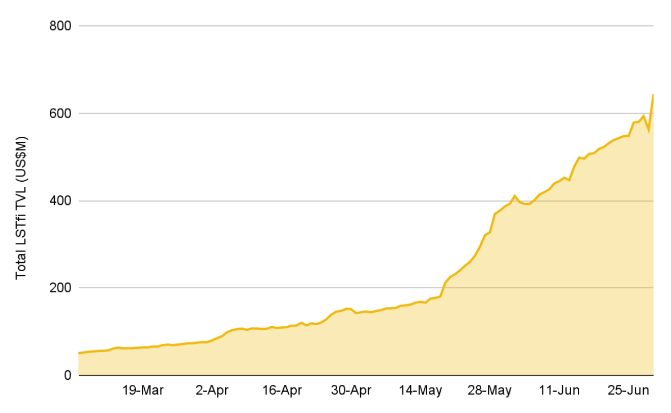

Liquid staking claims top spot in DeFi: Binance report

Liquid staking is a decentralized financing (DeFi) subsector that lets users make yield by staking their tokens without losing their liquidity. The staking system was an essential part of staking Ether (ETH) prior to the Ethereum Shanghai upgrade when users were not able to freely unstake their ETH. By then, liquid staking tokens (LSTs) offered users with liquidity while they earned yield with their ETH.Liquid staking commands 37.1% of the ETH staking market. The term combines liquid staking and DeFi, with tasks like yield-trading procedures, indexing services, and jobs enabling users to mint stablecoins using LSTs as security classified as LSTfi procedures. They described: “Liquid staking includes users communicating with an extra layer of smart agreement, which may expose them to the potential of bugs in the clever contracts used by liquid staking procedures.

The staking mechanism was a crucial part of staking Ether (ETH) prior to the Ethereum Shanghai upgrade when users were not able to freely unstake their ETH. By then, liquid staking tokens (LSTs) supplied users with liquidity while they earned yield with their ETH.Liquid staking commands 37.1% of the ETH staking market. They explained: “Liquid staking includes users interacting with an additional layer of smart agreement, which may expose them to the potential of bugs in the wise agreements used by liquid staking procedures.