Litecoin price at risk of a 30% drop if key LTC futures historical trend repeats

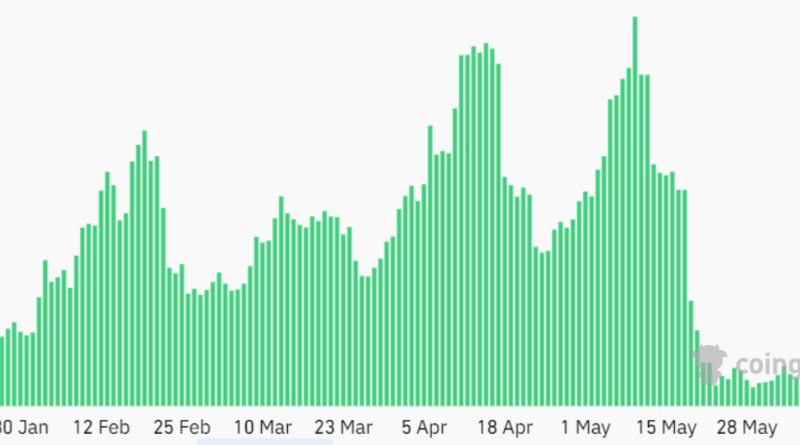

Source: TradingViewHowever, theres a disconcerting statistic coming from the derivatives market that indicates a sharp correction is most likely underway.Historical information doesnt favor Litecoin bulls Each of the previous three circumstances where Litecoin futures open interest dropped below $500 million caused rate drops of 38% or greater, which potentially matches the current scenario.Litecoin futures aggregate open interest in dollars from June 29 ($300 million) to July 2 ($615 million) reveals there was a substantial rise, suggesting increased demand for leveraged futures contracts.On July 2, Litecoins price reached a 14-month high however subsequently decreased 20% to $92. Even if its not always bullish for rate momentum, it allows for larger price swings due to utilize and possible liquidations when a traders position is closed due to an absence of margin.A look back at the November 2021 crash and open interestLitecoins open interest dropping below the $500 million limit seems a trusted indicator of financiers lessened interest, and the 3 newest occurrences verify the thesis, as its price faced drastic corrections in each instance.Litecoin futures aggregate open interest in USD, late 2021. Additional validating the significance of open interest, two other circumstances took place in 2021 between February and June, marking considerable drawdowns after breaking the futures open interest $500 million threshold.Similar events in February 2021 and May 2021Litecoin/USD 1-day rate at Coinbase, early 2021. Source: CoinGlassOn Feb. 8, 2021, Litecoins open interest rose above $500 million, marking a 64% rate gain, which peaked at $247 on Feb. 20, 2021.

Source: TradingViewHowever, theres an alarming figure coming from the derivatives market that indicates a sharp correction is most likely underway.Historical information doesnt prefer Litecoin bulls Each of the previous three instances where Litecoin futures open interest dropped listed below $500 million caused price drops of 38% or greater, which possibly matches the present scenario.Litecoin futures aggregate open interest in dollars from June 29 ($300 million) to July 2 ($615 million) reveals there was a significant surge, suggesting increased demand for leveraged futures contracts.On July 2, Litecoins rate reached a 14-month high however subsequently declined 20% to $92. Even if its not necessarily bullish for price momentum, it allows for larger rate swings due to take advantage of and possible liquidations when a traders position is closed due to a lack of margin.A look back at the November 2021 crash and open interestLitecoins open interest dropping below the $500 million limit seems a reliable sign of financiers decreased interest, and the 3 most current occurrences verify the thesis, as its price dealt with extreme corrections in each instance.Litecoin futures aggregate open interest in USD, late 2021. Additional validating the relevance of open interest, 2 other instances took place in 2021 between February and June, marking significant drawdowns after breaking the futures open interest $500 million threshold.Similar events in February 2021 and May 2021Litecoin/USD 1-day price at Coinbase, early 2021.