The last Bitcoin: What will happen once all BTC are mined?

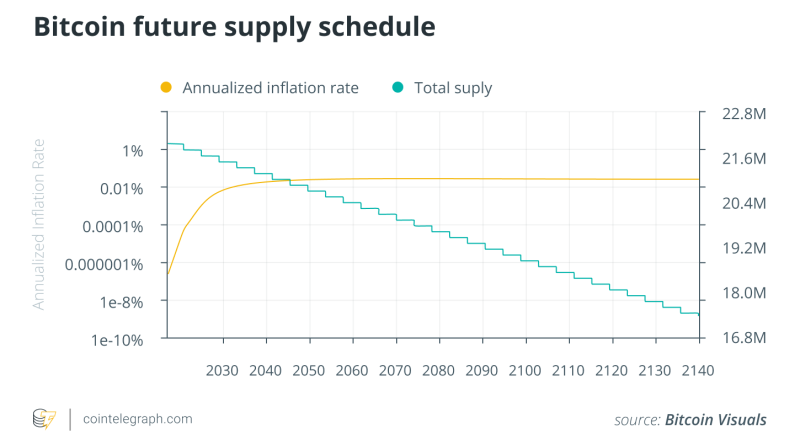

Hansen thinks deal charges will ultimately become the main incentive for miners to continue long after the last BTC is mined. “Thats why as deal fees become an increasingly essential part of Bitcoin mining economics, comprehending deal charge dynamics and forecasting them into the future ends up being much more critical,” he stated, adding: “Thus, its important to see charges increase in time, something that Bitcoin Ordinals, as of late, has aided with, for instance. “However, this shift is still most likely years away, provided that nobody currently mining will be alive when the last BTC block reward is gotten. It will be a long wait to find outAccording to Hansen, based on the block discovery rate and the halving process, which takes place roughly every four years– or every 210,000 blocks of deals– the last BTC will more than likely be mined around 2140. A Bitcoin halving is a scheduled decrease in the rewards that miners get, with the next one presently forecasted to occur around April 2024. This will reduce the benefit for each block to 3.125 BTC or roughly $94,190 at the time of writing. In theory, by limiting the supply of BTC, each coins value ought to increase as need boosts and supply remains fixed. Hansen states the rate of BTC in 2140 will depend upon unpredictable elements such as market need, the regulatory environment, macroeconomic aspects and technological developments.”The truth that all Bitcoin is in flow may develop deficiency, however whether this deficiency will translate to rate increases undergoes market dynamics,” he said. “As we look to a future where all Bitcoin has actually been mined, its crucial to keep in mind that Bitcoin was developed with this endgame in mind.”The tapering off of block benefits and shift toward transaction fees are intrinsic to the protocol, and represent an ingenious option to ensuring the ongoing security and viability of the network,” Hansen included. Related: Rising BTC deal costs are an excellent thing, Bitcoin educator sharesJaran Mellerud, a research expert from Hashrate Index, told Cointelegraph that as Bitcoin adoption and use grows, deal fees will drastically increase and end up being the main source of earnings for mining companies. Mellerud stated that, by the time the last BTC is issued, the block aid will have already been so small that it will not substantially impact the coin supply. “Due to the big block area demand relative to the limited block area supply, deal costs will need to skyrocket in a future scenario of hyperbitcoinization,” he said, adding: “If you dont think there will be sufficiently high deal fees in the future to justify the presence of mining, you dont actually think in Bitcoin.” What about fiatBy the time the last Bitcoin is mined, Mellerud believes its worth will not be measured in United States dollars or other fiat currencies. He speculates that already, fiat money systems will have long given that collapsed, and Bitcoin could be the successor, becoming the basic unit of account internationally.”Under such scenarios, the only legitimate way to measure the acquiring power of Bitcoin is by taking a look at how much energy a Bitcoin or satoshi can acquire,” Mellerud said. “Just as we currently measure the purchasing power of the U.S. dollar in energy terms, barrels of oil,” he added. A collapse of fiat money systems has long been forecasted, stimulated on by the lots of issues dealing with the standard monetary system. As just recently as March 2023, Silicon Valley Bank collapsed due to a liquidity crisis, with Signature Bank and Silvergate Bank following. Related: The first-world debt crisis suggests you can expect more pain aheadBefore the March 2023 banking crisis, a February survey carried out by organization intelligence company Morning Consult and commissioned by crypto exchange Coinbase found most participants were currently disillusioned with the worldwide financial system. A large part of participants are disillusioned with the global monetary system and desire modification. Source: Morning ConsultBitcoin may not be the very same in 120 yearsSpeaking to Cointelegraph, Pat White, co-founder and CEO of digital possession platform Bitwave, believes miners will stay a vital part of the ecosystem, however not all will endure, with some shutting down in the face of installing costs. According to a March 24 report from Glassnode, since 2010, miners have already been experiencing long durations of unprofitability, with just 47% of trading days paying. According to data from Glassnode, miners have actually currently been experiencing long durations of unprofitability. Source: Glassnode”I think its possible well see some miners shut down or other adjustment methods utilized in an effort to drive up fees,” White said, adding: “But I also think of that will happen well prior to the last Bitcoin is mined given that the last couple of halvings will get the block rewards down to the satoshi level.”However, White also states “a lot can occur in 120 years,” and BTC might fundamentally alter over the next century. White believes that by 2140, quantum computers will likely have broken the core file encryption under Bitcoin, though he states engineers dealing with it have actually long known its not quantum-secure.”That should not necessarily frighten people due to the fact that of this quantum security concern. Between now and 2140, there will have to be a major reworking of Bitcoin from the encryption layer upward,” he stated. “At that point, the Bitcoin designer neighborhood will have the ability to examine whether were in fact on track to have a functioning transaction fee-based network or if additional Bitcoin mining is essential to make sure the security of the network,” White added.White even more speculates that while Satoshi Nakamotos white paper states that 21 million BTC is the supply cap and the single most concrete rule, none people will likely live by 2140 to enforce that rule.He thinks crypto boils down to coding and agreement; if the neighborhood believes the transaction fee reward is inadequate to keep the network protected, future miners could in theory extend the BTC hard cap beyond 21 million.Related: $160K at next halving? Model counts down to new Bitcoin all-time highWhat result this might have on the price isnt clear, however either way, White thinks that the cost of Bitcoin will stabilize at some international inflation-reflecting rate point, and the significant price movement will happen at some time in the next 120 years if several nations seriously select it up as their reserve currency.In that instance, he says it will “most likely be independent of Bitcoin mining schedules,” and it would be the most solidifying moment to drive up the rate of BTC. Related: US law secures institutions and exposes retail investors– Rep. Torres”There are things we cant even envision that might impact Bitcoin– wars and energy crises obviously– but what if were a true multiplanetary types already and we have to extend the block production time to support solar system-level interaction speeds,” White stated. “What I constantly discover crucial is to concentrate on the hardest issues were seeing today and do what we can to fix them. That might suggest resolving for payments or digital ownership, or banking the unbanked– these are the issues to concentrate on now,” he included.

For their efforts, miners are rewarded with an established amount of BTC for each block of deals. According to the Blockchain Council, more than 19 million BTC has actually been granted to miners in block rewards, and according to Nakamotos white paper, only 21 million are offered. According to calculations shared in a May 1 tweet from on-chain analytics firm Glassnode, because 2010, charges and block rewards have actually netted miners over $50 billion.Since #Bitcoins inception, Miners have actually earnt a total earnings of $50.2 B from the block subsidy and fees, for an all-time estimated input expense of $36.6 B.This places the all-time-aggregate earnings margin for Miners at $13.6 B (+37%).

For their efforts, miners are rewarded with a predetermined amount of BTC for each block of deals. According to the Blockchain Council, more than 19 million BTC has actually been awarded to miners in block benefits, and according to Nakamotos white paper, just 21 million are available. According to calculations shared in a May 1 tweet from on-chain analytics firm Glassnode, given that 2010, fees and obstruct benefits have netted miners over $50 billion.Since #Bitcoins beginning, Miners have actually earnt an overall income of $50.2 B from the block aid and charges, for an all-time approximated input cost of $36.6 B.This positions the all-time-aggregate earnings margin for Miners at $13.6 B (+37%). A Bitcoin halving is a scheduled reduction in the benefits that miners receive, with the next one presently forecasted to take place around April 2024.”At that point, the Bitcoin designer neighborhood will be able to assess whether or not were really on track to have an operating deal fee-based network or if extra Bitcoin mining is required to make sure the security of the network,” White added.White even more hypothesizes that while Satoshi Nakamotos white paper states that 21 million BTC is the supply cap and the single most concrete rule, none of us will likely be alive by 2140 to enforce that rule.He thinks crypto boils down to coding and consensus; if the neighborhood thinks the transaction fee reward is inadequate to keep the network protected, future miners could theoretically extend the BTC tough cap beyond 21 million.Related: $160K at next halving?