Biggest mining difficulty drop of 2023? 5 things to know in Bitcoin this week

Fellow monetary analyst Tedtalksmacro noted that general worldwide reserve bank liquidity conditions, despite the prospective incoming walking, appeared to be at macro lows.”After complimentary falling since March, international CB liquidity might have found a bottom here,” he commented alongside comparative charts.”Historically thats benefited BTC + threat.”Global central bank liquidity vs. BTC/USD chart. Source: Tedtalksmacro/TwitterFundamentals due a dip in Hash Ribbons “capitulation”Bitcoins persistent trading variety is taking its toll once again on network basics, as fervent competition amongst miners cools.According to the latest estimates from BTC.com, Bitcoins mining problem will reduce by around 4% at its next automatic readjustment on July 26. Currently at all-time highs, problem has seen just a handful of drops this year, and todays might be the biggest of 2023 so far.Bitcoin network principles introduction (screenshot). Source: BTC.comHash rate tells a similar story of consolidation after striking its own all-time highs this month. Evaluating the Hash Ribbons metric, Charles Edwards, creator of crypto possession manager Capriole Investments, flagged a brand-new “capitulation” phase.While missing from the marketplace since late 2022, when Bitcoin was still suffering the repercussions of the FTX crisis, a capitulation is absolutely nothing for traders to fear, Edwards argued.Despite this, he called the explosive growth in hash rate of the past seven months “unsustainable.””We have a Hash Ribbon capitulation. AKA a slowing in Bitcoins Hash Rate growth after what has been an amazing (unsustainable) 50% boost in 2023,” he commented recently. “HR capitulation is not a sell signal, however its also not bullish. Danger management required up until growth resumes.”Bitcoin Hash Ribbons chart. Source: Charles Edwards/TwitterCointelegraph continues to cover thoroughly the status quo amongst miners, with numerous theories emerging over current BTC selling behavior.NVT taps highest because 2019As Bitcoin mines its 800,000 th block, a classic on-chain metric is delivering a similar signal that– a minimum of for the time being– BTC cost conditions may be overheated.The Network Value to Transaction (NVT) Ratio, which divides the Bitcoin market cap by the U.S. dollar value of everyday on-chain transactions, has actually struck four-year highs.NVT seeks to offer an indicator of when on-chain volume is out of sync with total network value, however its ramifications can vary.As explained by its creator, expert Willy Woo, NVT spikes can take place in both booming market and durations of “unsustainable” price development.”When Bitcoins NVT is high, it shows that its network assessment is outstripping the worth being transferred on its payment network, this can happen when the network is in high growth and financiers are valuing it as a high return financial investment, or additionally when the price remains in an unsustainable bubble,” he composed in an accompanying introduction to the metric on his analytics site, Woobull.Bitcoin NVT Ratio chart (screenshot). Source: WoobullIn his most current interview with Cointelegraph, meanwhile, Caprioles Edwards argued that NVT was still in check versus severe highs, such as those seen throughout 2021.”NVT is presently trading at a regular level,” he said, including that “provided its stabilized reading today, it does not tell us much; simply that Bitcoin is relatively valued according to this metric alone.”Long-term holders manage 75% of BTC supplyA silver lining in the making? Bitcoins offered supply continues to shrink behind the scenes.Related: Bitcoin can still hit $19K, alerts trader ahead of BTC rate huge moveAs kept in mind by different market participants, the amount of BTC available for purchase reveals enduring conviction amongst its most ardent hodlers.55% of the supply has actually now stayed dormant for a minimum of 2 years, and 29% for 5 years or more, data from on-chain analytics firm Glassnode states.”The Bitcoin Long-Term Holder Supply has actually reached a new ATH of 14.52 M BTC, comparable to 75% of the circulating supply,” additional analysis highlighted this week. “This suggests HODLing is the preferred market dynamic among mature investors.”An accompanying chart revealed the quantity of BTC in the hands of so-called long-term holders, or LTHs, specified as entities hodling coins for 155 days or more.Bitcoin Long-Term Hodler Supply annotated chart. Source: Glassnode/TwitterMagazine: Tokenizing music royalties as NFTs could help the next Taylor SwiftThis short article does not consist of financial investment guidance or recommendations. Every financial investment and trading relocation involves danger, and readers ought to perform their own research when making a choice.

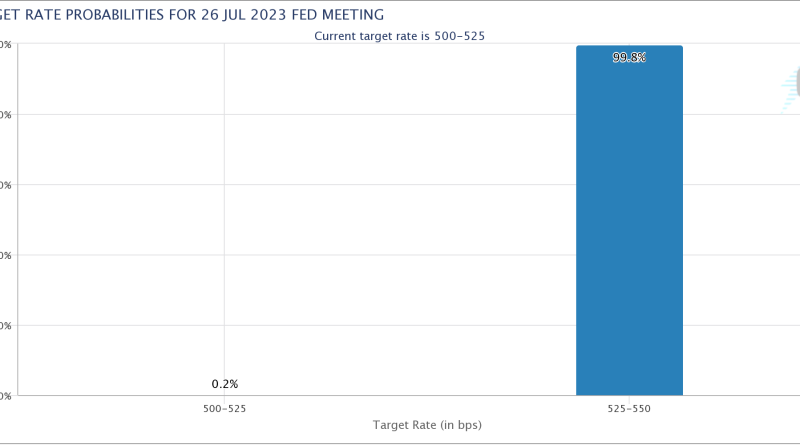

Bitcoin (BTC) goes into the last complete week of July on an unpredictable footing as $30,000 becomes resistance.In what promises to be an amazing– but maybe aggravating– week for traders, BTC rate action is staring down a mix of volatility triggers.Chief among these is the United States Federal Reserves decision on interest rates, this headlining an important slew of macro data releases. Source: TradingViewFed rate hike decision leads “action packed week” One occasion controls the macro landscape this week, and not only in crypto.The Feds Federal Open Market Committee (FOMC) will fulfill on July 26 to decide how far– if at all– to raise benchmark interest rates.Markets have little doubt that a walking is to come– unlike last month, language from Fed authorities has actually led them to practically unanimously anticipate a 0.25% increase.According to the most current data from CME Groups FedWatch Tool, the odds of that occurring currently stand at 99.8%. Source: CME GroupThe weeks macro information releases will just come after FOMC, leaving no room for these to sway a decision in time.” After a couple weeks of low volatility, things must get fascinating this week.”The Bitcoin Long-Term Holder Supply has reached a new ATH of 14.52 M BTC, equivalent to 75% of the distributing supply,” additional analysis highlighted this week.

Bitcoin (BTC) gets in the last complete week of July on an uncertain footing as $30,000 ends up being resistance.In what pledges to be an exciting– however perhaps stressful– week for traders, BTC price action is staring down a combination of volatility triggers.Chief amongst these is the United States Federal Reserves decision on interest rates, this headlining a crucial slew of macro data releases. Source: TradingViewFed rate trek choice leads “action jam-packed week” One event controls the macro landscape this week, and not only in crypto.The Feds Federal Open Market Committee (FOMC) will satisfy on July 26 to choose how far– if at all– to raise benchmark interest rates.Markets have little doubt that a hike is to come– unlike last month, language from Fed authorities has led them to almost unanimously forecast a 0.25% increase.According to the most current data from CME Groups FedWatch Tool, the chances of that taking place presently stand at 99.8%.” After a couple weeks of low volatility, things should get interesting this week.