Bitcoin price is down, but data signals that $30K and above is the path of least resistance

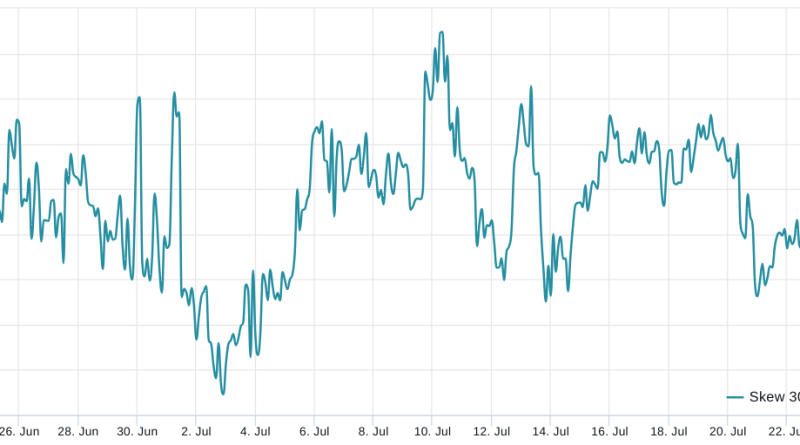

Still, there hasnt been any significant improvement in those cases, which will likely take years to settle.Bitcoins cost crash might have been related to the U.S. dollar reversionDespite historical volatility, Bitcoins crash ended up being more pronounced following 33 consecutive days of trading within a tight 5.7% day-to-day variety. The movement is even more noteworthy offered the S&P 500 gaining 0.4%, crude oil increasing by 2.4% and the MSCI China stock market index rising by 2.2%. In short, a skew metric increasing above 7% suggests traders prepare for a drop in Bitcoins rate, while periods of excitement usually yield a -7% skew.Bitcoin 30-day options 25% delta alter.

Still, there hasnt been any significant development in those cases, which will likely take years to settle.Bitcoins price crash might have been related to the U.S. dollar reversionDespite historical volatility, Bitcoins crash ended up being more pronounced following 33 successive days of trading within a tight 5.7% day-to-day range. The motion is even more notable given the S&P 500 acquiring 0.4%, crude oil increasing by 2.4% and the MSCI China stock market index surging by 2.2%. In healthy markets, BTC futures contracts typically trade at a 5 to 10% annualized premium, known as contango, which is not unique to crypto.Bitcoin 2-month futures annualized premium. In brief, an alter metric increasing above 7% recommends traders prepare for a drop in Bitcoins price, while durations of enjoyment typically yield a -7% skew.Bitcoin 30-day choices 25% delta skew.