Blockchain could save financial institutions $10B by 2030: Ripple

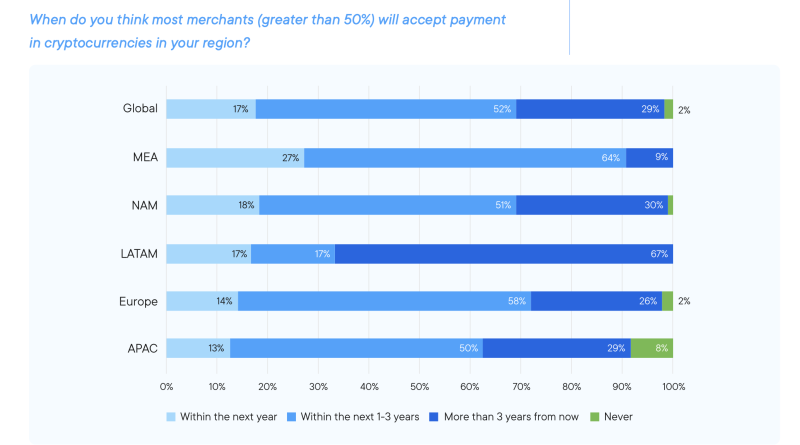

The study highlighted that 97% of those leaders securely think that blockchain technology will play a vital function in facilitating much faster payment systems within the 3 years.” Juniper Research supports this notion, indicating blockchains potential to significantly increase cost savings for banks conducting cross-border deals– an approximated $10 billion by 2030.” It was also mentioned that there is a substantial expected boost in global payment deals by the year 2030.” Global cross-border payment flows are expected to reach $156 trillion– driven by a 5% compound annual development rate (CAGR),” the report noted.Related: Xs ad earnings sharing: Crypto payments on the horizon?The report revealed a split in opinions amongst the surveyed leaders over when most of merchants would welcome digital currency payments. While 50% of those surveyed were positive that many merchants would adopt crypto payments within the next three years, there were differed confidence levels whether it would occur within the next year.Ripple and United States Faster Payments Council report: Transforming the method money moves report. Source: RippleMiddle East and African leaders showed the greatest level of confidence, with 27% of them thinking that the majority of merchants will accept crypto as a payment approach within the next year.Meanwhile, leaders in the APAC region were the least confident, with just 13% believing in the very same timeframe. However, across all 300 surveyed leaders worldwide, 17% expressed their belief that such adoption could take place within the next year. This comes after research from the Bank of International Settlements (BIS) revealed there might be as much as 24 reserve bank digital currencies (CBDC) by the year 2030. In a report released by BIS on July 10– which surveyed 86 central banks from October to December 2022– it revealed 93% of those organizations are researching CBDCs, and there might be as much as 15 retail and 9 wholesale CBDCs in blood circulation by 2030. Magazine: Elegant and ass-backward: Jameson Lopps first impression of Bitcoin

Blockchain has the potential to conserve monetary organizations approximately $10 billion in cross-border payment costs by the year 2030, according to a current report.Published by digital payment network Ripple, in partnership with the United States Faster Payments Council (FPC) on July 29, the report surveyed 300 payment leaders throughout 45 various countries, from numerous sectors, such as fintech, banking, and retail.Results show that international payments leaders are dissatisfied with legacy rails for cross-border payments.Learn why 97% believe #blockchain and #crypto will transform the method cash moves in our latest whitepaper with @Faster_Payments. https://t.co/qacuAAzZrR pic.twitter.com/ForjM05Wbb— Ripple (@Ripple) July 28, 2023