Binance starts BTC/FDUSD and ETH/FDUSD trading pairs with zero-fees

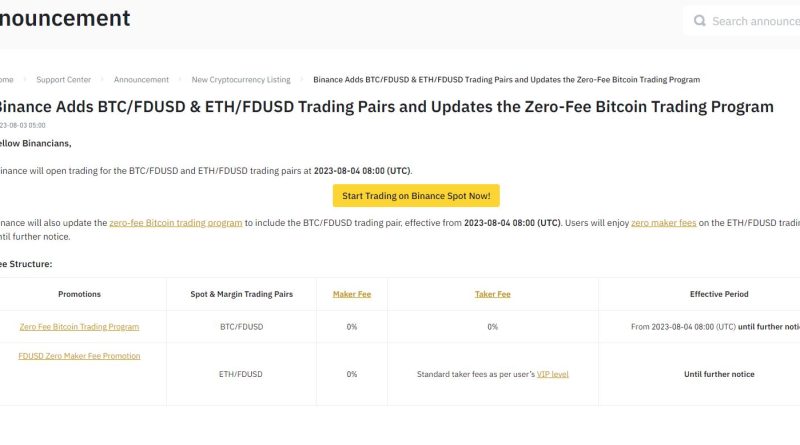

Crypto exchange Binance, on Thursday, August 3, announced that it would be opening trading for the Bitcoin/First Digital USD (BTC/FDUSD) and Ethereum/ First Digital USD (ETH/FDUSD) trading sets together with an upgraded zero-fee Bitcoin and Ethereum trading with newly added FDUSD stablecoin area and margin pairs.As per the statement, beginning from 08:00 UTC on August 4, users will gain from absolutely no maker and taker fees for BTC/FDUSD spot and margin trades through the Zero-Fee Bitcoin Trading Program. In addition, users can trade ETH/FDUSD with no maker charge, while the standard taker fee will use based upon the users VIP level.The trading volume for BTC/FDUSD spot and margin trading sets is not included in the VIP tier volume calculation or the Liquidity Providers programs, improving the trading experience for users.” BNB discounts, recommendation rebates, and any other changes will not use to the BTC/FDUSD spot and margin trading pairs during the promotion.” The recently introduced stablecoin, FDUSD, set up to be noted on Binance on July 26, 2023, at 8:00 am UTC, was delayed up until 2:00 pm UTC on July 26 due to FDUSD sets liquidity suppliers experiencing technical concerns. Screenshot of Binances announcement on the FDUSD sets and zero-fee bitcoin trading. Source: BinanceIn March, Binance concluded its zero-fee Bitcoin trading program and BUSD zero-maker charge promo, moving to the lesser-known TrueUSD (TUSD) stablecoin from BUSD. This modification, along with the elimination of Tether (USDT) from the zero-fee program, caused a significant drop in Binances market share and trading volumes by over 50%. The prices of cryptocurrencies like Bitcoin (BTC) and Ethereum (ETH) remained under pressure after the alteration.Related: Binances CZ alerts crypto community about emerging scamFirst Digital USD is backed by Hong Kong-based custodian and trust company First Digital. The group revealed the launch of the United States dollar-pegged FDUSD on June 1. FDUSDs market cap of $257 million is still low compared to other stablecoins like USDT, TUSD, BUSD and USTC. Hence, it will not have much effect on the crypto market now, but minting new FDUSD amidst demand from Binance can cause a significant boost in market cap.Magazine: Multichain saga screws users, Binance fires 1,000 personnel: Asia Express