Optimism transactions surpass Arbitrum, but what’s behind the uptick in users?

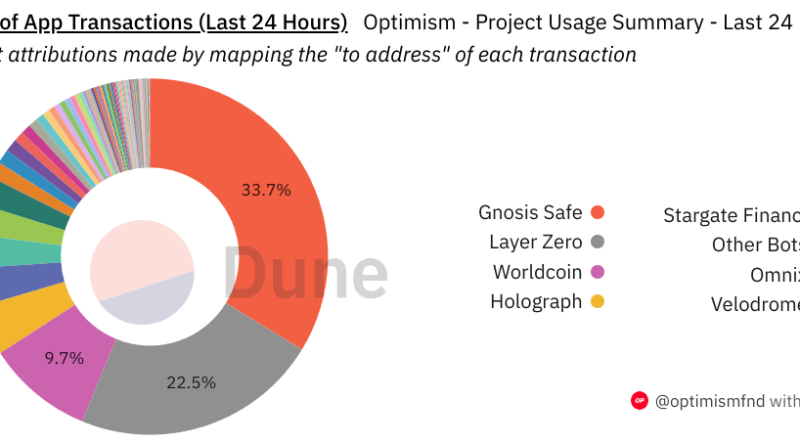

Optimism is a layer-2 scaling service that runs as a separate blockchain constructed on top of Ethereum. Despite having a smaller overall worth locked (TVL) than its rivals, Optimism might still have the possible to flourish in the significantly competitive decentralized financing (DeFi) landscape. Being one of the pioneers in the DeFi area, Optimism initially got an edge however had to contend with intense competitors. The task has actually been tracking behind other scaling services in terms of daily transactions for the past 6 months. Nevertheless, in late July, the scenario altered, as Optimism finally surpassed its main competitor, Arbitrum, and is revealing indications of increasing demand from users.The rise of layer-2 scaling solutionsThe increase in layer-2 activity on Ethereum has actually been substantial, exceeding mainnet activity by more than 4 times, according to information from L2beat. Different solutions have emerged to deal with Ethereums scalability obstacles, and each layer-2 job concentrates on different aspects, such as personal privacy, specific decentralized applications and nonfungible token markets. The leaderboard of deals and volumes constantly changes based on need, and each service comes with its own advantages and drawbacks.Optimism runs utilizing rollups, bundling transactions into a single transaction to be carried out on the base layer, acquiring all security functions from Ethereum. The approach behind Optimism assumes that all deals are valid unless challenged and shown otherwise, allowing for quick and economical transactions for users.Transactions on Ethereum mainnet vs. layer 2. Source: L2beatWhile Optimism and Arbitrum depend on rollups, the core distinction depends on Arbitrums central method, where a single entity (sequencer) is accountable for submitting scams proofs. On Optimism, anybody can send them.Transactions per 2nd, 7-day modification. Source: L2beatAmong the layer-2 competitors, Optimism has been the standout performer since July 20, experiencing a 47% growth in daily transactions. This development has actually enabled Optimism to go beyond competitor Arbitrum in daily transactions for the very first time in 6 months.Furthermore, the Optimism procedure has seen a rise in daily active addresses, with a 27.6% boost in 30 days, while Arbitrums activity has actually decreased by 7.5%. Arbitrum vs. Optimism, variety of special everyday active addresses. Source: GrowThePieThis pattern suggests a prospective shift in dominance, although reasoning too soon would be reckless. Arbitrums primary benefit depends on its much larger TVL compared to Optimism.According to DefiLlama, Arbitrum presently holds a considerable TVL of $2.35 billion, whereas Optimisms TVL is relatively lower at $920 million. Arbitrums supremacy is specifically apparent in the DeFi applications it shares with Optimism, such as Uniswap and Aave. In addition, Arbitrum boasts an excellent $500 million TVL in the derivatives exchange GMX.Coinbase and Worldcoin back the current surge in Optimism activityTwo of the primary factors for higher demand on Optimism are increased usage from Coinbase and Worldcoin (WLD). The task is also on track to carry out essential personal privacy mechanisms that could create another use case.A turning point for Optimism came with the launch of Coinbases sandbox on July 21, offering designers with a test environment to build and release brand-new applications on this layer-2 solution. This initiative incentivizes the development of brand-new tools, protocols and applications, cultivating development and innovation.One of the tasks using Optimism as a scaling option is Worldcoin, which has been acquiring considerable attention. The token airdrop on July 26 additional boosted activity on Optimism after supporting Uniswap on the Optimism mainnet. Worldcoin has actually also released many of its Safe wallets on Optimism. This adoption has actually contributed significantly to the everyday activity on the network, accounting for around 40%. Share of deals on Optimism, July 27. Source: Dune AnalyticsRelated: Worldcoin stuck after 70% drop from peak– More downside for WLD price?New personal privacy functions could benefit OptimismOptimisms ecosystem is set to go through a number of developments, consisting of 2 propositions by O( 1) Labs and RISC Zero to carry out zero-knowledge-proof systems. This move will offer the network with its own ZK-proof layers, akin to advancements on Polygon (MATIC) and zkSync.The development in active addresses on Optimism is a positive sign for the networks success, and the successful launch of the Worldcoin job marked a turning point for this scaling option. The rise in daily active addresses is likewise appealing, symbolizing the networks constant development and possible chances with the successful application of its privacy solutions.This post is for basic info purposes and is not meant to be and should not be taken as legal or investment advice. The opinions, views, and thoughts expressed here are the authors alone and do not necessarily reflect or represent the views and viewpoints of Cointelegraph.

Source: L2beatWhile Optimism and Arbitrum rely on rollups, the core distinction lies in Arbitrums centralized technique, where a single entity (sequencer) is responsible for sending fraud proofs. This development has enabled Optimism to exceed rival Arbitrum in everyday deals for the first time in six months.Furthermore, the Optimism protocol has witnessed a surge in everyday active addresses, with a 27.6% increase in 30 days, while Arbitrums activity has decreased by 7.5%. Arbitrums primary benefit lies in its much larger TVL compared to Optimism.According to DefiLlama, Arbitrum currently holds a substantial TVL of $2.35 billion, whereas Optimisms TVL is relatively lower at $920 million. Furthermore, Arbitrum boasts an outstanding $500 million TVL in the derivatives exchange GMX.Coinbase and Worldcoin back the current rise in Optimism activityTwo of the primary reasons for higher demand on Optimism are increased usage from Coinbase and Worldcoin (WLD). The token airdrop on July 26 further boosted activity on Optimism after supporting Uniswap on the Optimism mainnet.