Canadian crypto ownership declines amid tight regulations, falling prices

The BoC highlighted that ecosystem collapses, regulative difficulties and cost depreciation contributed to the decline in crypto ownership. Thinking about the governments intent to provide regulatory clarity integrated with a stable market, crypto ownership in the area is expected to pick up.Magazine: Deposit threat: What do crypto exchanges really do with your cash?

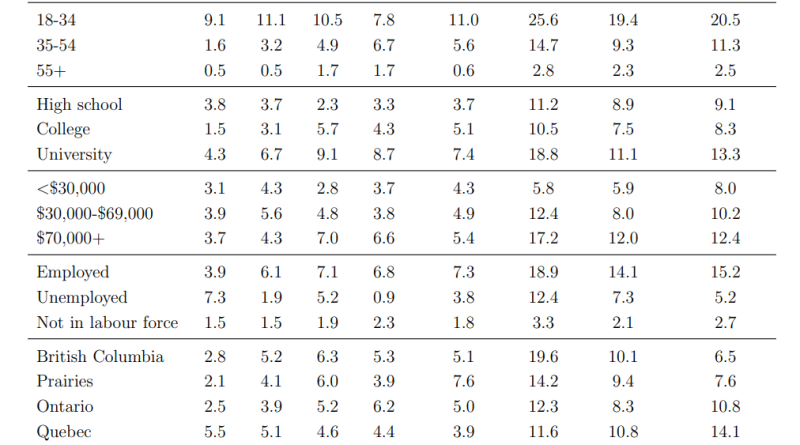

The Bank of Canada (BoC) reported a decline in the ownership of Bitcoin (BTC) and cryptocurrencies in the nation in 2022, as neither market conditions nor regulations sided in favor of Canadian crypto investors, according to a BoC study published on July 26. Source: Bank of CanadaThe above chart shows that Bitcoin ownership in Canada decreased to 9% by August 2022.” The greatest inspiration for Canadians interested in Bitcoin is as an investment, according to over one-third of the 4,996 participants in the Bank of Canadas 2022 survey.Percentage of Canadians who own Bitcoin, 2016 to 2022.

The Bank of Canada (BoC) reported a decline in the ownership of Bitcoin (BTC) and cryptocurrencies in the country in 2022, as neither market conditions nor guidelines sided in favor of Canadian crypto financiers, according to a BoC research study released on July 26. The research study consists of information from the yearly Bitcoin Omnibus Survey performed by the Canadian reserve bank, which revealed a regression from the enormous crypto adoption experienced in 2021. Bitcoin awareness and ownership in Canada, 2016 to 2022. Source: Bank of CanadaThe above graph shows that Bitcoin ownership in Canada decreased to 9% by August 2022. Nevertheless, BTC adoption saw a small uptick to 10% by the end of the year, and the drop in Bitcoin ownership does not indicate that financiers were expanding their investments into other cryptocurrencies. The report read:” Investors did not appear to shift out of Bitcoin and into other cryptoassets, as we observe reduced ownership of altcoins.” The greatest inspiration for Canadians interested in Bitcoin is as an investment, according to over one-third of the 4,996 respondents in the Bank of Canadas 2022 survey.Percentage of Canadians who own Bitcoin, 2016 to 2022. Source: Bank of CanadaMost Canadians obtained their crypto holdings through mobile and web apps. Bitcoin and crypto mining became the third-most-popular technique of collecting tokens for the 2nd consecutive year. Dogecoin (DOGE) was the most desired crypto investment considering the Elon Musk-induced buzz and its history of arbitrarily increasing in rate when it comes to the altcoin ecosystem. Ether (ETH), Bitcoin Cash (BCH) and Litecoin (LTC) were a few of the other popular altcoins amongst Canadians.Related: Parliamentary report recommends Canada acknowledge, strategize about blockchain industryAccording to the BoC, the research study matters for keeping an eye on the two conditions that might call for the issuance of an in-house central bank digital currency (CBDC): “if Canadians almost or do stop utilizing cash, or if Canadians extensively adopt and use personal cryptocurrencies for payments.” Hey Canada, we need your input! Our public assessment on a possible #DigitalCanadianDollar is now LIVE. #HaveYourSay by June 19: https://t.co/p8BdG3tQ9h pic.twitter.com/vKRoBfAngu— Bank of Canada (@bankofcanada) May 8, 2023