Coinbase Q2 beats estimates amid Blackrock custody deal, institutional focus

Crypto exchange Coinbase reported $708 million in earnings for the second quarter of 2023 enhanced by its custody deal with Blackrock and institutional focus, despite recent action taken against it by regulators.The exchanges recent profits reported net incomes of $663 million, down 10% compared to Q2 2022 but beating estimates on its growing market supremacy in the United States as rivals such as Binance are slowed down by regulative trouble.Our Q2 23 financial results remain in and our letter to investors can be discovered on the Investor Relations website at https://t.co/8ovHEtQp5N pic.twitter.com/03JF6gUS0R— Coinbase (@coinbase) August 3, 2023

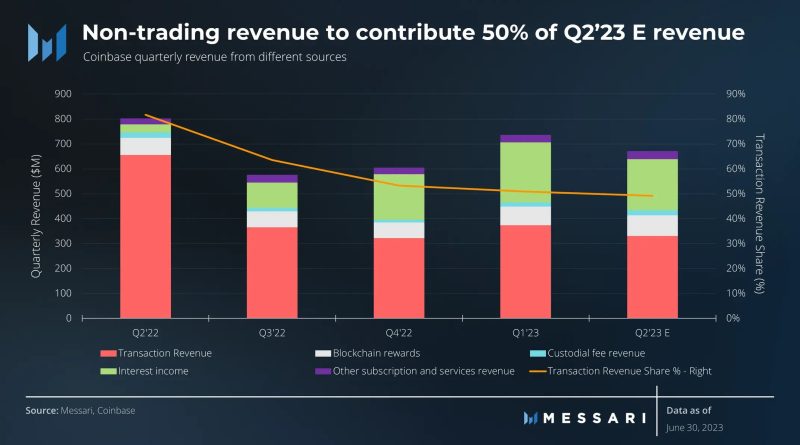

Early approximates from the Zacks Consensus Estimate put Coinbases incomes at $643.4 million, a 20.4% decrease from the previous year during the same time.However, losses were posted at $97 million– the sixth quarterly loss in a row for the exchange.Coinbases performance was credited to the strong crypto price cycle last quarter where the similarity Bitcoin (BTC) and other altcoins published brand-new yearly highs.A Messari report properly predicted Coinbases non-trading revenue would surpass its trading income for the very first time.The exchanges non-trading profits for the quarter reached $335.4 million against transaction income of $327.1 million.Coinbase CEO Brian Armstrong stated on an Aug. 3 earnings call that it was focused on the non-trading parts of business over the next 3 to five years, calling scalability, regulatory clearness and driving crypto utility as focus areas.Related: Coinbase CEO to Americans: Urge representatives to vote Yes on crypto regulatory clarity billsDuring the call, Coinbase chief legal officer Paul Grewal also revealed confidence the exchange would win the court case brought by the U.S. Securities and Exchange Commission, adding that it prepares to submit an order in court to dismiss the case completely. Coinbases share rate remained flat in after-hours trading, trading simply under $91. Its down over 73% from its $343 all-time high in November 2021, according to Google Finance.Additional reporting by Tristan Greene and Jesse Coghlan.