Bitcoin faces ‘endless spot selling’ as BTC price dips below $28.7K

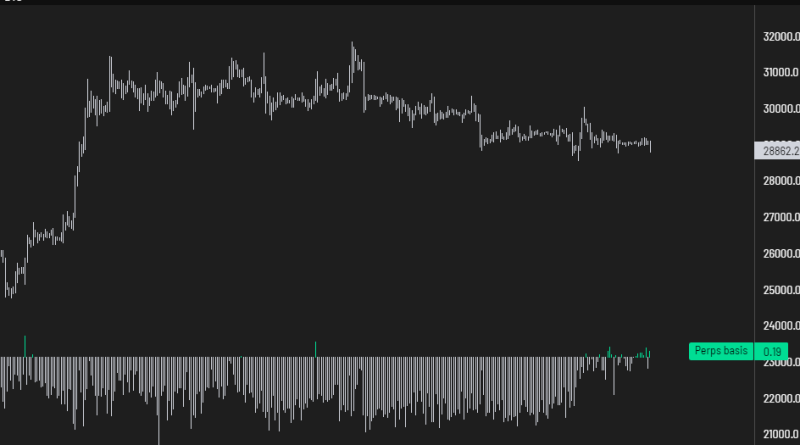

Source: TradingViewBitcoin traders brace for losses as $29,000 assistance breaksData from Cointelegraph Markets Pro and TradingView revealed BTC/USD returning nearer to its August lows after a shaky weekly close.The start of United States trading offered no indications of relief for bulls after a weekend of sideways behavior, with experts and traders already predicting a down result once the impasse broke.Commenting on the situation, popular trader Daan Crypto Trades kept in mind that derivatives trading at a premium over area put bulls in an even less beneficial position. Source: Daan Crypto Trades/XTrading suite DecenTrader alerted that one of its exclusive trading tools had actually turned bearish “throughout the majority of timeframes,” while earlier, popular trader Crypto Tony said that $29,000 was already damaging as support.”The thing about this structure general and normally this region acting as a confluence support area is because we likewise have 2 bull market bullish momentum exponential moving averages establishing here,” he stated about the area between $26,000 and present spot price.That assistance cluster, Rekt Capital added, might end up being what “really gets in the way” of a double leading, and rather enables Bitcoin to print a weekly greater low and continue upward.BTC/ USD 1-week chart with 200SMA; 21, 50EMA.

Source: TradingViewBitcoin traders brace for losses as $29,000 support breaksData from Cointelegraph Markets Pro and TradingView showed BTC/USD returning nearer to its August lows after a shaky weekly close.The start of United States trading provided no signs of relief for bulls after a weekend of sideways behavior, with traders and experts already forecasting a down result once the impasse broke.Commenting on the situation, popular trader Daan Crypto Trades kept in mind that derivatives trading at a premium over area placed bulls in an even less advantageous position. Source: Daan Crypto Trades/XTrading suite DecenTrader cautioned that one of its proprietary trading tools had flipped bearish “across most timeframes,” while earlier, popular trader Crypto Tony stated that $29,000 was currently weakening as support. #BitcoinLooks most likely to retest the green zone below and possible break lower from there.We had the 2 successive day-to-day closes listed below assistance signaling further disadvantage as most likely.

Bets on a drop into the Aug. 10 U.S. Consumer Price Index print were already on the table– something that would make up, ought to it play out, classic BTC price action.Data from monitoring resource CoinGlass put overall BTC long liquidations at over $10.5 million on the day. Cross-crypto long liquidations stood at $60 million.Can BTC price avoid a 2023 double top?Zooming out to weekly timeframes, on the other hand, popular trader and expert Rekt Capital exposed a fascinating face-off in the producing BTC/USD. Related: BTC cost meets CPI as volatility collapses– 5 things to know in Bitcoin this weekWeekly candles were in the process of completing a double leading development, he kept in mind in a YouTube update on the day, with confirmation due within the next month.To print the classic M-shaped pattern, however, Bitcoin would need to review the area around $26,000– something that would require an offense of several essential moving averages.These included the 200-week easy moving average (SMA), along with the 50-week and 21-week exponential moving averages (EMAs).”The thing about this structure overall and generally this region serving as a confluence assistance region is since we also have 2 bull market bullish momentum rapid moving averages establishing here,” he stated about the area between $26,000 and existing spot price.That assistance cluster, Rekt Capital added, might end up being what “really obstructs” of a double top, and instead enables Bitcoin to print a weekly greater low and continue upward.BTC/ USD 1-week chart with 200SMA; 21, 50EMA. Source: TradingViewThis article does not contain financial investment guidance or suggestions. Every investment and trading relocation involves danger, and readers ought to perform their own research study when making a choice.