Bitcoin, Ether price slump leads to crypto bloodbath with $1B in liquidations

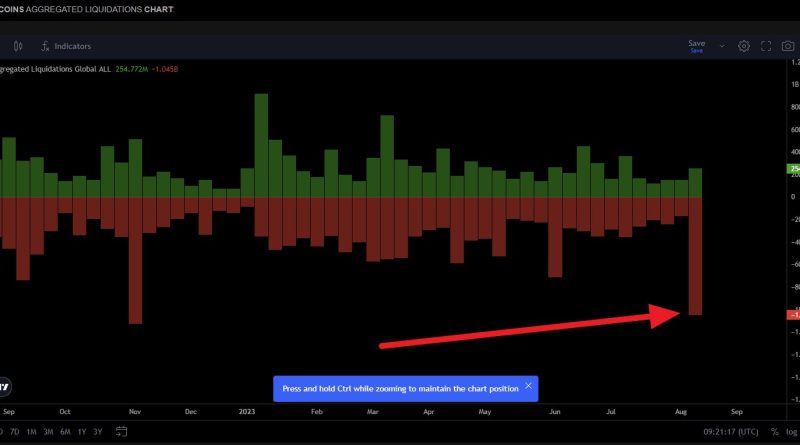

The Bitcoin (BTC) and Ether (ETH) cost downturn on Aug. 18 saw the top 2 cryptocurrencies fall to a 2-month low and set off a series of liquidations for countless derivative traders.The crypto bloodbath resulted in billions of dollars worth of hedged positions being liquidated and numerous traders lost millions of dollars in a single trade. According to Coinglass data, an overall of 176,752 traders got liquidated over the previous 24 hours. 90% of these liquidations happened within the last 12 hours, showing a fast rise in price volatility just days after BTC and ETH taped their lowest everyday volatility in a number of years. Crypto market liquidation information. Source: CoinglassAmong a sea of traders that lost a significant portion of their derivative positions, 2 particular liquidations caught the crypto communitys eye for the large scale of it. Throughout the price depression, a financier on Binances ETHBUSD contract was liquidated at $1,434.37 losing $55.9211 million, making it the biggest liquidation for the day. Another Binance trader on the BTCUSDT contract lost almost $10 million in liquidations.Related: Bitcoin speculators now own the least BTC considering that $69K all-time highsThe billion-dollar liquidation is the most significant liquidation occasion in crypto in the previous 8 months, after the last such occasion during the FTX collapse.Biggest liquidation event of 2023. Source: TradingViewThe price function in the crypto market was credited to several factors including the SpaceX Bitcoin write down, the macroeconomics, where BTC and ETH have been trading in a range for the previous couple of months. BTC held onto the essential $28,000 assistance for a couple of months while ETH held the $1,500 support prior to giving up the other day. The liquidity in the crypto market has been on the lower side, and popular crypto exchanges like Coinbase had seen a significant decrease in their trading volume.Magazine: Deposit risk: What do crypto exchanges actually do with your money?