Why did Bitcoin drop? Analysts point to 5 potential reasons

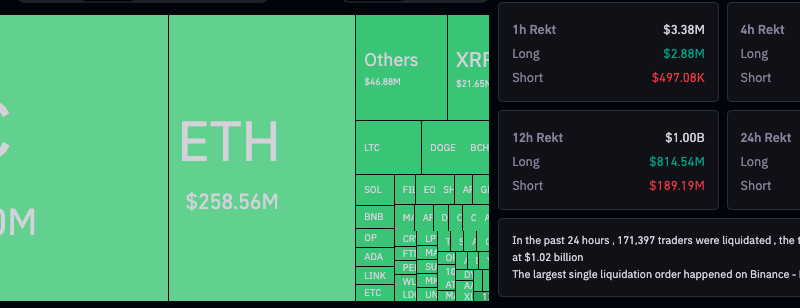

While there seems no agreement as to why the marketplaces all of a sudden dropped, several crypto market analysts have shared their preliminary theories with Cointelegraph. SpaceX offloads Bitcoin, interest rate fearseToro market expert Josh Gilbert pinned the drop on a report that SpaceX may have offloaded some or all of its $373 million in Bitcoin holdings, which came from an Aug. 17 short article from the Wall Street Journal. “Whenever you have a big name in the market selling Bitcoin, particularly someone as prominent as Elon Musk, it will put the cost under pressure.”This would put the sudden rate drop around 2.5 hours after the report was released online.Gilbert stated another theory could be the fast shift in belief, due to the more comprehensive markets expectations of future rates of interest hikes from the U.S. Federal Reserve. “If we likewise think about some of the weaknesses weve seen throughout global markets– particularly risk properties– over the last few weeks with the expectation that rates will likely remain higher for longer, it was a dish for a pullback,” Gilbert explained. “Bitcoin has actually struggled for a leg higher in the last month, trading in a tight variety of in between $29k and $30k with little excellent news to press the property higher, which has just exuberated this sell-off,” he added.Government bond yieldsTina Teng, a market expert from CMC Markets shared a different viewpoint, looking to the current increase in government bond yields as the root cause behind the sell-off. Teng explained that increasing bond yields typically shows a decrease in liquidity for the wider market. “This could be the primary factor that cryptocurrencies sank,” she said. In addition, Teng stated that while the Evergrande crisis might have an indirect cause on the price of Bitcoin she didnt think that it was among the origin of the decrease. “This has more of an effect on belief toward the Chinese economy and investors,” she explained.Whales selling bigWhile there were lots of other news events that might be responsible, pseudonymous derivatives trader @TheFlowHorse told Cointelegraph that the unexpected move down might have arised from a single big actor making a big sell, which then led to additional pressure on derivatives. “It was not simply a natural waterfall. Someone huge bailed for a purpose and set it in motion. Spot volume hardly compared to perps.”According to information from crypto analytics platform Coinglass, more than $427 million in Bitcoin long positions were liquidated in the last 4 hours. Over the course of the last 24 hours, there were more than more than $822 million liquidations for traders with open long positions– a bet that the rate of crypto assets will move upwards.More than $427 million worth of Bitcoin long positions have actually been liquidated in the last 24 hours. Source: CoinglassDescribing much of the descriptions for the decline as “pure speculation,” Horse suggested that since the reports of the SEC hinting its approval of an Ethereum Futures ETF came minutes after the dump– a big fund might have unloaded their Bitcoin position to “activate a waterfall to purchase ETH.” Related: Bitcoin cost briefly dips below $26K, being up to two-month lowsBitcoin has actually recovered a little considering that the crash, getting 1.2% in the last two hours, according to information from TradingView. At the time of publication, Bitcoin is changing hands for $26,619. Its rate appears to have actually been buoyed by news that the SEC might look to approve an Ethereum Futures ETF product as quickly as October. Deposit threat: What do crypto exchanges actually finish with your money?

Elon Musks SpaceX supposedly offering its Bitcoin (BTC) holdings, the personal bankruptcy of a Chinese home giant and worries of rate of interest walkings have been amongst the theories raised regarding Bitcoins freak price dip.On Aug. 18 around 9:35 pm UTC, the cost of Bitcoin suddenly plunged over 8% in a span of 10 minutes, taking with it the larger cryptocurrency market, leaving many in the crypto neighborhood scratching their heads.the fuck was that? pic.twitter.com/Lh2zGXv29n— Molly White (@molly0xFFF) August 17, 2023

“Whenever you have a big name in the market offering Bitcoin, specifically somebody as influential as Elon Musk, it will put the cost under pressure. Furthermore, Teng said that while the Evergrande crisis might have an indirect cause on the cost of Bitcoin she didnt think that it was among the root causes of the decline. Over the course of the last 24 hours, there were more than more than $822 million liquidations for traders with open long positions– a bet that the rate of crypto assets will move upwards.More than $427 million worth of Bitcoin long positions have actually been liquidated in the last 24 hours. Related: Bitcoin rate briefly dips listed below $26K, falling to two-month lowsBitcoin has recuperated slightly considering that the crash, acquiring 1.2% in the last two hours, according to information from TradingView.