What are the 3 assets most correlated with Bitcoin?

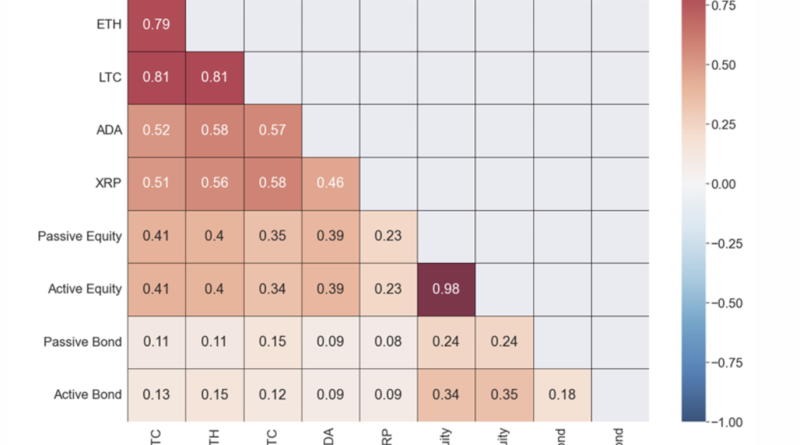

The financial media frequently points out Bitcoins (BTC) correlation to big tech. “Bitcoin is trading like a tech stock” is a typical narrative alongside BTCs often acute inverse-relationship with the United States dollar. But are these correlations set in stone, and can they be helpful for anticipating future price relocations? Lets take a more detailed look at several reports evaluating the relationship between Bitcoin and various property types. Bitcoins historic correlations vary across timeframesA report released in October 2022 by the Multidisciplinary Digital Publishing Institute showed up at a number of key conclusions relating to Bitcoins connections with standard financial assets, consisting of: The extreme volatility of the Bitcoin market suggests that long-lasting correlations are stronger than short-term connections; The “positive linkage in between Bitcoin and run the risk of possessions increases during extreme shocks” such as COVID-19; Bitcoin can be positively correlated with risk properties and adversely associated with the US dollar; Bitcoin can act as a hedge against the United States dollar. While some of these points can be countered with newer price data over the last 9 to 10 months, such as a significant drop in volatility, insight can still be acquired from analyzing them. In addition, other researchers have gone deeper into the relationship of specific properties to Bitcoin throughout set timeframes.Crypto-specific stocks A couple of crypto-related equities have been more associated to Bitcoin than any other properties on the market. The 90-day connection coefficient for BTC/MSTR, BTC/COIN, and BTC/RIOT have all stayed near 1 for the last several months. The symbols “BTC/xxxx” indicate the correlation coefficient for each property as determined versus Bitcoin. For MSTR, the coefficient has fallen no lower than 0.68 considering that September 2022. The coefficient for RIOT fell to approximately 0.75 in June 2023, while COIN trended near 0 for a time throughout May and June. COIN, ROIT, and MSTR year-to-date chart with 90-day correlation coefficients compared to BTC. Source: TradingViewAll of these stocks have actually exceeded Bitcoin up until now this year while also showing higher volatility. Financiers might be utilizing these possessions as proxies for Bitcoin, which cant be purchased through a brokerage account. One reason these three stocks are so carefully associated to Bitcoin has to do with the balance sheet of their respective business. They all have a considerable amount of Bitcoin holdings. As seen in the table listed below, MSTR has the most holdings of any public company with 152,333 Bitcoin. COIN can be found in 4th place with 10,766 Bitcoin, and RIOT is in 8th place with 7,094 Bitcoin.Bitcoin holdings by public companies. Source: CoinGeckoPrecious metalsWhen it comes to correlation with commodities and precious metals, in specific, silver actually beats gold in mirroring Bitcoins price moves considering that 2019. A November 2022 report by Jordan Doyle and Urav Soni of the CFA Institute entitled “How do cryptocurrencies correlate with conventional possession classes?” shed some light on Bitcoins most-correlated assets. Crypto and Commodities correlation heat map. Source: CFA InstituteSilver has been the commodity most closely-correlated to Bitcoin from October 2019 and to October 2022 with a connection coefficient of 0.26, according to the report. Golds connection, by comparison, was just 0.15, possibly due to silvers higher volatility. The report notes: Silver has the greatest connection, peaking at 0.26 for silver and bitcoin. Bitcoin, the so-called digital gold, exhibits only weak correlation with the precious metal.Passive and active equity funds and bonds When speaking of stocks as a whole and their correlation to Bitcoin, looking at an index or ETF would be the most common way to make a contrast. This provides an introduction of the property class in general rather than zeroing in on one specific stock, which may have any number of factors impacting it. As may be expected, growth funds tend to be more correlated with cryptocurrencies, most likely due to their more speculative nature. Significantly: “Growth funds display a stronger connection to cryptocurrencies than value funds. The correlation coefficient in between small-cap development funds and bitcoin, for example, is 0.41, compared to 0.35 for small-cap worth funds and bitcoin.” Crypto, equity funds, and bonds correlation heat map. Source: CFA InstituteIn other words, crypto markets as a whole are “weakly sensitive to interest rate characteristics” that were at least partly responsible for a broad drawdown in equities throughout 2022. Bonds bear little to no relationship with Bitcoin. Passive bond funds showed a connection of simply 0.11, while active bond funds were simply two basis points higher at 0.13. All information points are for the timeframe of October 2019-October 2022. Bitcoins correlations are not a crystal ballDue to Bitcoins big rate swings, all correlations can alter at a moments notice. Still, the data used here offers an accurate photo of the possessions most carefully associated to Bitcoin in the recent past. Related: Bitcoin and correlations: analyzing the relationship in between btc, gold, and the nasdaqIts likely that crypto-specific stocks will continue having a strong connection due to their Bitcoin holdings, while the correlation with commodities and equity funds might rapidly change course going forward.This short article does not contain investment recommendations or suggestions. Every investment and trading relocation involves risk, and readers must perform their own research study when making a choice.

Bitcoins historical connections differ throughout timeframesA report published in October 2022 by the Multidisciplinary Digital Publishing Institute showed up at numerous key conclusions concerning Bitcoins connections with conventional financial possessions, consisting of: The extreme volatility of the Bitcoin market indicates that long-term correlations are more powerful than short-term connections; The “positive linkage between Bitcoin and risk properties boosts throughout severe shocks” such as COVID-19; Bitcoin can be favorably correlated with danger possessions and adversely correlated with the United States dollar; Bitcoin can serve as a hedge versus the United States dollar. In addition, other scientists have gone deeper into the relationship of particular possessions to Bitcoin during set timeframes.Crypto-specific stocks A couple of crypto-related equities have actually been more correlated to Bitcoin than any other possessions on the market. Bitcoin, the so-called digital gold, exhibits only weak connection with the precious metal.Passive and active equity funds and bonds When speaking of stocks as a whole and their correlation to Bitcoin, looking at an index or ETF would be the most typical method to make a contrast. Bitcoins connections are not a crystal ballDue to Bitcoins large rate swings, all correlations can change at a moments notification. Related: Bitcoin and connections: taking a look at the relationship in between btc, gold, and the nasdaqIts likely that crypto-specific stocks will continue having a strong connection due to their Bitcoin holdings, while the connection with products and equity funds might rapidly change course going forward.This short article does not include financial investment recommendations or recommendations.