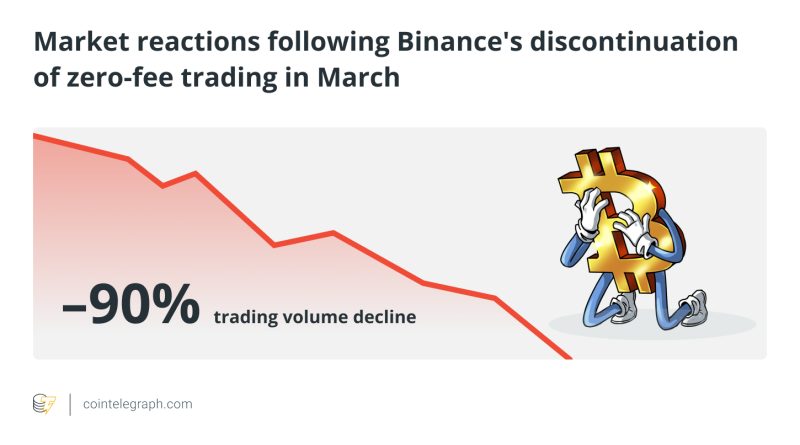

Binance’s zero-fee Bitcoin update could echo March downturn

Binance cryptocurrency exchange revealed its intention to customize its zero-fee Bitcoin trading program on Aug. 24. This action has the prospective to initiate a substantial market decline, similar to the 90% trading volume decrease observed following Binances discontinuation of zero-fee trading in March.In a main declaration, cryptocurrency exchange Binance revealed its strategies to execute updates to the zero-fee Bitcoin trading beginning with Sept. 7. Binance means to customize the zero-fee Bitcoin trading for the Bitcoin (BTC)/ True USD (TUSD) area and margin trading pair.Previously, traders experienced zero maker and taker costs while participating in BTC trading with TUSD pairs. A regular taker cost will now be implemented based on the users VIP level. Nonetheless, users will still experience no maker charges when carrying out Bitcoin trades on the BTC/TUSD spot and margin trading pair.”The matching trading volume on the BTC/TUSD area and margin trading pair will count towards VIP tier estimation and all Liquidity Provider programs. In addition, BNB discount rates, recommendation refunds and any other fee changes will resume for BTC/TUSD spot and margin trading volumes.”Seemingly, Binance is stopping its zero-fee Bitcoin trading initiative for TUSD, showing a reduced support for the TUSD stablecoin due to different concerns. Importantly, users will still keep the opportunity of no maker and taker charges while taking part in Bitcoin trading within the FDUSD area and margin trading pair.Binances change of its zero-fee Bitcoin trading plan for the BTC/TUSD area and margin trading set might be inadvertently prompting another round of selloffs in the market.Related: Binance dubs barred Russian banks on its platform as Yellow and Green cardsAccording to CoinMarketCap, the BTC/TUSD and BTC/USDT pairs are the most often traded for Bitcoin, making up 11% and 7% respectively. The trading volume in Tether (USDT) pairs experienced a considerable drop after Binance stopped supporting BUSD and designated TUSD as the sole trading set for zero-fee Bitcoin trading.Yet once again, the exchange is rerouting attention away from the widely traded TUSD to the lesser-known FDUSD stablecoin. Especially, FDUSD doesnt rank within the top 10 Bitcoin sets by trading volume, with The market capitalization of FDUSD standing at $324 million.Collect this post as an NFT to protect this moment in history and show your support for independent journalism in the crypto space.Magazine: Deposit risk: What do crypto exchanges actually make with your cash?