UK considers blanket ban on crypto investment cold calls

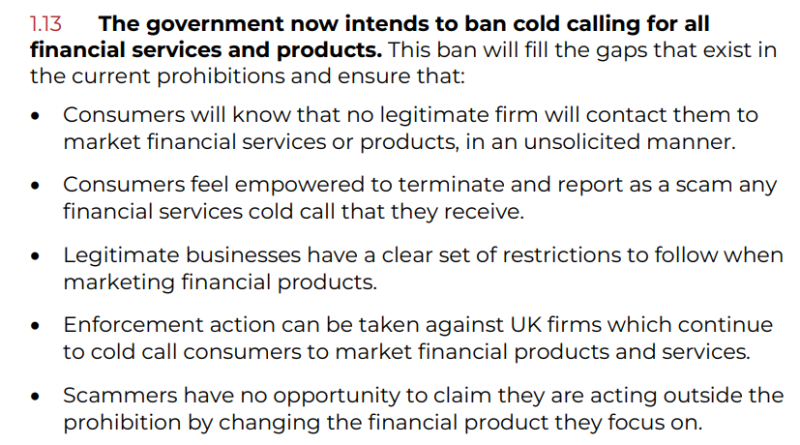

As the United Kingdom prepares for a ban on finance-related cold calls, His Majestys Treasury has issued a consultation paper, and it is calling for evidence to assess the complete impact on companies and the expenses associated with introducing and executing the ban.On May 3, the U.K. government revealed an ambitious scams technique, which would involve including 400 new tasks to upgrade its technique to intelligence-led policing. “The federal government will not tolerate this behavior,” said Andrew Griffith, the financial secretary to the Treasury, while slamming the increasing cold calls for financial services and items that typically target the most vulnerable members of society. Source: gov.ukIntending to enforce a blanket ban on monetary cold calls, the Treasury put forth 19 questions to stakeholders to ensure optimal effect on fraudsters and minimum result on organizations that typically rely on cold calling prospects.

As the United Kingdom gets ready for a ban on finance-related sales calls, His Majestys Treasury has provided an assessment paper, and it is calling for evidence to evaluate the complete influence on companies and the costs connected with introducing and carrying out the ban.On May 3, the U.K. government announced an ambitious fraud technique, which would involve adding 400 brand-new tasks to update its approach to intelligence-led policing. As Cointelegraph formerly reported, the National Crime Agency approximates that fraud costs the country around 7 billion pounds ($ 8.7 billion) annually. “The federal government will not tolerate this behavior,” stated Andrew Griffith, the economic secretary to the Treasury, while slamming the increasing cold calls for monetary services and products that frequently target the most susceptible members of society. The Treasurys case research study on crypto sales call scam. Source: gov.ukThe Treasury highlighted numerous circumstances where sales calls were responsible for financiers losses, out of which one included cryptocurrencies, as shown above. While the U.K. federal government previously implemented numerous restrictions and limitations on cold calling, fraudsters often find loopholes in the system to bypass the law. The Treasury plans to enforce a blanket ban on financing cold calls. Source: gov.ukIntending to enforce a blanket ban on monetary cold calls, the Treasury presented 19 questions to stakeholders to ensure optimal effect on fraudsters and minimum impact on companies that typically depend on cold calling prospects. The consultation closes on Sept. 27, 2023. Related: UK Treasury plans to exclude derivatives and unbacked tokens from regulative sandboxThe U.K. federal government just recently declined the attract think about and manage cryptocurrencies as gaming. “HM Treasury and the FCA [Financial Conduct Authority] will deal with the industry to ensure crypto firms are made totally knowledgeable about the standards needed for approval at the FSMA entrance. More interactions will be provided in due course to ensure standards for approval are plainly offered to crypto firms running in the UK.” The federal government action kept in mind that such an approach has the possible to totally counter the internationally predetermined suggestions from international companies and standard-setting bodies. Magazine: Recursive inscriptions: Bitcoin supercomputer and BTC DeFi coming soon