Arbitrum (ARB) falls to all-time low as network usage metrics decline

Lookonchain has actually observed a whale withdrawing ARB tokens from the Aave loaning platform and transferring some to Binance.A whale who is long $ARB on #Aave is offering $ARB to repay the debt.Over the previous 5 hours, the whale has withdrawn 5M $ARB ($ 3.85 M) from #Aave and transferred 3.8 M $ARB ($ 2.93 M) to #Binance. And the whale presently holds 8M $ARB ($ 6.16 M).

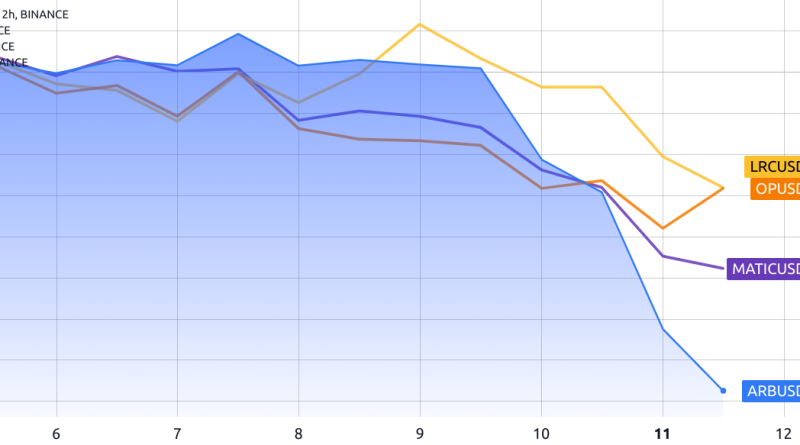

Between Sept. 9 and Sept. 11, the rate of Arbitrum (ARB) tokens experienced a sharp decline of 14.5%, marking its lowest point in history.Investors are now eagerly looking for insight into the factors driving this movement and questioning whether Arbitrum still has the competitive edge, especially thinking about that irrespective of the ARB token performance, the network TVL exceeds $1.6 billion.Arbitrum (ARB) vs. competitors Polygon (MATIC), Optimism (OP) and Loopring (LRC). The first proposal, posted on Sept. 2, aims to designate up to 75 million ARB tokens from the projects treasury to resolve “short-term community requirements” for active decentralized applications (DApps) within the community. Even if approved, this allotment represents less than 2% of the DAO treasury holdings and is not likely to have actually set off the ARB token rate correction, regardless of ones stance on the proposal.Another governance proposal that has actually gathered attention was introduced on Sept. 9 by PlutusDAO.

The obstacle with this analysis lies in the obscurity of domino effect. Typically, take advantage of long positions are obliged to close when token prices have currently fallen, rather than the reverse. This highlights the importance of investors analyzing Arbitrums activity and deposit patterns over the previous couple of months, which could have possibly activated the current price performance.Declining network activity is most likely the culpritArbitrums TVL has actually significantly declined to $1.67 billion, marking its lowest level considering that mid-February. Arbitrum network total worth locked. Source: DefiLlamaThis 25% decrease over the past 2 months raises several concerns, mainly suggesting a loss of financier self-confidence. This recession has the prospective to minimize liquidity and weaken the projects overall practicality. Additionally, it might deter new individuals, restraining network development and adoption. Next, its crucial to take a look at the variety of active addresses within the networks leading DApps.Arbitrum network leading decentralized applications by active addresses. Source: DappRadarThere is an obvious decline in 30-day active addresses, even among well-established DApps like Uniswap, 1inch, Radiant, SushiSwap and GMX. When considering the decline in TVL along with minimized user activity, it ends up being evident that there is a significant decrease in need for the network. While pinpointing a singular cause for this movement is challenging, one can hypothesize that completing chains such as zkSync Era and Coinbases Base might have contributed.The information recommends that Arbitrums 14.5% correction appears to result from a mix of investor frustration with the governance system and the networks uninspired activity, in spite of using considerably lower fees compared to Ethereum. Unless there is an increase in deals and a growth of its user base, it is unlikely that ARB will be able to close the rate efficiency gap with its competitors.This post is for general details functions and is not intended to be and need to not be taken as legal or financial investment suggestions. The thoughts, views, and opinions revealed here are the authors alone and do not necessarily show or represent the views and viewpoints of Cointelegraph.

Between Sept. 9 and Sept. 11, the price of Arbitrum (ARB) tokens experienced a sharp decline of 14.5%, marking its most affordable point in history.Investors are now excitedly seeking insight into the aspects driving this movement and questioning whether Arbitrum still has the competitive edge, specifically thinking about that irrespective of the ARB token performance, the network TVL exceeds $1.6 billion.Arbitrum (ARB) vs. rivals Polygon (MATIC), Optimism (OP) and Loopring (LRC). The very first proposition, published on Sept. 2, aims to assign up to 75 million ARB tokens from the tasks treasury to address “short-term community needs” for active decentralized applications (DApps) within the environment. Even if authorized, this allotment represents less than 2% of the DAO treasury holdings and is not likely to have actually activated the ARB token price correction, regardless of ones position on the proposal.Another governance proposal that has garnered attention was presented on Sept. 9 by PlutusDAO. Lookonchain has observed a whale withdrawing ARB tokens from the Aave lending platform and moving some to Binance.A whale who is long $ARB on #Aave is selling $ARB to repay the debt.Over the previous 5 hours, the whale has withdrawn 5M $ARB ($ 3.85 M) from #Aave and transferred 3.8 M $ARB ($ 2.93 M) to #Binance. Unless there is an upswing in transactions and an expansion of its user base, it is not likely that ARB will be able to close the cost performance gap with its competitors.This article is for basic info purposes and is not intended to be and must not be taken as legal or investment advice.