Solana falls 6% amid fears of FTX dump — but there’s a catch

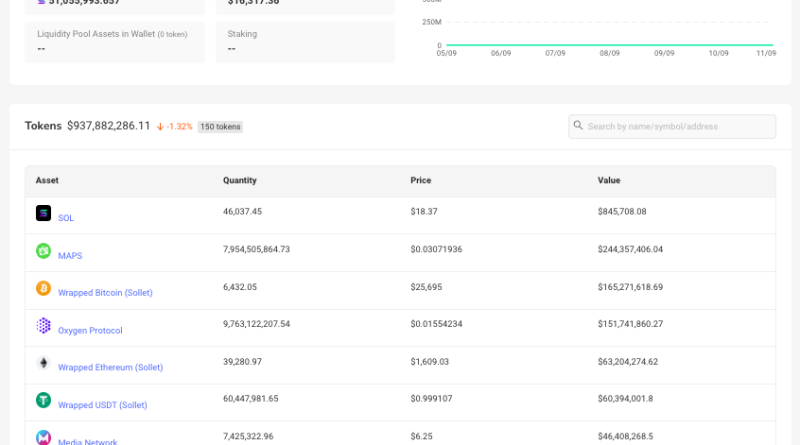

Notably, the plan has actually not yet been approved by the courts, however, the strategy and a number of other matters related to the FTX token sales are anticipated to come prior to the Delaware Bankruptcy Court on Sept. 13. Related: FTX wallet shifts $10M in crypto, triggering fear of token dumps to comeIn an April 12 hearing, FTX disclosed that it had recovered approximately $7.3 billion in liquid properties, with $4.8 billion of that amount being made up of possessions recovered since November 2022. Total however, according to files raised in the hearing, FTX held an overall of $4.3 billion in crypto possessions readily available for stakeholder healing at market prices as of April 12. FTX possessions offered for stakeholder healing since April 12. Source: Sullivan and CromwellAt the time of publication, Solana is changing hands for $18.38 apiece, down nearly 11% for the week. BitCulture: Fine art on Solana, AI podcast, music + book reviews

On Aug. 24, FTX proposed to designate Mike Novogratzs Galaxy Digital Capital Management as the investment supervisor that would manage the sales of its recuperated crypto holdings.In this strategy, the FTX estate would just be allowed to sell an optimum of $100 million worth of its tokens each week, however, that limit might be raised to $200 million on a private token basis. These limitations have been presented in a bid to minimize the impact of token sales on the broader market while still permitting for FTX to make financial institutions whole.The FTX collapse and as a result most significant black swan Solana ever endured put SOL at $8And were fretted about ~$ 600M that will be sold over the course of the next 5 years?Some Major L1s have greater inflation than this and no one cares. Related: FTX wallet moves $10M in crypto, sparking fear of token dumps to comeIn an April 12 hearing, FTX disclosed that it had actually recovered approximately $7.3 billion in liquid properties, with $4.8 billion of that amount being made up of properties recuperated as of November 2022.

Others have actually instead prompted calm, as the bankruptcy plan in fact restricts how much can be offered off at onceAccording to FTX insolvency filings, the proposed strategy for the liquidation of FTXs properties enforces a series of conditions on the sale of tokens. On Aug. 24, FTX proposed to select Mike Novogratzs Galaxy Digital Capital Management as the investment manager that would oversee the sales of its recuperated crypto holdings.In this plan, the FTX estate would only be allowed to sell an optimum of $100 million worth of its tokens each week, nevertheless, that limitation could be raised to $200 million on a private token basis. These limitations have actually been presented in a bid to decrease the impact of token sales on the more comprehensive market while still allowing for FTX to make lenders whole.The FTX collapse and as a result biggest black swan Solana ever withstood put SOL at $8And were fretted about ~$ 600M that will be sold over the course of the next 5 years?Some Major L1s have higher inflation than this and no one cares.