Bitcoin futures open interest jumps by $1B: Manipulation or hedge?

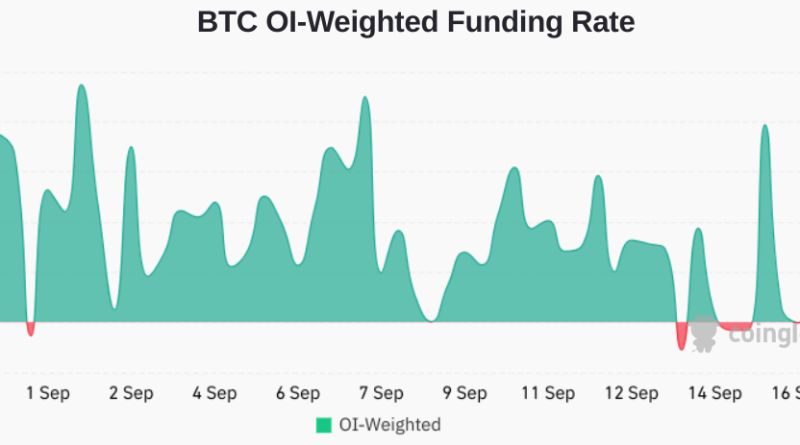

Bitcoins (BTC) open interest on derivatives exchanges experienced an abrupt rise of $1 billion on Sept. 18, prompting financiers to question whether whales were accumulating in anticipation of the unsealing of Binances court filings.However, a closer look at derivatives metrics recommends a more nuanced image, as the financing rate did not display clear signs of excessive buying demand.The choice to unseal these documents was approved to the United States Securities and Exchange Commission, which had actually accused Binance of non-cooperation regardless of previously concurring to a consent order related to unregistered securities operations and other allegations.BTC futures aggregate open interest, USD (green, left). In any case, 80% of the open interest increase disappeared in less than 24 hours.Futures buyers and sellers are matched at all timesIt can be presumed that many of the demand for leverage was driven by bullish belief, as Bitcoins rate climbed along with the boost in open interest and consequently plummeted as 80% of the agreements were closed. Quite the opposite unfolded on Sept. 19, as Bitcoins open interest expanded to $11.7 billion, while the financing rate plunged to zero.With Bitcoins rate rallying above $27,200 during this second phase of open interest growth, it becomes significantly evident that, regardless of the underlying intentions, the price pressure tends to be upward.

Bitcoins (BTC) open interest on derivatives exchanges experienced a sudden surge of $1 billion on Sept. 18, triggering financiers to question whether whales were collecting in anticipation of the unsealing of Binances court filings.However, a better look at derivatives metrics recommends a more nuanced photo, as the funding rate did not exhibit clear signs of excessive buying demand.The choice to unseal these files was granted to the United States Securities and Exchange Commission, which had implicated Binance of non-cooperation despite previously concurring to a permission order related to unregistered securities operations and other allegations.BTC futures aggregate open interest, USD (green, left). In any case, 80% of the open interest increase disappeared in less than 24 hours.Futures buyers and sellers are matched at all timesIt can be presumed that many of the demand for leverage was driven by bullish belief, as Bitcoins price climbed alongside the boost in open interest and subsequently dropped as 80% of the contracts were closed. Rather the opposite unfolded on Sept. 19, as Bitcoins open interest broadened to $11.7 billion, while the funding rate plunged to zero.With Bitcoins cost rallying above $27,200 throughout this second phase of open interest development, it ends up being progressively obvious that, regardless of the underlying motives, the rate pressure tends to be up.