Costo sells out of gold bars, but is it a better investment than Bitcoin?

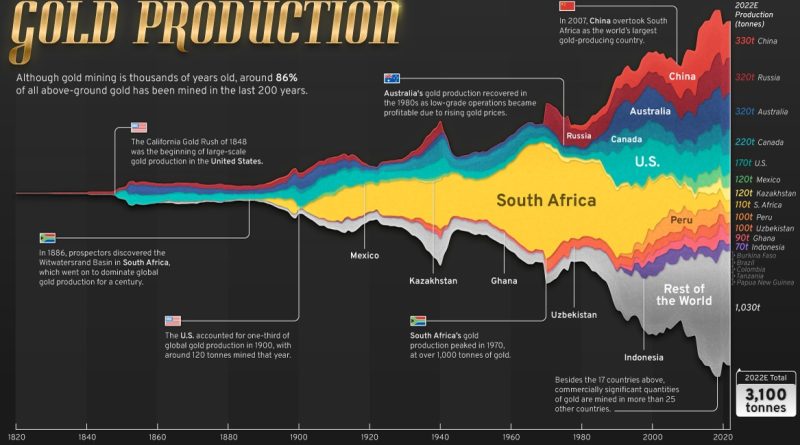

Costco has actually made headings this week after it quickly offered out of gold bars. In times of economic unpredictability and rising inflation, its not a surprise that investors are turning to standard safe-haven possessions like gold. The concern is whether golds performance will eventually catapult its rate above $2,050, a level last seen in early May.In the previous 12 months, the cost of gold has surged by an outstanding 12%. This rally has actually been partly sustained by the Federal Reserves efforts to combat inflation by preserving greater rate of interest, a move that benefits scarce properties like gold. While golds efficiency is good, its important to put it into point of view. Gold (yellow) vs. Bitcoin (orange), S&P 500 (green) and WTI oil (black), last 12 months. Source: TradingViewOver the same period, golds returns have actually roughly matched those of the S&P 500, which saw a gain of 15.4%, and WTI oil, which increased by 12%. Nevertheless, these gains fade in contrast to Bitcoins (BTC) incredible 39.5% rise. Still, its crucial to note that golds lower volatility at 12% makes it an appealing option for investors wanting to handle risk.Risk-reward scenarios prefer goldOne of golds greatest selling points is its dependability as a shop of worth throughout times of crisis and unpredictability. Golds status as the worlds biggest tradable possession, valued at over $12 trillion, places it as the main prospect to gain from capital inflows whenever investors leave conventional markets like stocks and real estate.Gold (yellow) vs. Bitcoin (orange), S&P 500 (green) and WTI oil (black), Feb/Mar 2020. Source: TradingViewFor example, at the height of the COVID-19 pandemic, gold just dipped by 2.2% in the 30 days leading up to March 24, 2020. According to data from the World Gold Council, main banks have been net purchasers of gold for the 2nd consecutive month, including 55 loads to their reserves, with noteworthy purchases by China, Poland and Turkey. Bloomberg reported that Russia plans to reinforce its gold reserves by an additional $433 million to shield its economy from the volatility of product markets, especially in the oil and gas markets.200 years of gold production. Source: Visual CapitalistTaking a closer take a look at production figures, Visual Capitalist approximates that roughly 3,100 tonnes of gold were produced in 2022, with Russia and China accounting for 650 tonnes of this total. The World Gold Council likewise forecasted that if gold prices continue to increase, overall production might reach a record high of 3,300 tonnes in 2023. One crucial metric to think about when examining golds investment capacity is its stock-to-flow ratio, which determines the production of a product relative to the overall quantity around. Related: Bitcoin cost holds consistent as S&P 500 plunges to 110-day lowGolds stock-to-flow has remained steady at around 67 for the previous 12 years. On the other hand, Bitcoin has actually experienced three arranged halvings, efficiently reducing its issuance, and presently boasts a stock-to-flow ratio of 59. This suggests that Bitcoin has a lower comparable inflation rate compared to the precious metal.Bitcoin can surpass gold even with lower inflowsBitcoins performance could surpass golds as the U.S. federal government approaches a shutdown due to reaching the financial obligation limit, causing financiers to seek alternative limited properties. If its inflow is much smaller sized, Bitcoins $500 billion market capitalization makes it easier for the cost to leap even. Furthermore, reserve banks might be compelled to offer their gold holdings to cover costs, even more enhancing Bitcoins appeal.Theres likewise the possibility of new gold discoveries. While gold stays a stalwart on the planet of safe-haven assets, Bitcoins remarkable gains and lower comparable inflation rate make it a strong competitor for investors seeking alternative stores of value. Regardless of this, the continuous financial uncertainty and the Federal Reserves financial policies will continue to benefit both assets.This post is for general info functions and is not intended to be and must not be taken as legal or investment recommendations. The opinions, views, and thoughts expressed here are the authors alone and do not necessarily show or represent the views and viewpoints of Cointelegraph.

The question is whether golds performance will eventually catapult its cost above $2,050, a level last seen in early May.In the previous 12 months, the price of gold has surged by an impressive 12%. Still, its crucial to note that golds lower volatility at 12% makes it an appealing option for investors looking to handle risk.Risk-reward circumstances favor goldOne of golds strongest selling points is its dependability as a shop of value during times of crisis and uncertainty. Bloomberg reported that Russia prepares to bolster its gold reserves by an additional $433 million to protect its economy from the volatility of product markets, particularly in the oil and gas industries.200 years of gold production. Additionally, main banks might be forced to sell their gold holdings to cover costs, even more increasing Bitcoins appeal.Theres also the possibility of new gold discoveries.