Leased proof-of-stake (LPoS), explained

Routine cryptocurrency users have probably come across the term proof-of-stake (PoS) when dealing with crypto staking, however what is rented proof-of-stake (LPoS), and is there a connection in between the two?Yes, they are related, as LPoS is merely a variation of the PoS system. Leases can be canceled at any time.Wait for block generation: Leased funds join a nodes swimming pool, increasing the chance of winning the next-block lottery.Consensus involvement: LPoS lets leasers sign up with the consensus process; larger nodes have much better chances of producing the next block.Generate blocks: Winning nodes confirm transactions, assemble them into blocks, and earn transaction fees as rewards.Share rewards: Node operators distribute rewards to leasers based on their financial investment, with greater stakes leading to more substantial rewards.Please note that the leased tokens never in fact leave the leasers hardware wallet and stay in total control of the tokenholder. The only thing worth noting is that the larger a nodes financial stake, the greater its chances of winning the right to produce the next block.Fixed tokensMining does not add more tokens to LPoS, as the system just enables token leasing.ScalabilityDevelopers of LPoS prioritize high-on-chain scalability over second-tier apps.RewardsOther blockchain systems use block token benefits, however LPoS problems deal fees to reward successful node operators. The immediate the stake verifies LPoS transactions, its age resets to zero.Size of stake: The higher the stake, the better the opportunity of recognition selection.PoS uses passive cryptocurrency deposits rather than the raw computational power in mining hardware used in proof-of-work (PoW) systems, making PoS more resource-efficient than PoW.Currently, two leading blockchains utilize LPoS. LPoS crypto mining alternatives Alternatives to LPoS that utilize PoS include entrusted proof-of-stake, pure proof-of-stake and proof-of-validation.

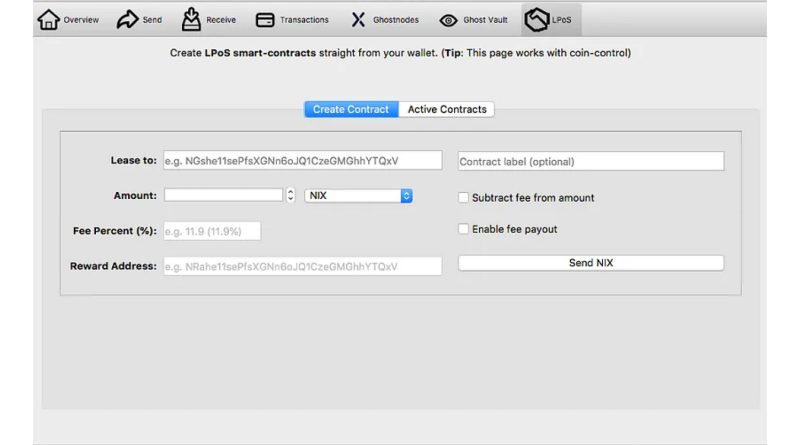

Comprehending rented proof-of-stake LPoS is a type of PoS indicated to increase mining power, address fundamental issues discovered in PoW, and improve other types of PoS, such as delegated proof-of-stake (DPoS). Regular cryptocurrency users have probably come across the term proof-of-stake (PoS) when dealing with crypto staking, but what is leased proof-of-stake (LPoS), and is there a connection between the two?Yes, they are related, as LPoS is simply a version of the PoS system. Proof-of-stake is a crucial element of the blockchain agreement system, where validators take part in staking to verify and generate transaction blocks.Validators on proof-of-stake platforms normally need to stake more cryptocurrency to enhance their opportunities of block generation, and here is where LPoS can be found in helpful. Tokenholders who do not have the technical knowledge or monetary muscle can lease their tokens to validator node operators, enhancing the validators possibility to get the opportunity to produce brand-new blocks. In return, they will make a share of the deal charge paid to the validator.In an LPoS environment, tokenholders can rent their stake or run a full node. However, the more tokens staked by a node, the much better its possibilities of being chosen to produce a brand-new block. LPoS permits users to get the profits of mining without going through the mining process. How rented proof-of-stake works LPoS operates on the same properties as a lotto because more stakes increase somebodys chances of winning rewards.So, how does rented proof of stake work? The LPoS system follows a series of set processes: Create a lease deal: Tokenholders lease coins to a node, defining the quantity and recipient address. Leases can be canceled at any time.Wait for block generation: Leased funds join a nodes pool, increasing the chance of winning the next-block lottery.Consensus involvement: LPoS lets leasers sign up with the consensus procedure; larger nodes have much better chances of producing the next block.Generate blocks: Winning nodes confirm deals, compile them into blocks, and earn transaction fees as rewards.Share benefits: Node operators disperse rewards to leasers based on their financial investment, with greater stakes resulting in more significant rewards.Please note that the leased tokens never ever really leave the leasers hardware wallet and remain in total control of the tokenholder. The holder only links the selected node(s) and doesnt transfer the tokens to the said node.No party can trade or transfer the tokens, consisting of the holder. The holder can just negotiate or invest the allotted coins upon canceling the lease. Secret features of leased proof-of-stake Some of the features of LPoS consist of decentralization, balance leasing, repaired tokens and scalability. The main features of LPoS consist of: Balance leasing Leased tokens do not move to validators, nor can they be traded. Users can rent out their tokens and money from cold storage or wallets.DecentralizedLPoS divides benefits based on the staked amount, getting rid of the need for a mining pool. Its also excellent for blockchain governance, as it utilizes a peer-to-peer protocol to prevent third-party intervention.Unpredictable block generationTheres no chance to anticipate who will win the right to produce the next block. The only thing worth noting is that the bigger a nodes financial stake, the greater its possibilities of winning the right to create the next block.Fixed tokensMining does not add more tokens to LPoS, as the system only enables token leasing.ScalabilityDevelopers of LPoS prioritize high-on-chain scalability over second-tier apps.RewardsOther blockchain systems use block token rewards, however LPoS issues deal costs to reward successful node operators. The function of LPoS in blockchain recognition LPoS is a type of PoS used to validate cryptocurrency transactions in a blockchain network. LPoS utilizes nodes or network devices to confirm and verify blockchain transactions. Node-based recognition uses computational randomness, depended upon the financial stake of a node, to appoint rights to validate blockchain transactions.A PoS agreement algorithm counts on these elements to determine what node is best fit to validate transactions at any provided time: Age of tokens: The longer the staked tokens remain unused on the LPoS platform, the better the possibilities of being selected to verify the next transaction. The immediate the stake confirms LPoS deals, its age resets to zero.Size of stake: The higher the stake, the better the possibility of validation selection.PoS utilizes passive cryptocurrency deposits rather than the raw computational power in mining hardware used in proof-of-work (PoW) systems, making PoS more resource-efficient than PoW.Currently, two leading blockchains utilize LPoS. The very first is the Waves blockchain, which utilizes the LPoS agreement algorithm to verify the blockchains state by permitting users to rent tokens to producing nodes and receive rewards distributed by these nodes. Nix makes use of a permissionless staking mechanism that permits users to stake through a different third-party wallet, with the 3rd celebration responsible for the staking. Advantages of leased proof-of-stake The many advantages of LPoS come from getting rewards without actively trading, increasing your chances of receiving benefits by joining a larger node, and the fundamental security functions hard-baked into the LPoS process.One can realize a number of take advantage of participating in LPoS: Passive investment Users can take part in block generation and receive some rewards without really taking part in the block-generating process.Allows smaller sized financiers to participateLPoS protocols contain a minimum financial investment requirement for network participation. Waves only permits a node to take part in block generation if it has a minimum of 1,000 Waves (WAVES). Financiers with less than this can rent cryptocurrency tokens to more popular nodes for a possibility at acquiring rewards.Difficult to manipulateThe LPoS generating balance guideline computes the most affordable balance after considering renting in the most recent 1,000 blocks, preventing adjustment attempts by moving funds in between accounts.Increases chances of winning rewards The LPoS operates in a method that rewards nodes with the most substantial economic stake in the network. For that reason, renting tokens to a bigger node increases the chances of getting benefits than if the leaser decided to go solo.Retain ownershipNo one can trade or move the leased tokens (which will not even leave the wallet), minimizing the possibilities of loss.Low barrier to entryIt does not need mining hardware to participate in recognition. LPoS crypto mining alternatives Alternatives to LPoS that make use of PoS consist of delegated proof-of-stake, pure proof-of-stake and proof-of-validation. While technically not a method to mine cryptocurrencies, PoS permits users to confirm transactions and create new blocks on a blockchain. LPoS enables users to rent crypto tokens to nodes that confirm LPoS transactions.Several options to LPoS permit users to use the PoS agreement mechanism: Delegated proof-of-stake (DPoS)Users can delegate the production of brand-new blocks to delegates or witnesses through a democratic ballot system, with votes weighted by the number of tokens hung on a platform.Pure proof-of-stake (PPoS) This one is mainly utilized by the Algorand blockchain for the advancement of decentralized applications (DApps). Users can cast their votes to select agents who vote on propositions and propose new blocks.Proof-of-validation (PoV)This intends to attain agreement through staked validator nodes. The variety of tokens staked with each validator figures out the validators voting numbers. When a validator with a minimum of two-thirds of the networks total voting sends a devote vote on a block, that verifies the brand-new block.Hybrid proof-of-stake (HPoS) Some LPoS procedures utilize the power of PoS and PoW. They utilize PoW to produce brand-new block housing transactions and use PoS to validate the blocks.