Tether’s bank partner Britannia sued over $1B deposit: Report

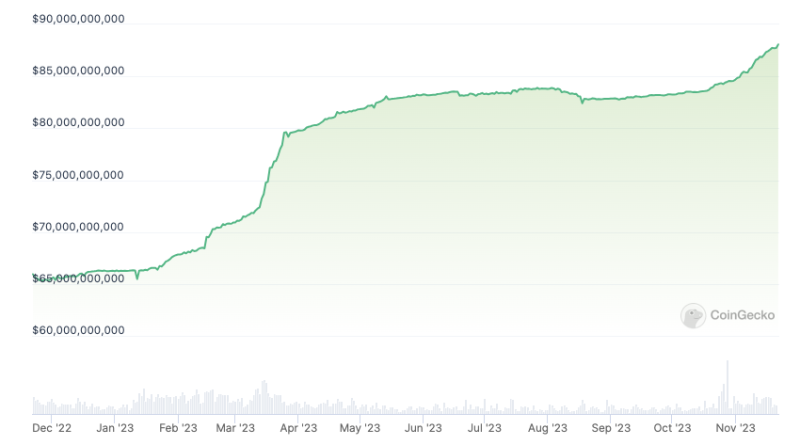

Tethers bank partner Britannia Financial is reportedly facing a suit over claims it failed to pay the complete rate of revenue-generating properties supposedly associated to a big deposit from Tether.Arbitral International, a business registered in the British Virgin Islands, has actually sued Britannia over a $1 billion deposit from Tether, the Financial Times reported on Nov. 21, mentioning court files filed in the High Court of Justice in London in 2023. The claim associates with Britannias acquisition of Arbitrals Bahamas-based brokerage organization referred to as Arbitral Securities. Britannia announced the acquisition in October 2021, integrating the brokerage into its own brokerage, Britannia Securities.According to the new report, Britannia and Arbitral agreed that Britannia Financial would pay an additional amount based on the number of revenue-generating properties the Arbitral Securities held a year after the sale. The contract reportedly stipulated this would consist of the customers originally introduced by Arbitral or associated parties.Citing the court filings, the report stated that Tether opened an account with a subsidiary of Britannia Financial in November 2021. Britannia Financial was apparently presented to Tether by Aldo Mazzella, who is explained as a “expert introducer” and someone thought to have had a business relationship with Tether given that around 2017. On the other hand, Arbitral argued that an executive at Arbitral Securities also played a role in the Britannia-Tether partnership.The news comes a few months after Bloomberg reported that Tether included Britannia Bank and Trust as a Bahamas-based personal bank to procedure dollar transfers on its platform. Other banking partners reportedly consisted of Deltec Bank and Capital Union Bank.Tether chief technology officer and new CEO Paolo Ardoino apparently formerly claimed that the stablecoin firm had strong relations with more than seven banks.Tether and Britannia Financial did not instantly respond to Cointelegraphs demand for comment.Related: Tether freezes $225M in USDT linked to romance scammers in the middle of DOJ investigationTethers (USDT) stablecoin has been gradually getting momentum on the market and inching towards a $90 billion market capitalization, according to data from CoinGecko. On Nov. 20, USDTs worth struck another brand-new high at $88 billion, up 33% since the beginning of 2023. USDT market capitalization since January 2023. Source: CoinGeckoAccording to Tether, USDT added more than $20 billion to its market cap in 2023 due to 2 key elements, consisting of continued market enjoyment around the possible approval of an area Bitcoin exchange-traded fund. Tethers record-breaking growth has also been sustained by growing need in emerging markets like Brazil, according to the firm.Magazine: Exclusive: 2 years after John McAfees death, widow Janice is broke and requires responses