Bitcoin supercycle 2024: Is this the cycle to end them all?

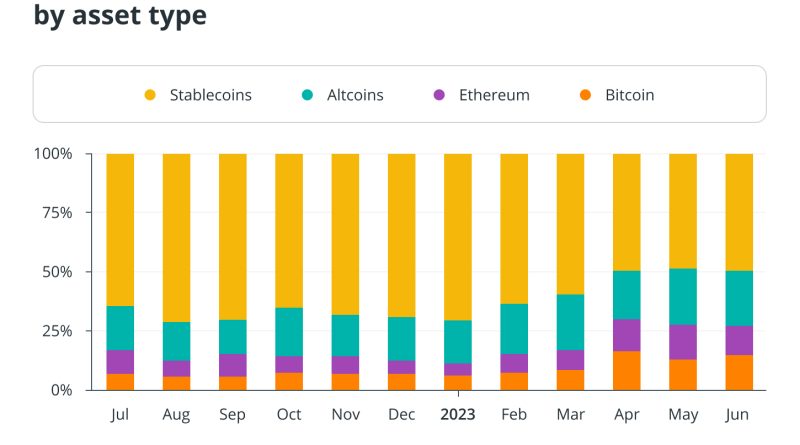

The traditional knowledge of the cryptoverse is that there is a boom-and-bust cycle to the blockchain and cryptocurrency market. This cycle is led by the “King of Cryptos,” Bitcoin. Bitcoin (BTC) is programmatically set to have a halving cycle roughly every four years, which cuts the supply of brand-new coins awarded to miners in half. The halving sends a supply shock to the marketplace, and as seen in the past three cycles, this under- and overvaluation in the market is partly responsible for the significant ups and downs.Other elements likewise play crucial functions in this cycle, consisting of general network adoption, expanded use cases for Bitcoin– like the Lightning Network for scalability and Ordinals for nonfungible tokens– and the ever-popular “institutional adoption.”In 2020, Dan Held, a Bitcoin educator and marketing adviser for Trust Machines, anticipated that Bitcoin would eventually see a “supercycle,” pointing out the increased value of the network as adoption grows (Metcalfes law), increased scarcity due to the halving and increased institutional adoption.This supercycle will, theoretically, see Bitcoin add to new all-time highs, from which there will be no further drawback, as there will be adequate adoption and institutional support to continue to prop up the price.Crypto winter season sets in at the end of 2021This support did not take place in the last cycle, and Bitcoin fell from its all-time high of $69,000 at the end of 2021, bringing the remainder of the market down with it. All those elements of lowered supply, greater network development, and more service and institutional support were insufficient to support the meteoric rise.Institutional support was growing so much during the last leg of the cycle that exchange-traded funds (ETFs) were approved worldwide. The first physically-backed BTC ETF was launched in Canada in February 2021 by Purpose Investments. Considering that then, Canada has also authorized the CI Galaxy Bitcoin ETF and Evolve Bitcoin ETF. In Germany, there is the ETC Group Physical Bitcoin ETF, while Brazil and Australia also released spot Bitcoin ETFs in 2021 and 2022. Yet these items did not provide the institutional support lots of think will originate from ETFs.However, the different stock markets worldwide do not compare to the United States.The European Union makes up 11.1% of worldwide equity markets, while Australia and Canada make up 1.5% and 2.7%, respectively. All these markets integrated are overshadowed by the United States, which makes up 42.5% of all international equity markets. This does lend some weight to the concept that this cycle might hold the pledge of Helds “Bitcoin supercycle,” as the largest country in all global equity markets might quickly permit spot Bitcoin ETFs to trade.BlackRock, among the most popular names in property management and investment circles, requested its own spot Bitcoin ETF in June 2023, supplying a sort of thumbs-up for other intuitions to begin getting involved. Organizations are only one element here. Adoption might be an emerging market pattern According to Chainalysis current “2023 Geography of Cryptocurrency Report,” India, Nigeria and Vietnam were the leading 3 nations for crypto adoption in 2023. The rankings were based on an index rating that took a look at central services, retail services, peer-to-peer (P2P) exchange trade volume, decentralized financing (DeFi) and retail DeFi worth received.The U.S. comprises North Americas biggest percentage of deal volume, and the country ranked 4th total. As the chart listed below shows, North America had the largest portion of large institutional transfers but some of the most affordable quantities of little and large retail. Current: Former Coinbase exec posits blockchain-driven vision of future societiesThis differentiation is crucial, as the marketplace worth of a product is not stemmed from centralized entities but rather from decentralized independent actors perceiving worth in the commodity. As the Chainalysis report and Cointelegraph Researchs recent “Investing in DeFi” report suggest, investing in Bitcoin and other cryptocurrencies belongs to emerging markets investing at this stage in the adoption cycle.Participants, not organizations, bring valueWhile institutional adoption will unquestionably be an essential factor if and when the Bitcoin supercycle takes hold, Bitcoin itself needs to have actually perceived value from market participants, or it will not have the remaining power. History is replete with examples of growing industries that were superseded by a brand-new technology the market discovered handy which toppled giants almost overnight. The intro of petroleum products totally reversed the whaling industry in the mid-1800s. There was a large market and institutions behind worldwide whaling interests with boats, trade and infrastructure. Still, no matter just how much money was behind it, the marketplace saw better usage with the brand-new products.More just recently, and closer to the technological innovation led by the blockchain transformation, the dot-com bubble of the mid-1990s and early 2000s saw numerous companies overvalued. Part of the overvaluation was based on the assumption that adoption would be more quick than what in fact happened.Signals such as the internet browser Netscape seeing 3 million downloads in three months had investors delighted about what the remainder of the market could do.In 1995, Netscape had a successful going public, backed by institutions like Morgan Stanley, which pushed the stock rate from $14 to $28– valuing the not-yet rewarding 16-month-old company at over $1 billion. Investors kept searching for the next Netscape amongst the slew of Silicon Valley business, and money poured into the area. In economics, the very height of the boom cycle, where overvaluation is at its apex just before the bust, is called the “Minsky moment.”The dot-com bubbles Minsky moment can be found in 2002. There was a load of financier sentiment and institutional cash flowing around, but there was no underlying adoption of a lot of the business that saw investments. Absolutely nothing was eventually there to support these business and their value.The Nasdaq Stock Market increased significantly between 1995 and 2000, peaking in March 2000 at 5,048.62 before falling 76.81% to 1,139.90 in October 2002. Without customers and the actual usage of these companies services in the market, there was absolutely nothing to keep the overvaluation afloat.What does this mean for Bitcoin?According to Chainalysis, “Theres no sugarcoating it: Worldwide grassroots crypto adoption is down.” However, as stated previously, lower-middle-income (LMI) countries– like India, Nigeria and Ukraine– have actually seen increased adoption.”LMI is the only classification of countries whose overall grassroots adoption remains above where it was in Q3 2020, prior to the most current booming market,” its report states.While the United States may be fourth in regards to crypto adoption, its not driven by P2P Bitcoin transactions, as the U.S. ranked 12th in that category.Rather, stablecoin trading took the lions share of transactions, with Bitcoin generally trading less than altcoins. Bitcoin is not presently a widespread circulating medium in America. This is not due to Bitcoins lack of perceived value on the market but rather the lack of need for Americans to utilize it for payments.LMI nations are seeing higher adoption due to high inflationary financial problems within their respective nations, and Bitcoin, as much as it varies, can be a much better alternative than holding domestic currency. As the world continues with the pattern of dedollarization, the flight to safety might be Bitcoin. Could this occur in the United States? The three significant credit ranking firms– Standard and Poors (S&P), Moodys Investors Service, and Fitch Ratings– have all downgraded the U.S. credit score. In August 2011, S&P reduced the U.S. credit score from AAA to AA+. Fitch did the same in August 2023. And on Nov. 10, 2023, Moodys reduced its outlook on the U.S. credit score from “steady” to “negative,” pointing out growing deficits and decreased ability to pay back the national debt.The drops in credit ratings signal reducing confidence in the U.S. and, by extension, the standing of the U.S. dollar being the central system of account for worldwide settlement.If run-away inflation starts to rear its head in the U.S., it is possible that options will be utilized rather of keeping cash.Chances are its incredibly early in this cycleWhile Held introduced the idea of a Bitcoin supercycle, he has often stated that people are still early in terms of entering into stacking sats. While increased institutional adoption might offer Bitcoin a rise in fiat worth and higher paths for investment, all the following components need to remain in play for the supercycle to be in full swing: Institutional need: Assuming BlockRock and the other financial powerhouses are granted area Bitcoin ETFs in the U.S., the quantity of financial investment from institutions, household offices, sovereign wealth funds and high-net-worth people might offer Bitcoin assistance in raising the fiat worth to a particular level. Galaxy Digital, for example, anticipates this will bring Bitcoin up to around the $59,000 level.Supply: The next Bitcoin halving event will occur around April 2024 at block height 840,000, and 96.9% of all the existing BTC will have been mined. This indicates the supply part of the supercycle equation is examined. Even if grassroots require stays the very same, this would indicate a higher fiat rate. Still, as was seen in previous cycles, a price increase (“number-go-up” technology) will likely increase demand, at least in the short-term, due to fear of missing out on out.Adoption: While some might purchase Bitcoin for “number-go-up” reasons, its real use will give it a long-term worth proposal. It is yet unknown whether Americas financial and sociopolitical environment will nudge people to embrace Bitcoin as a legal tender, a store of wealth or a hedge versus further dollar inflationary pressure.What are the probabilities of a 2024 Bitcoin supercycle?Cointelegraph asked billionaire endeavor capitalist and serial blockchain investor Tim Draper what he thought the possibilities were for a 2024 Bitcoin supercycle. According to him, “I think it will be the following cycle, when we can run our businesses unimpeded by regulatory uncertainty, where we can purchase our food, clothing, shelter and taxes all in Bitcoin.”Julian Liniger, CEO of Bitcoin-only exchange Relai, informed Cointelegraph that the marketplace “will see an extreme reduction in supply due to the upcoming halving, while Bitcoin ETFs and the typically increasing interest in the property Bitcoin imply a substantially greater demand.”Liniger added that aspects like a loss of confidence in fiat currencies, increased banking oversight and the collapse of exchanges like FTX “strengthen the Bitcoin story.”Magazine: This is your brain on crypto: Substance abuse grows among crypto traders”With BlackRock and other major gamers on board, I likewise think its not unlikely that we will see an extreme 180-degree turn in the public understanding of Bitcoin. Instead of a speculative asset that takes in as much electrical power as entire countries, Bitcoin could quickly be seen as a safe house promoting the shift to renewable energies,” he said.Bitget CEO Gracy Chen told Cointelegraph that, inorder for the supercycle to happen, “The market requires adequate funds to counter negative beliefs. Re-establishing easy gain access to channels between conventional finance and the crypto market, especially after the suppression of 3 crypto-friendly banks. Secondly, global governments, including the U.S., need to officially recognize Bitcoin properties as equal to gold and stocks. This includes eliminating constraints on the trading and holding of Bitcoin for the public. Such integration with traditional finance supplies the structure for widespread Bitcoin adoption and creates beneficial conditions for the Bitcoin Superycle to materialize.”The Bitcoin supercycle is most likely not upon the world for this continued adoption cycle. There is simply too much speculation over adoption and everyday use occurring globally for the possession to have no or just a soft correction to cushion the fall as soon as the Minsky minute pops the bubble. 2028, on the other hand, may be a different story altogether.This post does not contain investment advice or suggestions. Every financial investment and trading move includes threat, and readers need to perform their own research study when making a choice.

“In 2020, Dan Held, a Bitcoin teacher and marketing advisor for Trust Machines, predicted that Bitcoin would ultimately see a “supercycle,” citing the increased worth of the network as adoption grows (Metcalfes law), increased deficiency due to the halving and increased institutional adoption.This supercycle will, in theory, see Bitcoin run up to brand-new all-time highs, from which there will be no further downside, as there will be adequate adoption and institutional support to continue to prop up the price.Crypto winter sets in at the end of 2021This assistance did not occur in the last cycle, and Bitcoin fell from its all-time high of $69,000 at the end of 2021, bringing the rest of the market down with it. Since then, Canada has actually also authorized the CI Galaxy Bitcoin ETF and Evolve Bitcoin ETF. As the Chainalysis report and Cointelegraph Researchs current “Investing in DeFi” report recommend, investing in Bitcoin and other cryptocurrencies is similar to emerging markets investing at this stage in the adoption cycle.Participants, not organizations, bring valueWhile institutional adoption will certainly be an important factor if and when the Bitcoin supercycle takes hold, Bitcoin itself requires to have perceived value from market participants, or it will not have the staying power. While increased institutional adoption might give Bitcoin a rise in fiat value and higher paths for investment, all the following elements must be in play for the supercycle to be in full swing: Institutional need: Assuming BlockRock and the other financial powerhouses are given spot Bitcoin ETFs in the U.S., the amount of investment from organizations, household workplaces, sovereign wealth funds and high-net-worth people could give Bitcoin support in raising the fiat value to a specific level. It is yet unidentified whether Americas sociopolitical and financial environment will nudge people to adopt Bitcoin as a medium of exchange, a shop of wealth or a hedge versus additional dollar inflationary pressure.What are the likelihoods of a 2024 Bitcoin supercycle?Cointelegraph asked billionaire venture capitalist and serial blockchain investor Tim Draper what he believed the possibilities were for a 2024 Bitcoin supercycle.