FTX collapse, Binance’s US settlement provide strong case for MiCA regulations

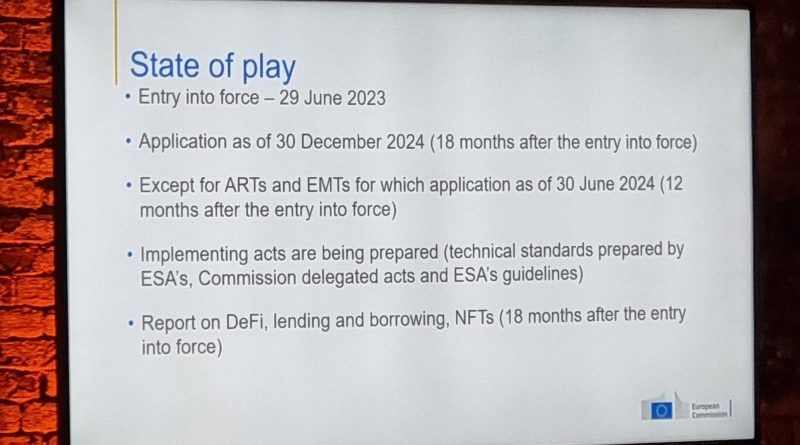

The collapse of FTX in 2022 and Binances recent $4.3-billion settlement with United States authorities provide a strong argument for the provisions of the European Unions Markets in Crypto-Assets (MiCA) legislation, a European Commission official said in an interview.Ivan Keller, policy officer for the European Commission, spoke to Cointelegraph at the MoneyLIVE conference in Amsterdam.” The policy officer also offered an upgraded view of the course towards MiCAs full application across the European Union. Hailed as one of the first extensive cryptocurrency legal frameworks worldwide, the guidelines set out by MiCA will use to all EU member states.Keller stressed that MiCAs goal is to promote innovation while resolving the risks to customers, market stability, financial stability and financial sovereignty.

The collapse of FTX in 2022 and Binances current $4.3-billion settlement with United States authorities supply a strong argument for the arrangements of the European Unions Markets in Crypto-Assets (MiCA) legislation, a European Commission authorities said in an interview.Ivan Keller, policy officer for the European Commission, spoke to Cointelegraph at the MoneyLIVE conference in Amsterdam.” The policy officer likewise gave an updated view of the path toward MiCAs complete application across the European Union. Hailed as one of the very first comprehensive cryptocurrency legal frameworks globally, the guidelines set out by MiCA will apply to all EU member states.Keller stressed that MiCAs objective is to promote development while attending to the threats to customers, market stability, financial stability and financial sovereignty.