Milei vowed to close Argentina’s central bank — But will he do it?

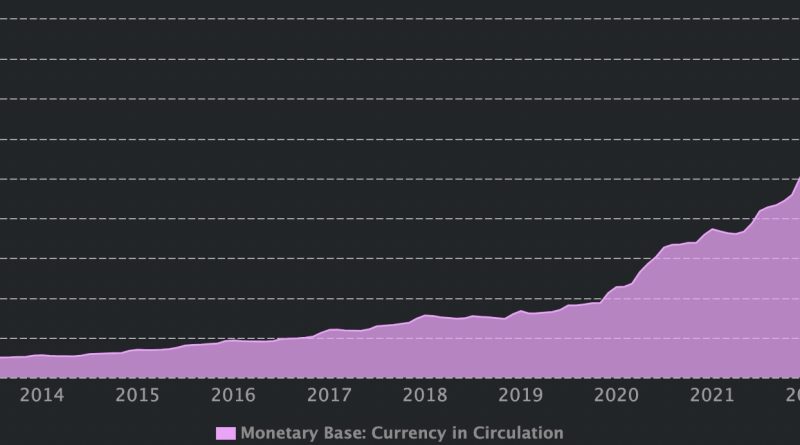

We also have Argentinas monetary base. According to the countys latest balance sheet, that figure stands at $7.7 billion. (Thats 220,000 Bitcoin, for those keeping track, and simply a little more than MicroStrategys $6.9 billion assessment.) For comparison, the U.S. monetary base is higher than $5 trillion.That figure suggests the difficulty of replacing the financial base will be terrific, but not insurmountable. One of the difficulties of exchanging currency is getting paper currency for daily activities, however we in the crypto world understand that both stablecoins and Bitcoin can help a lot in this process.It would make sense if Milei uses the plan established by El Salvador. That would indicate first adopting the U.S. dollar, and to subsequently begin accepting Bitcoin.Argentinas financial base, 2014-2023. Source: CEICData.com and The Central Bank of ArgentinaA currency typically requires “legal tender” status, which means that all facilities in the nation are needed to accept it. Milei may set up a major policy modification in this regard. If he is truly a liberal (the classical term for “libertarian”), he may enable the marketplace to choose which currencies succeed.Related: History tells us were in for a strong bull market with a tough landingIt is popular that Argentines keep a large quantity of savings in dollars outside of their nation. The numbers doubt, however it could be in the variety of S100 billion to $300 billion. What is truly important is that, under the new exchange-rate guidelines of this brand-new government, that cash might feel comfortable returning to the country.Meet Argentinas new president Javier Milei.When he was growing up, kids called him “The Madman” due to the fact that of his energetic outbursts.At the age of 18, Milei, who was a soccer player, offered up the sport to pursue a career in economics.Milei began getting popular for disputes … pic.twitter.com/fK31aNFb5Q— Collin Rugg (@CollinRugg) November 20, 2023

Argentina– even during the Menem duration of the 1990s– did not have a fully convertible currency. So the very first thing the future federal government is likely to do is unify all currency exchange rate and decree the currencys free convertibility. If it doesnt do that, we must start to get worried.As a last observation, its important to note that the main bank and the treasury are 2 totally various entities. It is possible for a nation to work without a main bank, but its more difficult not to have a treasury that controls inflows (via taxes) and outputs (through public spending). Treasuries are also the companies of federal government bonds. While a country can release bonds in foreign, it does not control the currency printer. That increases the risk of not having the currency to pay for the bonds. That suggests a countrys financial obligation capacity decreases, requiring it to deal with a much lower level of utilize and an earnings and expense policy suitable with that reality.Notably, that likewise requires a country to be incredibly effective with its fiscal policies. That result is most likely at the root of Mileis proposal.Alexandre Vasarhelyi is a partner at BLP Gestora accountable for managing cryptocurrency funds. He ended up being involved with digital properties at the beginning of 2017, after more than 23 years in the standard monetary sector, where he dealt with exclusive trading desks including Banco Indosuez, Credit Suisse, Deustche Asset Management, ING Bank and Banco Pine. He has operated repaired and variable earnings assets, currencies, alternatives, and commodities in international and regional markets. He holds a degree in Production Engineering from Escola Politécnica of the University of São Paulo, a postgraduate degree from Rio de Janeiros Fundação Getulio Vargas (FGV), and an MBA from the Brazilian Institute of Capital Markets.This short article is for general details functions and is not meant to be and should not be taken as legal or investment recommendations. The views, opinions, and ideas revealed here are the authors alone and do not necessarily reflect or represent the views and viewpoints of Cointelegraph.

The image of a presidential candidate damaging a design of the main bank with a sledgehammer will not leave Argentines memories for a long time. Lets begin by recognizing that it is not impossible for a nation to live without a main bank. It likes central banks, and aArgentinas main creditor, its viewpoint will be really crucial in the process.In a recent campaign ad, Javier Milei appears receiving the clothes of Capitan Ancap, his superhero equivalent, and destroying the argentine Central Bank with Thors Hammer. Source: CEICData.com and The Central Bank of ArgentinaA currency usually needs “legal tender” status, which implies that all facilities in the nation are needed to accept it. It is possible for a country to work without a main bank, but its more difficult not to have a treasury that manages inflows (by means of taxes) and outputs (via public spending).

The image of a presidential prospect damaging a design of the main bank with a sledgehammer will not leave Argentines memories for a long time. Lets begin by acknowledging that it is not impossible for a country to live without a main bank. It likes central banks, and aArgentinas main lender, its opinion will be extremely crucial in the process.In a recent campaign advertisement, Javier Milei appears getting the clothes of Capitan Ancap, his superhero counterpart, and damaging the argentine Central Bank with Thors Hammer.