BTC price eyes $40K amid record hash rate — 5 things to know in Bitcoin this week

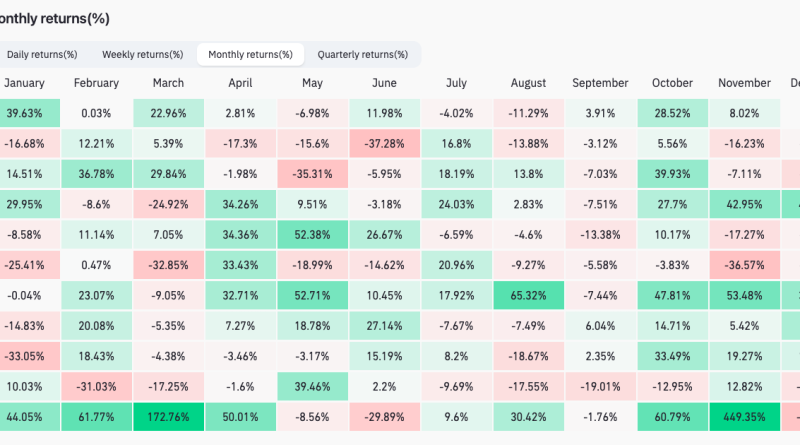

” Bitcoin order book data for Binance. Source: Skew/XWith the month-to-month close just days away, Bitcoin is currently up 7.8% month-to-date, making November 2023 completely average compared to years gone by.Data from monitoring resource CoinGlass shows that November is typically characterized by much stronger BTC rate moves, and that these can be both up and down.Q4 in general, meanwhile, has actually so far provided gains of almost 40%. Source: CoinGlassKey Fed inflation markers lead macro catalystsA classic macro week with volatility activates to match awaits Bitcoin traders as November draws to a close.The United States Federal Reserve will receive some key information on inflation over the coming days, this feeding into next months choice on interest rate policy.Fed Chair Jerome Powell will speak on Dec. 1, following comments from senior Fed authorities throughout the week.The information releases of the most interest to markets will likely be Q3 GDP and Personal Consumption Expenditures (PCE) print for October, coming Nov. 29 and Nov. 30, respectively.Previously, U.S. macro information began to reveal inflation abating more quickly than markets expected, leading to positive reevaluations amongst risk assets.Key Events This Week:1. Source: CME GroupGBTC eyes BTC rate parityWhile Bitcoin is still waiting for U.S. regulators to greenlight the nations very first spot price exchange-traded fund (ETF), markets show that the state of mind continues to palpably alter for the better.Nowhere is this more apparent than in the largest Bitcoin instuttional investment vehicle, the Grayscale Bitcoin Trust (GBTC). “And in the case ARK is rejected and the rest held off yet again, the real make-or-break deadline is 15 March 2024– where Blackrock and the primary bunch of candidates face their own last deadline,” it added.Bitcoin hash rate passes 500 exahash watershedIn advance of the upcoming block aid cutting in half in April 2024, Bitcoin miners are deploying record processing power to the network.Hash rate– the estimated procedure of this implementation– is now at its greatest levels ever, and this month passed 500 exahashes per second (EH/s) for the very first time.Bitcoin hash rate raw information (screenshot).

” Bitcoin order book information for Binance. Source: Skew/XWith the month-to-month close just days away, Bitcoin is currently up 7.8% month-to-date, making November 2023 thoroughly typical compared to years gone by.Data from monitoring resource CoinGlass reveals that November is typically characterized by much stronger BTC price relocations, and that these can be both up and down.Q4 overall, meanwhile, has actually so far delivered gains of almost 40%. Source: CoinGlassKey Fed inflation markers lead macro catalystsA timeless macro week with volatility sets off to match awaits Bitcoin traders as November draws to a close.The United States Federal Reserve will receive some crucial data on inflation over the coming days, this feeding into next months decision on interest rate policy.Fed Chair Jerome Powell will speak on Dec. 1, following comments from senior Fed officials throughout the week.The information releases of the most interest to markets will likely be Q3 GDP and Personal Consumption Expenditures (PCE) print for October, coming Nov. 29 and Nov. 30, respectively.Previously, U.S. macro information started to reveal inflation abating more rapidly than markets anticipated, leading to positive reevaluations among risk assets.Key Events This Week:1.

“Full trading week ahead and volatility is here to remain,” financial commentary resource The Kobeissi Letter summarized on X.Data from CME Groups FedWatch Tool presently puts the odds of the Fed holding rates at present levels at a practically consentaneous 99.5%. Fed target rate possibilities chart. Source: CME GroupGBTC eyes BTC cost parityWhile Bitcoin is still awaiting U.S. regulators to greenlight the countrys first spot price exchange-traded fund (ETF), markets reveal that the mood continues to palpably alter for the better.Nowhere is this more apparent than in the biggest Bitcoin instuttional financial investment vehicle, the Grayscale Bitcoin Trust (GBTC). Itself due to be transformed to a spot ETF, GBTC is quick approaching parity with its hidden asset set, BTC/USD. When almost 50% lower, the GBTC share cost had a mere 8% discount rate to net asset value, or NAV, since Nov. 24, per CoinGlass data.GBTC premium vs. possession holdings vs. BTC/USD chart (screenshot). Source: CoinGlassThe funds renaissance has actually formed a crucial narrative over both a successful ETF consent to come and the introduction of genuine mass institutional interest in Bitcoin for the very first time.”Looks like the mkt is truly anticipating this ETF approval quickly,” William Clemente, co-founder of crypto research study firm Reflexivity, responded to the data at the weekend.In regards to the watershed moment striking, nevertheless, dates of note now all come after the new year. In its newest market update sent out to Telegram channel subscribers, trading company QCP Capital argued that Jan. 3, 2024 would be a timely approval date, this coinciding with the 15th anniversary of the Bitcoin genesis block.Thereafter, Jan. 10 marks an interim due date for the very first area ETF in line, that of ARK Invest, as “the final deadline for ARKs application is consisted of in the first approval batch.” “And in the case ARK is rejected and the rest delayed yet again, the real make-or-break due date is 15 March 2024– where Blackrock and the primary lot of candidates face their own last due date,” it added.Bitcoin hash rate passes 500 exahash watershedIn advance of the upcoming block subsidy halving in April 2024, Bitcoin miners are deploying record processing power to the network.Hash rate– the approximated procedure of this implementation– is now at its highest levels ever, and this month passed 500 exahashes per second (EH/s) for the very first time.Bitcoin hash rate raw data (screenshot). Source: MiningPoolStatsThe achievement not just represents a psychological landmark, however highlights miners conviction to future profitability– even when BTC cost performance still stays 50% listed below its own peak.At the exact same time, outflows from known miner wallets to exchanges are at their most affordable levels in seven years, per information from on-chain analytics platform CryptoQuant.”The flow of movement from Bitcoin miner wallets to exchange wallets eventually represents the activity of these entities in the open market,” contributing expert Caue Oliveira wrote in among its Quicktake market updates.”The entry of coins into exchanges increases the liquidity of BTC on these platforms, providing extra selling pressure in the market.”Bitcoin miner exchange streams chart. Source: CryptoQuantOliveira kept in mind that miners are always offering some portion of their holdings, but the current 90 BTC regular monthly average is the lowest considering that 2017. Bitcoin exchange balances resume downtrendAfter a month of chaos brought on by withdrawal shut-offs and legal action against some of the greatest crypto exchanges, BTC balances are trending down when again.Related: Bitcoin to $1M post-ETF approval? BTC cost predictions diverge wildlyIn line with the broader trend in location for five years, exchanges stocks of BTC are wandering ever lower.According to the most recent information from on-chain analytics firm Glassnode, the combined holdings of the significant exchanges totaled 2.332 million BTC as of Nov. 26. With the exception of current lows in October, this is the smallest amount of offered BTC since April 2018. At its peak in March 2020, just after the COVID-19 cross-market crash, the tally stood at 3.321 million BTC.Bitcoin exchange balance chart. Source: GlassnodeThe picture was complicated in November thanks to traders reactions to Binance getting a record $4.3 billion U.S. fine, along with Poloniex and HTX halting withdrawals altogether after a hack.This short article does not consist of investment recommendations or recommendations. Every investment and trading relocation involves danger, and readers need to perform their own research when making a choice.