11th anniversary of Bitcoin’s first halving: from $12 to $37,000

The very first Bitcoin transaction happened almost 15 years ago on Jan. 3, 2009, a few months after the pseudonymous developer of Bitcoin, Satoshi Nakamoto, released the Bitcoin white paper in October 2008. The most current Bitcoin halving took place in 2020, cutting the block subsidy from 12.5 BTC to 6.25 BTC.As Bitcoin halvings substantially increase the cryptocurrencys deficiency, the Bitcoin cost cycle has actually been historically affected by halvings. Many Bitcoin advocates are especially bullish on the Bitcoin rate in 2024 amid growing expectations that United States securities regulators could finally authorize an area Bitcoin exchange-traded fund.The 2024 cutting in half will not be the last one.

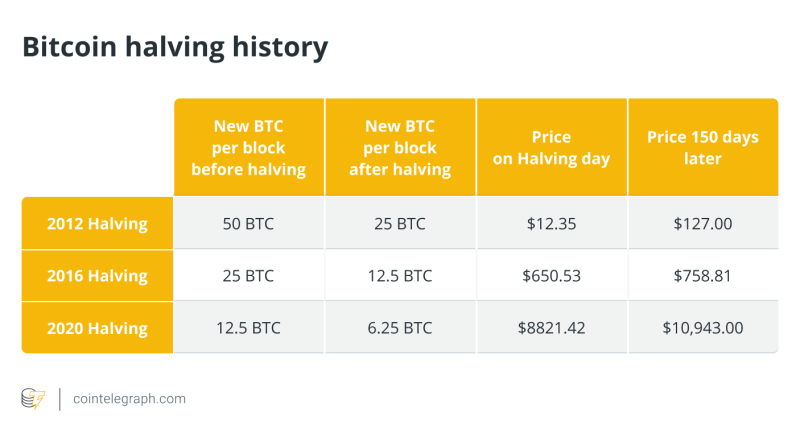

Bitcoin (BTC), the biggest cryptocurrency by market value, experienced its first-ever halving 11 years ago today. As the community commemorates the anniversary of the first Bitcoin halving, its timely to revisit some of Bitcoins historical turning points ahead of the next halving expected in April 2024. The first Bitcoin deal took place nearly 15 years back on Jan. 3, 2009, a couple of months after the pseudonymous developer of Bitcoin, Satoshi Nakamoto, published the Bitcoin white paper in October 2008. On Nov. 28, 2012, or three years and ten months after Bitcoins initial block was mined, the first-ever halving occasion took place. At the time, BTC traded at just around $12, according to data from StatMuse, or 308,200% below Bitcoins current price, according to information from CoinGecko.Though Bitcoins halving and the digital currencys 21 million supply cap are not directly explained in Nakamotos white paper, the file still means particular mechanisms to manage the development of new BTC. The white paper checks out:” To compensate for increasing hardware speed and differing interest in running nodes over time, the proof-of-work trouble is identified by a moving typical targeting a typical number of blocks per hour. If theyre produced too quick, the problem boosts.” Unlike some fundamental information in the BTC white paper, the halving element is discussed in the Bitcoin source code. The halving is specifically available on the Bitcoin Core GitHub repository on the validation.cpp file indicates that the miners block aid is “halved every 210,000 blocks, which will take place every 4 years.” A Bitcoin halving-related snippet from the Bitcoin Core repository. Source: GitHubThe Bitcoin cutting in half mechanism had actually been configured into the BTC mining algorithm to neutralize inflation by keeping scarcity.Before the very first halving occurred, miners were compensated with as much as 50 BTC per block. After the first halving occasion in 2012, the aid was slashed to 25 BTC, followed by the second halving in 2016, which minimized the subsidy to 12.5 BTC. The most recent Bitcoin halving took place in 2020, cutting the block aid from 12.5 BTC to 6.25 BTC.As Bitcoin halvings significantly increase the cryptocurrencys deficiency, the Bitcoin price cycle has actually been historically impacted by halvings. Just a year after its first-ever halving, Bitcoin had actually risen to nearly $1,000, while the second halving set off a 350% rise throughout the year after the event, with BTC consequently rallying to all-time highs of almost $20,000 in December 2017. Related: Crypto community starts Bitcoin halving countdown as milestone date nearsIn the aftermath of the 3rd Bitcoin halving, BTC rose as high as $69,000 in November 2021. The anniversary of the very first Bitcoin halving comes as the cryptocurrency community waits for the 4th Bitcoin halving, which is now anticipated to occur on April 17, 2024. Numerous Bitcoin advocates are specifically bullish on the Bitcoin rate in 2024 in the middle of growing expectations that United States securities regulators might lastly authorize an area Bitcoin exchange-traded fund.The 2024 cutting in half will not be the last one, though. Bitcoin miner reward is anticipated to be halved 34 times till it reaches 0 BTC after all 21 million Bitcoins are mined. Based upon the existing schedule, the optimum supply of 21 million bitcoins will be reached around 2140. Magazine: 5,050 Bitcoin for $5 in 2009: Helsinkis claim to crypto popularity