Bitcoin metric that ‘looks into future’ eyes $48K BTC price around ETF

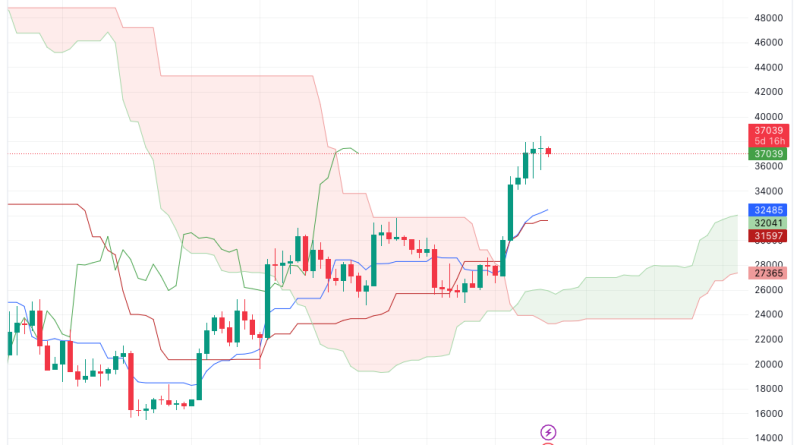

Bitcoin (BTC) may travel to almost $50,000 as the United States okays the very first spot price exchange-traded fund (ETF). As flagged by popular expert CryptoCon, the Ichimoku Cloud indication is counting down to upside BTC price continuation.Analysis: $43,000 BTC rate is “most conservative level”Bitcoin is in an unusual position on weekly timeframes when it comes to Ichimoku Cloud signals.As Cointelegraph reported, the indicator, which combines past, present and future trading hints, recommends that the BTC rate gains have only just begun.In a post on X (formerly Twitter) on Nov. 27, CryptoCon had the ability to provide a particular target for what could occur next.Ichimokus leading spans have actually crossed, causing the development of a new advantage cloud. With the delayed period, Chikou, breaking out of resistance, cost should now rationally head greater.”The Weekly Ichimoku cloud called our last Bitcoin increase to 38k 2 months ahead of time with the cross forecasted in the future,” he composed. “Now we wait for it to fill its next calls, the completion of our increase and the very first target of 43k. This has actually taken anywhere from 7 to 11 weeks from the cross, approximately 10 weeks means our move finishes in early January.”Bitcoin Ichimoku Cloud annotated chart. Source: CryptoCon/XCryptoCon included that $43,200 remained in reality the “most conservative level,” which $48,000 was a suitable ceiling.He concluded:”Even with some time out in between, the indicator that looks into the future states we are refrained from doing!”BTC/USD 1-week chart with Ichimoku Cloud features highlighted. Source: TradingViewBitcoin traded at $37,000 at the time of writing on Nov. 28, per information from Cointelegraph Markets Pro and TradingView.A match made in heaven?Ichimokus timing is probably as fascinating as its targets.Related: $48K is now affordable BTC price target– DecenTraders FilbfilbShould traditional timing play out, based upon previous bull markets, the $48,000 move ought to come in early January– corresponding with the anticipated ETF approval date.Little is understood about what U.S. regulators have in shop, or which specific ETF products, if any, will get the thumbs-up first.In the meantime, the Securities and Exchange Commission (SEC), in charge of the ETFs coming to market, continues to push crypto sentiment with enforcement actions against Binance, the worlds biggest exchange.A $4.3 billion fine and the elimination of Changpeng Zhao, called “CZ,” as CEO has on the other hand benefited the shares of rival exchange Coinbase, these up over 250% year-to-date. This post does not consist of investment guidance or suggestions. Every financial investment and trading relocation involves risk, and readers need to conduct their own research when making a choice.