BIS advises central banks to plan in advance for CBDC security

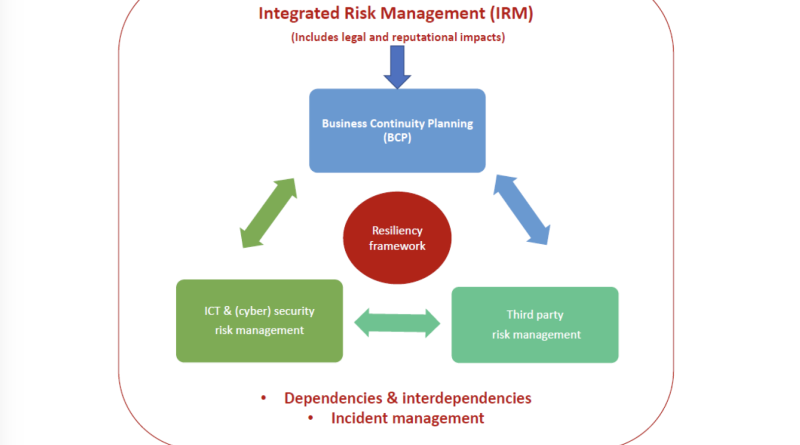

Issuance of a central bank digital currency (CBDC) needs appropriate attention to security, the Bank for International Settlements (BIS) reminded main lenders in a report on Nov. 29. An incorporated risk-management framework ought to be in location beginning at the research study stage, and security should be designed into a CBDC, the report said.Risks associated with CBDCs will vary throughout nations, as conditions and objectives differ, and they will alter across time, requiring consistent management. Related: Security audits not enough as losses reach $1.5 B in 2023, security expert saysThe research study suggests an integrated threat management structure to reduce CBDC risks.Proposed CBDC strength structure. The Eastern Caribbean Central Banks DCash, a live CBDC, suffered a two-month outage in early 2022 due to an ended certificate in the software.

Issuance of a central bank digital currency (CBDC) requires sufficient attention to security, the Bank for International Settlements (BIS) advised central bankers in a report on Nov. 29. An incorporated risk-management framework must be in location beginning at the research stage, and security ought to be developed into a CBDC, the report said.Risks associated with CBDCs will differ across countries, as conditions and objectives vary, and they will change across time, requiring continuous management. Related: Security audits not enough as losses reach $1.5 B in 2023, security expert saysThe research study recommends an integrated danger management framework to reduce CBDC risks.Proposed CBDC resilience framework.

On the other hand, the DCash pilot project had actually been considerably expanded the previous year to offer assistance in Saint Vincent and the Grenadines after a volcanic eruption there, enhancing the currencys durability, the research study advised. Magazine: HTX hacked again for $30M, 100K Koreans test CBDC, Binance 2.0: Asia Express