Tether’s ‘new era for capital raises’ Bitfinex bond flops

The Bitfinex tokenized bond was issued on the Liquid Network, a high throughput Bitcoin sidechain. Cointelegraph reached out to Bitfinex and Tether for remark however did not receive an instant reaction. Related: Tether, Bitfinex concur to drop opposition to FOIL requestIn April, Bitfinex Securities received a Digital Asset Service Provider license in El Salvador, which has actually been checking out releasing its own Bitcoin bonds.Sovereign dollar bonds in the Central American nation have actually been performing solidly, with a 70% return in 2023 as reported by Cointelegraph in August. Publication: Can you trust crypto exchanges after the collapse of FTX?

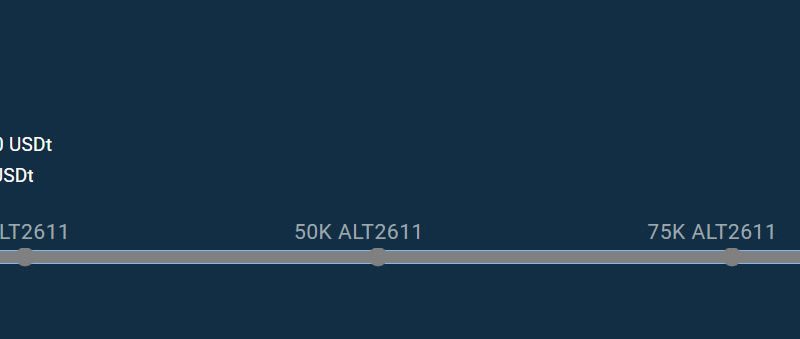

Bitfinexs recently introduced Tether (USDT) tokenized bond, hailed as a “brand-new age for capital raises,” appears to have actually failed to amass the financial investment and interest the firm anticipated.Bitfinex Securities, a platform concentrated on listing tokenized real-world assets (RWA), announced its very first tokenized bond in October, called ALT2611 Tokenized Bond, with the product going reside on Nov. 15. Nevertheless, after a two-week offer period, just $1.5 countless a $10 million target has been raised, according to the official website. The target of 100,000 ALT2611 worth 10 million USDT was set for two weeks after launch in the statement, however it appears to have been extended by another fortnight as simply 15,000 ALT2611, or 15% of the target has actually been reached so far.Screenshot from ALT2611 capital raise. Source: BitfinexALT2611 is a 36-month 10% voucher bond denominated in USDT and issued by Alternative, a Luxembourg-based securitization fund, handled by Mikro Kapital. Tokenized bonds are digital representations of standard bonds issued on the blockchain, which provides several benefits over their traditional paper equivalents, such as liquidity, accessibility, security, transparency, and 24/7 trading. The minimum initial purchase size was 125,000 USDT, with secondary market trading in denominations of 100 USDT. ALT2611 is not provided or made available to American people or individuals present in the U.S. Crypto trader Novacula Occami commented, “Bitfinexs very first USDT bond concern is a flop,” before including, “Sorry Paolo, USDT aint going to control capital markets. BitFinex Securities Kazakhstan isnt keeping investment lenders up during the night.” However, when it introduced, Tether primary innovation officer Paolo Ardoino labeled it as a “new age for capital raises” that would see USDT become the “hidden denomination property of this brand-new monetary system.” Exciting!This is the very first bond noted on Bitfinex Securities. A brand-new era for capital raises through deep liquid markets and stock/fond markets has begun.Furthermore $USDt will end up being the underlying denomination property of this brand-new financial ecosystem.And yes. It leverages … https://t.co/ekXj3gY7Xj— Paolo Ardoino (@paoloardoino) October 25, 2023

Bitfinexs recently introduced Tether (USDT) tokenized bond, hailed as a “new period for capital raises,” appears to have actually stopped working to garner the financial investment and interest the company anticipated.Bitfinex Securities, a platform focused on listing tokenized real-world properties (RWA), announced its very first tokenized bond in October, called ALT2611 Tokenized Bond, with the product going live on Nov. 15. The minimum preliminary purchase size was 125,000 USDT, with secondary market trading in denominations of 100 USDT. ALT2611 is not provided or made readily available to American people or individuals present in the U.S. Crypto trader Novacula Occami commented, “Bitfinexs first USDT bond problem is a flop,” before including, “Sorry Paolo, USDT aint going to control capital markets.