Pension funds could use AI to cut costs, increase returns, says report

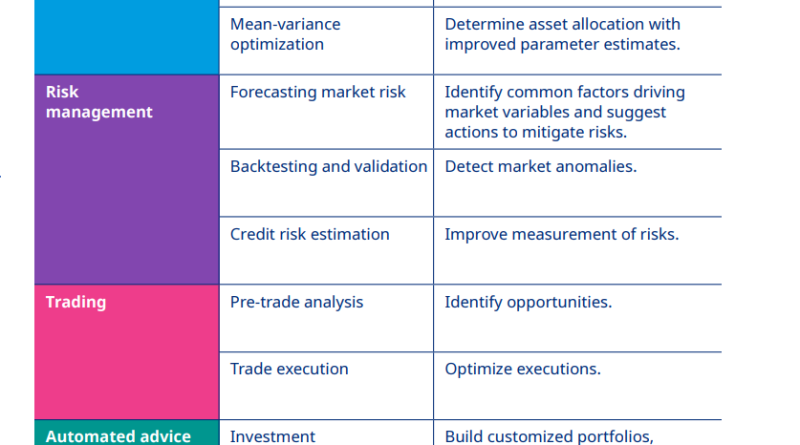

Artificial intelligence might be utilized by pension funds to cut costs, increase investment returns and highlight possible dangers, however there are still “considerable obstacles to overcome” with its use, states the Mercer CFA Institute global pension report.On Oct. 17, the annual joint report from the consulting firm and investment professional association significant AI as helpful for helping pension fund supervisors trawl through mass quantities of data that could build and highlight opportunities customized financial investment portfolios.” Natural language AI tools could also be used by pension funds to analyze their members– scraping data from emails and calls so the fund can customize its marketing and outreach efforts based on how each individual communicates.AI-assisted analysis is promoted to recognize patterns and find market belief and signals to recommend non-traditional future investment chances. The innovation is likewise anticipated to make it possible for automation of middle and back office environments, decreasing costs that can narrow differentials in between passive and active financial investment strategies.A summary of the use of AI in financial investment management.

Related Content

- Decentralized sensors to combat noise pollution hit the blockchain

- PayPal’s PYUSD struggles with early adoption — Nansen

- Sam Bankman-Fried’s temporary release request denied as trial date looms

- Crypto Demystified: A Beginner’s Guide to Understanding Digital Currency

- Researchers in China developed a hallucination correction engine for AI models