Sam Bankman-Fried sues insurance company for defense costs as trial opens

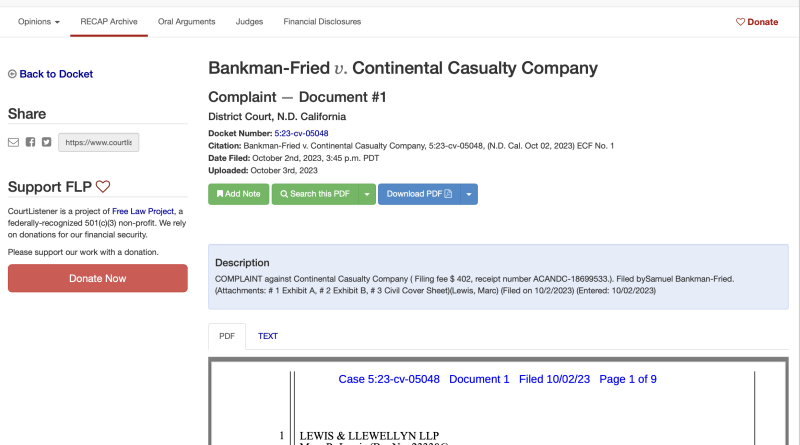

Such protection can be organized into a metaphorical tower of policies, where a policy on a provided layer comes into force when the policy listed below it reaches its limit. There was no clawback provision in the policy.Related: Sam Bankman-Fried is paying for legal defense utilizing formerly gifted funds from Alameda: ReportThe suit kept in mind that Paper Birds 2 main D&O policy providers, Beazley and QBE, paid his defense expenses according to the terms of the policy. The complaint mentioned that Hiscox expected claims to be made under its policy for $5 million in coverage and the interpleading was essential to make sure fair disbursement of policy funds. Bankman-Fried sought to collect D&O insurance coverage payments under a policy issued to West Realm Shires, which is more frequently referred to as FTX US.

Such coverage can be arranged into a metaphorical tower of policies, where a policy on a provided layer comes into force when the policy listed below it reaches its limit. There was no clawback provision in the policy.Related: Sam Bankman-Fried is paying for legal defense utilizing formerly talented funds from Alameda: ReportThe suit noted that Paper Birds 2 main D&O policy companies, Beazley and QBE, paid his defense costs according to the terms of the policy. The grievance specified that Hiscox anticipated claims to be made under its policy for $5 million in coverage and the interpleading was needed to guarantee reasonable disbursement of policy funds.

Related Content

- Fed rate pause triggers traders’ pivot to stocks — Will Bitcoin catch up?

- Crypto Biz: Bidding war for SVB Capital, new crypto funds and Citi’s private blockchain

- Bitcoin could be worth less than $20K in 2023, US inflation data says

- Researchers at ETH Zurich created a jailbreak attack that bypasses AI guardrails

- Maine state treasurer to focus on handling abandoned cryptocurrency accounts