Stablecoin protocol Reserve invests $20M in Convex, Curve and Stake DAO

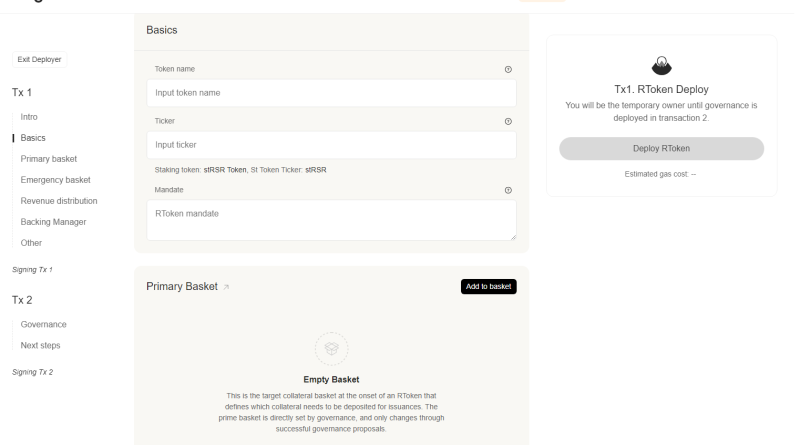

Stablecoin protocol Reserve is investing $20 million into the governance tokens of yield farming apps Curve (CRV), Convex (CVX) and Stake DAO (SDT), according to a June 20 announcement. Electronic USD (eUSD), High-Yield USD (hyUSD), Reserve (RSV), Reserve Dollar (RSD) and ETH+ are a couple of examples of stablecoins that have been created through Reserve.Reserve Protocols “Register” app used to create stablecoins. The procedure gained these tokens through its comprehensive usage of Convex to earn yield for its users.Related: Yield farming app accumulates $12M TVL 2 weeks after launchThe Reserve group mentioned that this new $20 million investment might allow for new features for RTokens, consisting of “collateralized loans, wallet products, tokenizing genuine world properties, and more transparent fintech systems.

Thank you for reading this post, don't forget to subscribe!

Related Content

- FTX advisers billed the bankrupt firm for a whopping $103M in Q1

- Friend.tech revenue surges over 10,000 ETH, TVL tops 30,000 ETH

- SEC waives BlockFi’s $30M fine until creditors are paid

- Coinbase gains legal support as scholars file amicus brief

- BTC miner Rhodium faces lawsuit over an alleged $26M in unpaid fees: Report