We’re In A Bull Market For Off-Chain Bitcoin

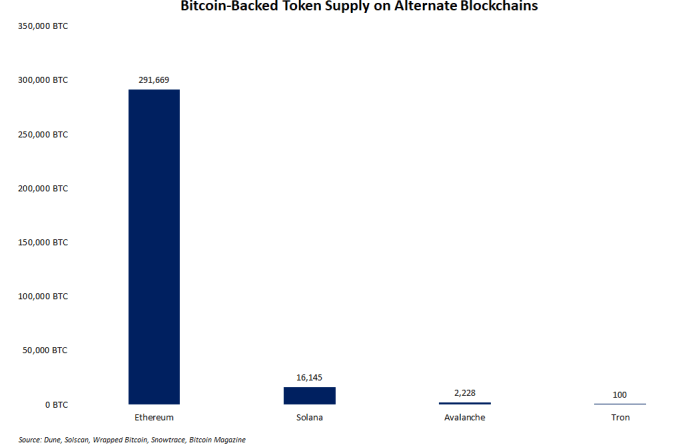

Utilizing bitcoin in these methods is not fit for every financier, however anyone who cares about the broad scope of Bitcoin adopters ought to take note of these trends to much better understand where and how bitcoin are moving.Defining Off-Chain BitcoinBefore analyzing some information, this section will hopefully reduce some of the potential preconceived reviews or mental blocks readers might have about these applications that might color their unbiased interpretation of information in the following sections. The following information focuses on these open monetary tools for alternative bitcoin uses.Overview Of Layer 2 Bitcoin CapacityProtocols built in layers of the Bitcoin innovation stack above the base layer blockchain are typically criticized for their meager adoption. Lightning pushes utility in the Bitcoin-native economy in the same method that tokenized bitcoin has a clear and direct result on bitcoin serving as a kind of reserve asset for non-Bitcoin-native sectors of the more comprehensive cryptocurrency market.Rehypothecation is another popular issue with many bitcoin monetary products. And, in fact, almost all of these products constructed on and apart from the Bitcoin procedure itself are developed to service a one-for-one bitcoin-backed or -swapped property, whether its an easy transfer of bitcoin from the base layer to the Lightning Network or a swap of “real” bitcoin for a bitcoin token utilized on other blockchains. One of the leading tokenized bitcoin products kept by BitGo, for example, publishes evidence of the reserves backing the bitcoin tokens it issues.The Future Of Off-Chain BitcoinReaders who ideologically decline the set of tradeoffs inherent to tokenized bitcoin products will certainly not be convinced by anything in this article to change their thinking, nor are they criticized per se in this post.

Using bitcoin in these methods is not suited for every financier, however anybody who cares about the broad scope of Bitcoin adopters ought to take note of these patterns to better comprehend where and how bitcoin are moving.Defining Off-Chain BitcoinBefore analyzing some information, this section will ideally reduce some of the possible preconceived critiques or psychological blocks readers may have about these applications that might color their objective interpretation of information in the following areas. Lightning pushes energy in the Bitcoin-native economy in the very same method that tokenized bitcoin has a clear and direct effect on bitcoin serving as a type of reserve property for non-Bitcoin-native sectors of the more comprehensive cryptocurrency market.Rehypothecation is another popular concern with many bitcoin monetary items. And, in truth, nearly all of these items constructed on and apart from the Bitcoin procedure itself are designed to service a one-for-one bitcoin-backed or -switched asset, whether its a simple transference of bitcoin from the base layer to the Lightning Network or a swap of “genuine” bitcoin for a bitcoin token used on other blockchains.

Related Content

- Director YOLO’d $4M of Netflix budget into Dogecoin, made $27M: Report

- Bitcoin user pays $3.1M in transition fee for one 139 BTC transfer

- State Of The Bitcoin Derivative Market

- Bitcoin crash pre-halving? Stablecoin metric that marked 2019 top flashes warning

- Inflationary Bear Market Spells Trouble For Investors