Cambridge Bitcoin Electricity Consumption Index updated to reflect hardware distribution and hashrate increases

The researchers sharpened in on concerns around what had actually driven substantial increases in hash rate in recent years as more recent mining devices eclipsed older models in computing power.Related: Nuclear and gas fastest growing energy sources for Bitcoin mining: DataNeumueller and his fellow scientists kept in mind that the deficiency of hardware-related data presented a significant difficulty as it limited the CBECIs ability to accurately assess the types of hardware that miners use as well as their ubiquity.” Neumueller highlighted a divide in opinion, with critics suggesting that Bitcoin “endangers environmental advancements and might intensify environment modification,” while advocates argue that the mining industry could fight environment change and provide other societal benefits.” The CBECI consists of a wide range of rich data points and visualizations, including the indexs Bitcoin network power need, a mining map showing the geographical circulation of Bitcoins mining hash rate as well as a greenhouse gas emissions index.

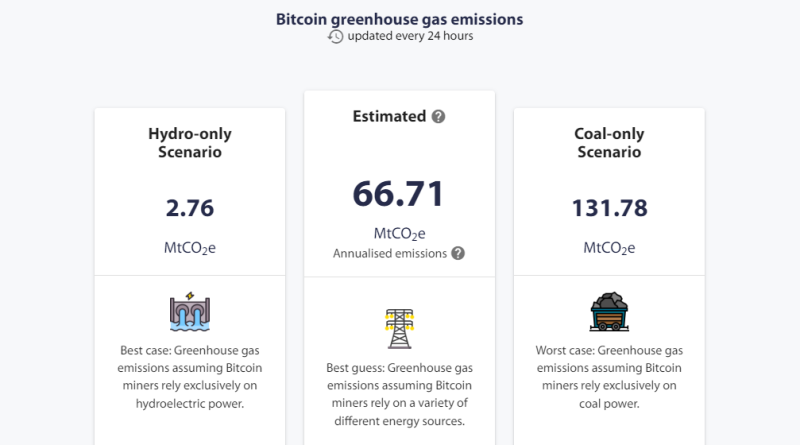

Researchers behind the well-known Cambridge Bitcoin Electricity Consumption Index (CBECI) have actually officially revised its approach to enhance the accuracy and dependability of the Indexs estimates for the very first time considering that its creation in 2019. The CBECI was released in July 2019 in an effort to supply dependable data-driven insights to concerns about Bitcoin minings energy-intensive nature and associated ecological effect. Speaking exclusively to Cointelegraph ahead of statement of the revision, head scientist Alexander Neumueller unpacked the Indexs function in offering a reasonably accurate price quote of the Bitcoin (BTC) networks electrical energy consumption and contextualizing the data in a manner that is digestible for the layperson on the street.Key takeaways from the modified approach included a focus on recent advancements in Bitcoin mining hardware and hash rate and whether the CBECI was precisely showing the changing landscape. The researchers focused on concerns around what had actually driven considerable increases in hash rate in the last few years as newer mining devices eclipsed older models in computing power.Related: Nuclear and gas fastest growing energy sources for Bitcoin mining: DataNeumueller and his fellow scientists noted that the shortage of hardware-related information positioned a substantial challenge as it limited the CBECIs ability to precisely assess the types of hardware that miners utilize along with their universality. This led the researchers to formerly develop an approach that replicates a day-to-day hardware circulation based upon performance and power use information of genuine hardware. Neumeuller keeps in mind that the foundation of the previous CBECI method assumed that every lucrative hardware design launched less than five years ago similarly fuelled the total network hashrate.This in turn resulted in a “disproportionally a great deal” of older mining hardware compared to more recent designs in the approachs assumed hardware distribution during incredibly successful mining periods.Related: Iris Energy purchases 248 Nvidia GPUs worth $10M for generative AI and Bitcoin miningThe scientists subsequently found that more recently released devices seemed underrepresented while devices nearing the end of its life cycle was overrepresented. This prompted the change in the CBECI methodology.Neumeller then discussed how his group began comparing hashrate boosts with United States import data reflecting recent Bitcoin mining hardware deliveries. This was integrated with an examination of openly readily available sales data from mining hardware producer Canaan.CBECI took a look at U.S. import records on Bitcoin mining equipment (left) and approximated computing power obtained from import data (right). Researchers utilized the hash rate (in TH/s) and gross weight mentioned by the maker and used a similarly weighted mix of the following designs from Canaans Avalon A1246, Avalon A1266, Avalon A1346 and Avalon A1366.The analysis, which thought about a variety of thorough aspects, was used to test the hypothesis that boosts in network hash rate can be credited to more just recently released mining hardware.” This hypothesis was based on U.S. import information, and we looked for additional proof to validate it. If Canaans sales data is representative of the market, it substantiates this claim.” Neumueller highlighted a divide in opinion, with critics suggesting that Bitcoin “endangers ecological developments and might intensify climate change,” while supporters argue that the mining market might fight climate modification and provide other societal benefits. “However, the detailed nature of the market and the absence of info are often under-recognised, including cherry-picked information points and biased point of views.” The CBECI includes a vast array of abundant information points and visualizations, consisting of the indexs Bitcoin network power need, a mining map reflecting the geographic distribution of Bitcoins mining hash rate in addition to a greenhouse gas emissions index. The CBECI and greenhouse gas emissions indexes offer 3 various estimates for both sectors, providing a hypothetical variety for these specific metrics. Collect this article as an NFT to maintain this moment in history and reveal your assistance for independent journalism in the crypto space.Magazine: Recursive inscriptions: Bitcoin supercomputer and BTC DeFi coming quickly

Related Content

- Friend.tech pronounced ‘dead’ after activity and fees tank

- How to Make Money with Bitcoin: Tips and Tricks for Successful Investing

- YouTube helps recover hacked channel that attempted XRP crypto scams

- Hodling hard: Bitcoin’s long-term investors own over 76% of all BTC for the first time

- Bitcoin continues dominance as 3rd week of fund inflows correct previous months’ outflows