Bitcoin no longer asset of choice for criminals — former Elliptic crypto adviser

Criminal offense in Web3 is shifting away from Bitcoin (BTC) to stablecoins, and Ponzi plans stay common, according to Elliptics previous head of technical crypto advisory.Tara Annison shared the latest insights from the dirty world of cryptocurrency-related criminal activity during a discussion on the last day of EthCC in Paris, attending to a broad variety of ways digital properties are either assisting in crime or being utilized to launder funds.” Annison highlighted a potential silver lining from a law enforcement viewpoint, noting that central companies like Circle might freeze specific USDC tokens prior to crooks can “off-ramp out of the asset” into fiat through DEXs or central exchanges. They utilize a coin swap service, they use a mixer, they utilize a bridge, all basically to attempt and toss blockchain analytics firms off the trail.” Annison also touched on the increasing usage of cryptocurrencies to avert sanctions and finance terrorist activities, highlighting TRON (TRX) and Tether (USDT) as popular possessions for illicit use.The introduction of metaverse experiences has also seen the area attract dubious actors.

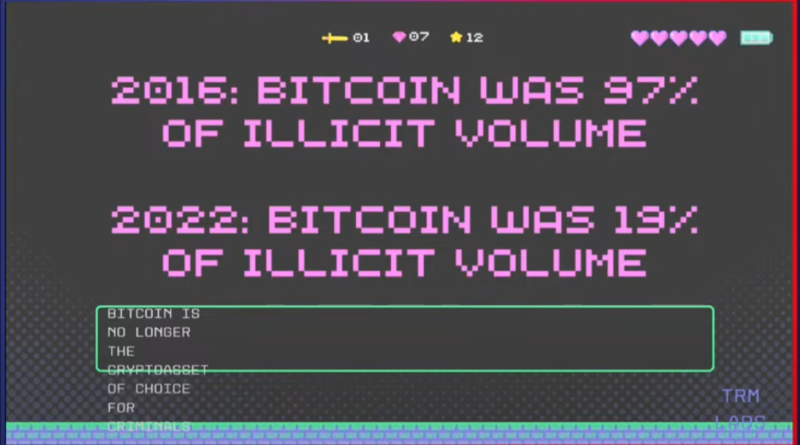

Crime in Web3 is moving far from Bitcoin (BTC) to stablecoins, and Ponzi plans stay common, according to Elliptics former head of technical crypto advisory.Tara Annison shared the most recent insights from the murky world of cryptocurrency-related criminal offense during a presentation on the last day of EthCC in Paris, attending to a wide range of ways digital possessions are either facilitating criminal offense or being used to wash funds. According to Annison, Bitcoin is no longer the cryptocurrency of choice for illicit activities or laundering cash. As the cryptocurrency market has actually developed, the establishment of decentralized finance procedures, blending services and stablecoins present new opportunities for bad guys to explore.Slide from Annisons presentation. Source: Tara Annison.Criminals have actually shifted toward utilizing dollar-denominated properties, like USD Coin (USDC), with their easy ease of access and ability to be laundered through decentralized exchanges (DEXs). “The wrongdoers use that as a target point. Its likewise incredibly simple to launder through DEXs. Theres deep liquidity, actually good volume, so thats pretty fretting.” Annison highlighted a possible silver lining from a police perspective, noting that centralized companies like Circle might freeze particular USDC tokens before wrongdoers can “off-ramp out of the possession” into fiat through DEXs or centralized exchanges.” What were seeing now is an increased variety of accounts with USDC and USDT being blacklisted, and these are frozen funds that the criminals now cant access.” Ponzi and pyramid schemes remain a feature of the sector, with Annison noting that $7.8 billion was stolen from unwitting victims of these types of rip-offs. Related: How the IRS seized $10B worth of crypto using blockchain analyticsCriminals are finding more advanced ways to wash funds. Annison stated chain swapping and asset swapping prevail as wrongdoers try to conceal illegal activity.” Weve seen that to the tune of about $4.1 billion. So they hop throughout using a DEX. They use a coin swap service, they use a mixer, they utilize a bridge, all essentially to attempt and toss blockchain analytics companies off the path.” Annison stated that $1.2 billion stolen from DEXs ultimately winds up on centralized exchanges. In contrast with previous years, scams in the sector are down 46%. The factor, according to Annison, is the ongoing bearish market, which has inevitably made the sector less appealing for cybercriminals.” Theyre less hyped up, the costs are lower, so its not as profitable for lawbreakers. At least next time were in a bear market, do bear in mind that the frauds are at least down.” Annison likewise touched on the increasing use of cryptocurrencies to avert sanctions and finance terrorist activities, highlighting TRON (TRX) and Tether (USDT) as popular assets for illicit use.The introduction of metaverse experiences has actually also seen the space draw in dubious actors. Different criminal offenses are emerging in virtual worlds, consisting of phishing attacks, nonfungible token theft, wallet polluting and enhanced truth hacks.Annisons presentation highlighted the reality of criminal activity in the sector, which will demand increased security measures to secure users and combat illegal activities.Magazine: United States enforcement companies are showing up the heat on crypto-related criminal activity

Related Content

- ‘This will be our last post’ — LBRY throws in towel against the SEC

- UK Treasury seeks input on taxing DeFi staking and lending: Finance Redefined

- Phishing scam via fake Zoom link costs GIGA investor $6M

- Binance sold USDC for BTC & ETH after Silvergate bank collapse: PoR report

- Bitcoin price stability creates lucrative setups in TON, XMR, MNT and QNT