dYdX founder claims targeted attack led to $9M insurance claim

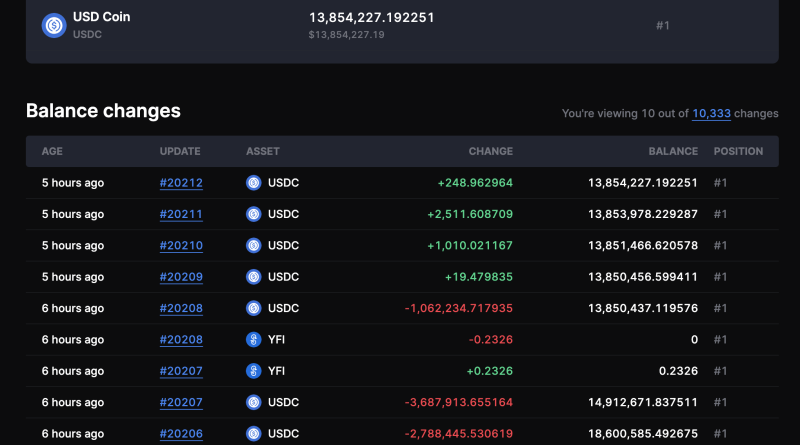

Decentralized exchange (DEX) dYdX was forced to utilize its insurance fund to cover $9 million in user liquidations on Nov. 17. According to dYdX founder Antonio Juliano, the losses arised from a “targeted attack” against the exchange. Based upon reports from the dYdX group on X (formerly Twitter), the v3 insurance fund was used “to fill spaces on liquidations processes in the YFI market.” The Yearn.Finance (YFI) token dropped 43% on Nov. 17 after soaring over 170% in the previous weeks. The abrupt cost crash raised issues within the crypto neighborhood about a possible exit scam. The supposed attack targeted long positions in YFI tokens on the exchange, liquidating positions worth nearly $38 million. Juliano thinks trading losses affecting dYdX, as well as the sharp decline in YFI, have been brought on by market control: “This was pretty clearly a targeted attack versus dYdX, including market adjustment of the whole $YFI market. We are examining alongside several partners and will be transparent with what we find.” According to Juliano, the v3 insurance fund still holds $13.5 million, and users funds were not impacted by the event. “Even though no user funds were affected, we will likewise be carrying out a comprehensive review of our threat parameters and making appropriate changes to both v3 and potentially the dYdX Chain software if essential,” he kept in mind on X.Balance modifications on dYdXs insurance wallet. Source: DYDX ExplorerThe successful trade eliminated over $300 million in market capitalization from the YFI token, leading the neighborhood to raise eyebrows about a possible expert job in the YFI market. Some users declared that 50% of the YFI token supply was held in 10 wallets managed by designers. Nevertheless, Etherscan information suggests some of these holders are crypto exchange wallets.Cointelegraph reached out to dYdX and Yearn.Finances teams for remark and is awaiting a resoonse.Magazine: Beyond crypto– Zero-knowledge proofs reveal prospective from voting to fund