SEC’s first deadlines to approve 7 Bitcoin ETFs coming over the next week

Magazine: Hall of Flame: Wolf Of All Streets frets about a world where Bitcoin strikes $1M.

Nevertheless, fellow Bloomberg ETF analyst Eric Balchunas thought about the chances of the SEC revoking the Bitcoin futures ETFs as “highly not likely” since of the SECs reported openness to Ethereum futures ETFs.Lol, this guy turned the last paragraph of Judge Raos legal smackdown today into an MGMT-esque sythe banger. Actually captures the mood registered nurse, well done. https://t.co/BBJZR5O6To— Eric Balchunas (@EricBalchunas) August 29, 2023

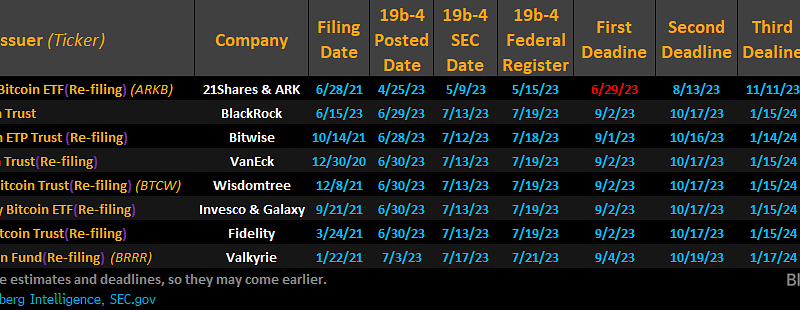

The United States Securities and Exchange Commission is facing its first deadlines to choose on 7 new Bitcoin (BTC) spot exchange-traded fund applications with the most current being Sept. 4 amid its defeat to Grayscale Investments in a U.S. federal appeals court.Investment company Bitwise will learn if its ETF will win the SECs approval on Sept. 1 while BlackRock, VanEck, Fidelity, Invesco and Wisdomtree will all be waiting for the SECs decision for their funds by Sept. 2, according to a number of SEC filings.Meanwhile, Valkyrie is set to hear back from the SEC on Sept. 4. List of current Bitcoin area ETF candidate filing dates and deadlines. Source: BloombergThe U.S. Court of Appeals ruled on Aug. 29 that the SECs rejection of Grayscales application to convert its Grayscale Bitcoin Trust (GBTC) into an area Bitcoin ETF was “approximate and capricious”– but it does not indicate the SEC should authorize Grayscales application or others in the future, says Bloomberg ETF analyst James Seyffart.In an Aug. 29 Bloomberg interview, Seyffart explained Grayscales win “certainly” increases the chances of an effective outcome for the next wave of candidates. He isnt sure when that day might come though, as the SEC can delay its decisions and has 2 more proposed due dates for each fund prior to being required to make a last choice on the 240th day post-filing. For the waiting for candidates, the last due dates for the SEC are al mid-March next year.99.99999% of the world does not understand that the SEC has to select 7 BTC ETFs within the next 3 days:- blackrock-bitwise-vaneck-wisdomtree-invesco-fidelity -valkyriethe suits at our doorstep– odin free (@odin_free) August 29, 2023

What are the SECs choices post-Grayscale decision?After todays ruling in favor of Grayscale, the regulator has 90 days to file an appeal with the U.S. Supreme Court or apply for an En banc review– where a full circuit court can overturn a ruling made by a three-judge panel.However, the SEC hasnt explained what its next move will be.If the SEC doesnt appeal the court will need to define how its judgment is carried out which might consist of instructing the SEC to authorize Grayscales application, or at the extremely least review it.Related: BTC price jumps to 2-week highs on Grayscale vs. SEC Bitcoin ETF winEither method, Seyffart just saw 2 practical alternatives for the regulator.The first is for it to concede defeat and authorize Grayscales conversion of its GBTC to a Bitcoin spot ETF.Alternatively, the SEC would require to revoke the listing of Bitcoin futures ETFs totally or deny Grayscales application based upon a brand-new argument, said Seyffart.The second potential opportunity is to reject on factors not used before/yet … which i have been saying for months could involve Custody or settlement of #Bitcoin which is not something that futures ETFs need to fret about. SEC has actually made a lot of noise around custodians– James Seyffart (@JSeyff) August 29, 2023

Related Content

- Bitcoin traders torn between breakout and $28K dip as BTC price stalls

- ‘Unjustly enriched’: Core Scientific knocks back $4.7M claim from Celsius

- $3M worth of customer funds swiped via alleged Swaprum DEX rug pull

- What I Discovered About Bitcoin Culture On The Bitcoin Tour

- Oprah and The Rock collect crypto donations for Maui wildfire victims