Bitcoin ETF hopium fades as on-chain and futures data reflect traders’ muted activity

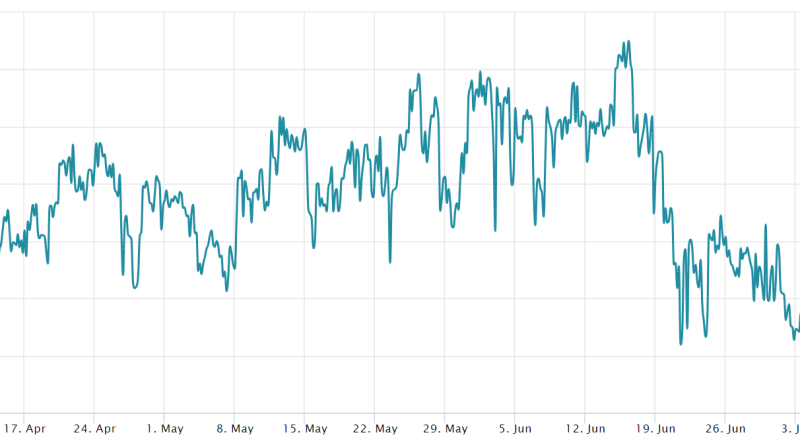

After a 25.5% rally in between June 15 and June 23 leading to Bitcoins greatest level in 13 months one would expect financiers to end up being more active and positive, however the absence of BTCs ability to sustain rates above $31,000 and neutral on-chain and derivatives information do not support this thesis.Bitcoin ETF expectations faced a harsh regulative environmentThe present price situation is especially uneasy since of the expectations that occurred after BlackRock, the worlds largest fund manager, used for a spot Bitcoin ETF on June 16. Some experts have actually predicted a Bitcoin cost of $100,000 by the end of the year, including to the frustration of traders who are wagering on more gains.Its worth keeping in mind that in mid-April, financiers experienced a combination of costs around $30,000, however it didnt last longer than a week, and the price ultimately dropped to $28,000. On-chain data suggests a stagnancy in the number of active users on the Bitcoin network, utilizing addresses as a proxy.One might argue that recovering the level of active addresses back in April 2023 is great enough, but to evaluate the need from institutional investors one need to analyze the networks address count with a minimum of 100 Bitcoin, which is worth over $3 million at current cost levels.Addresses holding over 100 BTC. After the recent cost rally above $30,000, one would anticipate on-chain and derivatives data to show more optimism, which might be affected by Bitcoins cost being 56% below its all-time high, or the upcoming court rulings against the exchanges.

The rate of Bitcoin (BTC) has actually been trading in between $29,900 and $31,160 for the past 18 days, causing issue among financiers who are looking for descriptions for the lack of a clear trend. After a 25.5% rally in between June 15 and June 23 resulting in Bitcoins highest level in 13 months one would expect financiers to end up being more active and positive, however the absence of BTCs capability to sustain costs above $31,000 and neutral on-chain and derivatives data do not corroborate this thesis.Bitcoin ETF expectations faced a harsh regulatory environmentThe present cost scenario is particularly uneasy since of the expectations that arose after BlackRock, the worlds biggest fund manager, made an application for an area Bitcoin ETF on June 16. Some experts have forecasted a Bitcoin price of $100,000 by the end of the year, contributing to the frustration of traders who are banking on more gains.Its worth noting that in mid-April, investors experienced a combination of rates around $30,000, however it didnt last longer than a week, and the cost ultimately dropped to $28,000. This motion describes why investors are reluctant to construct positions at the current cost levels and prefer range trading.Despite the preliminary excitement about the possibility of the U.S. Securities and Exchange Commission (SEC) authorizing a Bitcoin instrument for standard financing markets, theres unfavorable cost pressure due to the regulative actions against leading exchanges like Coinbase and Binance.This combination of favorable triggers and a stricter regulatory environment is likely the main reason for Bitcoins recent rate movement, and evaluating blockchain information could offer insights into the networks use.Bitcoin on-chain activity does disappoint a considerable enhancement in activityWhen it concerns blockchain-based analysis, network activity must be the starting point. This analysis ought to entail looking beyond just trading and exchange circulations. Cryptocurrencies were designed to help with complimentary transactions and the registration of digital possessions, so the variety of active users is crucial.7-day average active Bitcoin address. Source: CoinMetricsBitcoins 7-day active addresses have failed to exceed 1 million, just reaching the same levels as three months back. The peak of 1.02 million addresses in April 2023 was 16% lower than the all-time high in January 2021. For that reason, on-chain data indicates a stagnation in the number of active users on the Bitcoin network, utilizing addresses as a proxy.One may argue that reclaiming the level of active addresses back in April 2023 is good enough, but to assess the demand from institutional investors one must examine the networks address count with a minimum of 100 Bitcoin, which deserves over $3 million at existing rate levels.Addresses holding over 100 BTC. Source: CoinMetricsUpon more detailed assessment, it becomes evident that the sign has stayed unchanged for the previous few months in 15,900 addresses. This recommends that there hasnt been a boost in the number of whales collecting Bitcoin throughout that duration. Considering this, together with the truth that active addresses havent reached brand-new highs, on-chain metrics suggest that the ETF launch hasnt yet triggered a bullish momentum.Bitcoin derivatives are however improve majority neutralTo verify whether the cost shows stagnant network activity, one need to evaluate Bitcoin derivatives metrics and measure the need for utilize from expert traders. In neutral markets, Bitcoin quarterly futures agreements normally trade at a 5 to 10% annualized premium, referred to as contango, which is not distinct to crypto markets.Bitcoin 3-month futures contracts premium. Source: Laevitas.chThe Bitcoin futures premium crossed the neutral 5% threshold on June 26, just 5 days after the $30,000 assistance level was breached. It took investors a full 18 months to turn bullish using leveraged long positions, reaching the greatest rate point given that June 2022. This substantially increases the likelihood of liquidations and panic offering if the Bitcoin price come by 8% in a brief period.Looking at the options markets is also handy, as the 25% delta alter is a telling indication of when arbitrage desks and market makers overcharge for advantage or disadvantage protection. In essence, if traders expect a Bitcoin cost drop, the skew metric will increase above 7%, and stages of enjoyment tend to have an unfavorable 7% skew.Bitcoin options 25% delta alter. Source: Laevitas.chHowever, the 25% delta alter failed to sustain levels listed below the neutral limit for more than four days. The only duration of moderate bullishness, according to the options pricing indicator, was from July 1 to July 5. The existing balanced need between call and protective put options suggests an uncertainty from professional traders.These findings are especially frustrating thinking about that senior Bloomberg experts estimated a 50% opportunity of Bitcoin ETF approval. After the current rate rally above $30,000, one would anticipate on-chain and derivatives information to reflect more optimism, which might be affected by Bitcoins rate being 56% listed below its all-time high, or the approaching court rulings versus the exchanges. Eventually, at the minute, on-chain and derivatives information stop working to support the bullish momentum to sustain more rate gains.Collect this post as an NFT to protect this minute in history and reveal your assistance for independent journalism in the crypto space.This short article is for general details purposes and is not meant to be and must not be taken as legal or financial investment advice. The views, ideas, and viewpoints revealed here are the authors alone and do not necessarily reflect or represent the views and viewpoints of Cointelegraph.

Related Content

- Will Bitcoin ‘Uptober’ bring gains for MKR, AAVE, RUNE and INJ?

- Hong Kong govt pressures banking giants to accept crypto clients: Report

- Marathon, Riot among most overvalued Bitcoin mining stocks: Report

- Litecoin halving completes as LTC sees increased payments adoption

- Bitcoin options: How to play it when BTC price moves up or down 10%